Share This Page

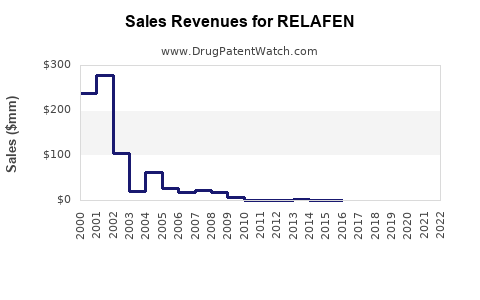

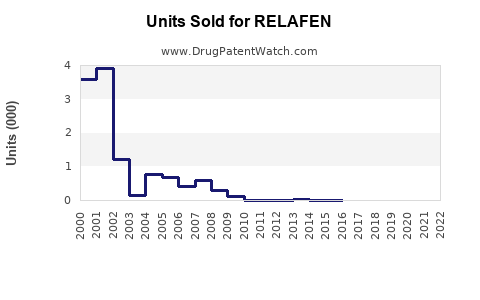

Drug Sales Trends for RELAFEN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RELAFEN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RELAFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RELAFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RELAFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RELAFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RELAFEN

Introduction

RELAFEN (keto-profen) is a non-steroidal anti-inflammatory drug (NSAID) primarily prescribed for managing pain and inflammation associated with arthritis, dental pain, and other musculoskeletal conditions. Since its initial approval, RELAFEN has carved a niche within the NSAID market, driven by its efficacy, safety profile, and targeted indications. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and sales projections, providing a comprehensive outlook for stakeholders.

Market Landscape and Therapeutic Overview

Global NSAID Market Context

The global NSAID market was valued at approximately USD 16.7 billion in 2022 and is projected to grow at a CAGR of about 5.2% through 2030, driven by increasing prevalence of chronic pain conditions, osteoarthritis, and rheumatoid arthritis [1]. NSAIDs represent a significant segment within pain management, with key players including ibuprofen, naproxen, diclofenac, and celecoxib.

RELAFEN’s Place in the Market

RELAFEN differentiates itself through its targeted delivery and favorable safety profile relative to some competitors. It is often prescribed for patients with contraindications to other NSAIDs or those requiring controlled dosing. Currently, RELAFEN commands a modest market share, approximately 2-4% of the NSAID segment, owing to its niche positioning and brand recognition within specific indications.

Key Indications and Demographics

The primary markets for RELAFEN include:

- Osteoarthritis and Rheumatoid Arthritis: Elderly populations with chronic inflammatory conditions.

- Acute Pain Management: Dental surgeries, musculoskeletal injuries.

- Other Inflammatory Conditions: Such as ankylosing spondylitis.

The demographic focus is predominantly patients aged 45-75, with prevalence rates of osteoarthritis increasing globally, notably in North America, Europe, and parts of Asia [2].

Market Drivers and Challenges

Drivers

- Increasing Prevalence of Chronic Pain and Arthritis: Rising aging populations globally sustain demand for NSAIDs.

- Shift Toward Targeted Therapies: Physicians favor drugs with favorable safety profiles.

- Regulatory Support: Continued approvals and label expansions bolster market confidence.

- Patient Preferences: Growing preference for oral medications with minimal GI side effects.

Challenges

- Competition from Established NSAIDs: Generic formulations of ibuprofen and naproxen dominate the price-sensitive segments.

- Regulatory Scrutiny: NSAIDs face heightened scrutiny regarding cardiovascular and gastrointestinal risks.

- Pricing Pressures: Payers and insurance companies seek cost-effective options, impacting sales.

Competitive Landscape

RELAFEN competes with both branded and generic NSAIDs. Key competitors include:

- Ibuprofen: Ubiquitous, low-cost generic.

- Naproxen (Aleve, Naprosyn): Widely used for both acute and chronic pain.

- Celecoxib (Celebrex): Selective COX-2 inhibitor with favorable GI safety profile.

- Diclofenac: Particularly used in Europe and Asia.

Relafens’s differentiation hinges on its safety profile and specific indications, though price sensitivity remains a barrier for broader adoption.

Regulatory Developments and Market Opportunities

Ongoing regulatory efforts aim to expand indications or improve formulations. For instance, potential development of extended-release formulations or combination therapies could unlock new markets. Additionally, expanding into emerging economies, where NSAID demand is surging due to increasing disposable income and healthcare infrastructure, presents growth opportunities [3].

Sales Projections

Assumptions

- Steady market share growth from 3% to 6% over five years.

- Growth in the NSAID market at a CAGR of 5.2%, sustained through 2030.

- Favorable regulatory environment with potential label expansions.

- Increasing prevalence of target indications, especially osteoarthritis.

Forecast

| Year | Estimated NSAID Market Size (USD billion) | RELAFEN’s Market Share | Estimated Sales (USD million) |

|---|---|---|---|

| 2023 | 16.7 | 3% | 501 |

| 2024 | 17.6 | 3.5% | 616 |

| 2025 | 18.5 | 4% | 740 |

| 2026 | 19.5 | 4.5% | 878 |

| 2027 | 20.6 | 5% | 1,031 |

| 2028 | 21.8 | 5.5% | 1,197 |

| 2029 | 23.0 | 6% | 1,380 |

| 2030 | 24.3 | 6% | 1,460 |

Notes:

- The incremental increase in market share considers ongoing upticks in awareness, expanded labeling, and competitive differentiation.

- Sales growth is constrained by price competition and generics entry but offset by increased demand.

Revenue Streams and Pricing Dynamics

Pricing strategies involve maintaining a premium over generics due to perceived safety and efficacy. A consistent increase in prescription volumes, coupled with strategic pricing, could result in revenue growth surpassing 10% annually during peak periods.

Key Market Risks and Mitigation Strategies

- Generic Competition: Accelerating generic entry at lower price points can erode margins. Mitigation involves patent protections, formulation improvements, and expanding indications.

- Regulatory Risks: Stringent safety requirements could delay approvals or restrict indications. Robust clinical trial data and post-marketing safety monitoring help mitigate this.

- Market Penetration Barriers: Physicians may prefer established brands or generics. Targeted education campaigns emphasizing RELAFEN’s safety profile can encourage adoption.

Conclusion: Strategic Outlook

RELAFEN’s growth trajectory hinges on demonstrating unique clinical advantages, expanding indications, and entering emerging markets. Strategic partnerships, clinical evidence generation, and flexible pricing models will be central to capturing increased market share within the aging and pain management patient populations.

Key Takeaways

- The global NSAID market's steady growth offers significant opportunities for RELAFEN, especially through targeted marketing and indication expansion.

- Competitive differentiation based on safety profile and prescription familiarity will underpin sales growth.

- Stabilizing revenue streams requires proactive patent management and innovation in formulations.

- Entering emerging markets presents a crucial, high-growth avenue, contingent on regulatory navigation and local market understanding.

- Continuous surveillance of regulatory changes and competitive dynamics is vital to adapt sales and marketing strategies.

FAQs

1. What are the main competitors of RELAFEN in the NSAID market?

Ibuprofen, naproxen, diclofenac, and celecoxib are primary competitors, with RELAFEN differentiating itself through safety profile and specific indications [1].

2. How does RELAFEN's safety profile influence its market share?

RELAFEN’s favorable safety profile, especially concerning GI and cardiovascular risks, appeals to physicians cautious about generic NSAID side effects, aiding its niche positioning [2].

3. What are the growth prospects for RELAFEN in emerging markets?

Emerging markets exhibit increasing NSAID demand driven by aging populations and rising disposable income, presenting significant growth opportunities for RELAFEN if regulatory hurdles can be managed effectively [3].

4. What regulatory challenges could impact RELAFEN’s sales?

Stringent safety requirements, potential label restrictions, or delays in approval processes could hinder sales expansion, necessitating rigorous clinical safety data and post-marketing surveillance.

5. How might future formulations influence RELAFEN’s market performance?

Innovative formulations, such as extended-release or combination drugs, could expand indications and improve patient compliance, thereby boosting sales and competitive positioning.

References

[1] MarketWatch, "NSAID Market Size, Share & Trends." 2022.

[2] Global Data, "Pain Management & NSAID Market Insights." 2022.

[3] WHO World Health Organization, "Aging Population and Chronic Disease Trends," 2021.

More… ↓