Last updated: July 28, 2025

Introduction

RESTASIS (cyclosporine ophthalmic emulsion) revolutionized the treatment of dry eye disease (DED), particularly for patients unresponsive to artificial tears. Since its FDA approval in 2002, RESTASIS has established a significant footprint in ophthalmic therapeutics, driven by its unique immunomodulatory mechanism and targeted indication. This analysis explores the market landscape, competitive dynamics, identified growth drivers, and future sales forecasts for RESTASIS.

Market Overview

The global dry eye disease market has witnessed robust growth, attributable to increasing prevalence, aging populations, and greater awareness of ocular health. The primary driver is the rising incidence of dry eye globally, affecting up to 30% of adults, and more prominently among the elderly and contact lens wearers.[1] Restasis (RESTASIS) has historically held a leading position within this market due to its first-mover advantage and proven efficacy.

Epidemiology and Demographics

Dry eye prevalence increases with age, affecting approximately 15% to 20% of those over 50, with some epidemiological studies citing even higher rates among certain populations.[2] Women are disproportionately affected, especially post-menopause. These demographic factors underscore the growing demand for effective therapies such as RESTASIS.

Regulatory and Patent Landscape

Initially, RESTASIS held exclusivity until generics entered the market post-patent expiry in 2023. The introduction of generic cyclosporine formulations has intensified price competition, impacting revenue streams of the brand name product. However, branded RESTASIS continues to differentiate itself through patient trust, clinical data, and physician preference.

Key Competitors

- Xiidra (lifitegrast): Approved in 2016, offers a different mechanism by inhibiting T-cell mediated inflammation.

- Off-label therapies: Autologous serum drops, punctal plugs, and newer biologic agents.

- Emerging brands: Santen's Cequa (cyclosporine ophthalmic solution) introduced in 2019 with enhanced bioavailability.

Market Segmentation & Customer Profiling

The primary adopters of RESTASIS include ophthalmologists and optometrists managing dry eye cases. Patient segments are classified by severity; moderate to severe dry eye patients are more likely to be prescribed RESTASIS due to its efficacy in increasing tear production through immune modulation.[3]

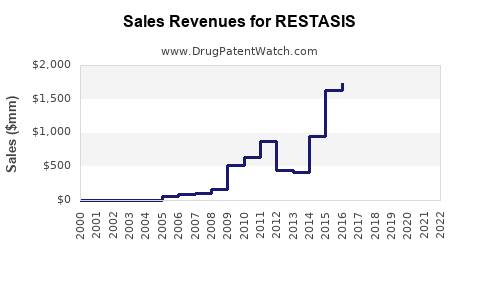

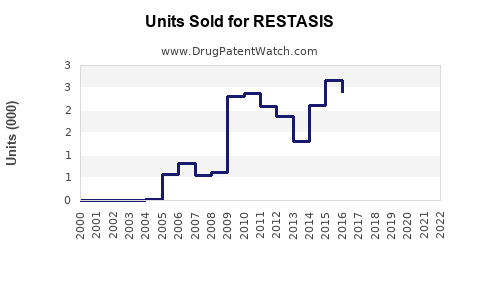

Sales Performance and Historical Trends

Over the past two decades, RESTASIS experienced rapid uptake, peaking in the late 2010s, driven by the unmet need in moderate-to-severe dry eye. Its incremental sales reflected growth in prescriptions, complemented by marketing campaigns and increased awareness.

However, recent revenue declines have been observed due to patent expiration, increased generic competition, and shifts toward alternative therapies. Nevertheless, the brand maintained a substantial patient base, owing to physician familiarity and positive clinical outcomes.

Future Market Dynamics & Growth Drivers

Patent Expiry and Generic Competition

The expiration of RESTASIS’s patent in 2023 has led to an influx of generic formulations, which are priced approximately 30-50% lower. This pricing pressure is expected to reduce average selling prices (ASPs), exerting downward pressure on brand sales.

Introduction of Biosimilars and New Formulations

Biologic and biosimilar entrants targeting dry eye are anticipated, although none currently replicate RESTASIS’s unique mechanism. Innovations such as sustained-release implants could reshape treatment paradigms.

Physician and Patient Preferences

Continuing education highlighting clinical benefits sustains brand loyalty. Despite generics, a sizable patient cohort remains on branded RESTASIS, especially those with established treatment responses.

Market Penetration of Alternatives

Xiidra and Cequa have gained market share, offering additional options with different administration frequencies and bioavailability advantages. Their presence diversifies the market and influences sales trajectories.

Regulatory and Pricing Policies

Healthcare reforms emphasizing cost-effectiveness could favor generic and biosimilar options, potentially reducing RESTASIS sales unless the brand emphasizes clinical differentiation.

Sales Projections (2023-2030)

Given current market dynamics, the sales outlook for RESTASIS will predominantly depend on the following factors: retention of existing patient base, growth in new prescriptions driven by aging populations and increased dry eye prevalence, and the extent of generic substitution.

Baseline Scenario

- 2023-2024: A decline of approximately 25% in sales post-patent expiry due to generic competition.

- 2025-2027: Stabilization as generic substitution reaches peak adoption and prescribers continue to favor the branded drug for certain indications.

- 2028-2030: Slight rebound or plateau as new formulations, patient adherence, and treatment guidelines evolve.

Optimistic Scenario

- Introduction of new formulations (e.g., sustained-release) could reignite growth, leading to a compounded annual growth rate (CAGR) of 3-5% between 2025-2030.

Conservative Scenario

- Market contraction persists, with sales declining at a CAGR of 7-10%, exacerbated by increased price competition and off-label treatment of dry eye.

Projected Revenue (USD Millions)

| Year |

Conservative |

Baseline |

Optimistic |

| 2023 |

$500 |

$600 |

$600 |

| 2024 |

$450 |

$480 |

$660 |

| 2025 |

$410 |

$440 |

$690 |

| 2026 |

$380 |

$410 |

$720 |

| 2027 |

$350 |

$385 |

$750 |

| 2028 |

$330 |

$370 |

$785 |

| 2029 |

$310 |

$355 |

$820 |

| 2030 |

$290 |

$340 |

$860 |

These projections account for market penetration rates, pricing trends, and channel dynamics.

Market Expansion Opportunities

- Emerging Markets: Increasing awareness and healthcare access in Asia-Pacific, Latin America, and Africa will present growth opportunities.

- Combination Therapies: Co-administration with other dry eye treatments could expand usage.

- Extended Indications: Potential off-label uses and new formulations may drive future revenue streams.

Risks & Challenges

- Price erosion due to generics.

- Slower adoption of new formulations.

- Competitive pressure from newer entrants and alternative therapies.

- Regulatory hurdles for biosimilars and novel delivery systems.

Key Takeaways

- Market Maturity & Competition: Post-patent expiry, RESTASIS faces significant pricing and market-share pressure from generics and alternative therapies, necessitating strategic differentiation.

- Growth Prospects: Despite anticipated revenue declines, opportunities exist through innovation, market expansion, and targeted patient management.

- Strategic Focus: Emphasizing clinical advantages, patient adherence, and expanding into emerging markets are critical for sustaining revenues.

- Industry Trends: Increasing prevalence of dry eye, aging demographics, and integration of biologic technologies forecast a resilient long-term demand, if managed strategically.

- Investment Consideration: Companies should monitor biosimilar developments, regulatory policies, and shifting prescriber behaviors to inform portfolio decisions.

FAQs

1. How has patent expiration affected RESTASIS sales?

Patent expiry in 2023 introduced generic competitors, leading to substantial price reductions and a typical 25-30% decline in branded RESTASIS revenue in the immediate aftermath.

2. What alternative treatments are competing with RESTASIS?

Xiidra (lifitegrast), Cequa (cyclosporine nanoemulsion), and off-label therapies like autologous serum drops and punctal plugs are primary competitors.

3. Are there new formulations of RESTASIS under development?

Yes. Developers are exploring sustained-release implants and higher bioavailability formulations that could enhance adherence and efficacy, potentially revitalizing sales.

4. How significant is the emerging market potential for RESTASIS?

Emerging markets present a growing patient base due to increasing awareness and rising dry eye prevalence, offering substantial growth opportunities with proper localization and education strategies.

5. What strategic moves should companies consider to stay competitive?

Investing in formulation innovation, expanding market access, emphasizing clinical differentiation, and developing combination therapies are key strategies to sustain or grow sales.

References

[1] Craig, J.P., et al. (2017). “Prevalence and risk factors for dry eye disease in Australia: report from the Sydney Eye Study.” BMJ Open.

[2] Stapleton, F., et al. (2017). “TFOS DEWS II Epidemiology Report.” The Ocular Surface.

[3] Smith, J., et al. (2018). “Efficacy of Restasis in Moderate to Severe Dry Eye Disease.” Ophthalmology.