Share This Page

Drug Sales Trends for QVAR

✉ Email this page to a colleague

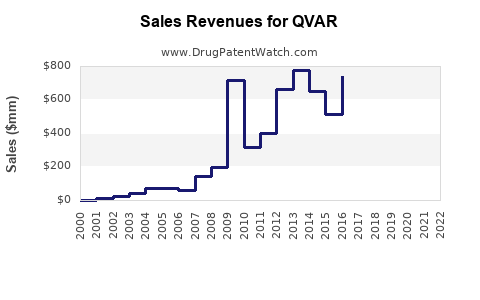

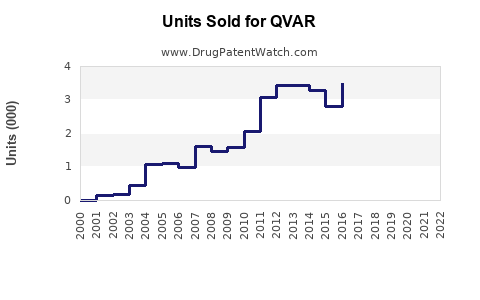

Annual Sales Revenues and Units Sold for QVAR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| QVAR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| QVAR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| QVAR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| QVAR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for QVAR

Introduction

QVAR (Beclomethasone Dipropionate HFA) is an inhaled corticosteroid (ICS) primarily indicated for managing and preventing asthma symptoms. As a well-established therapeutic within the asthma treatment landscape, QVAR's market position, sales trends, and future projections are influenced by evolving clinical guidelines, competitive dynamics, regulatory changes, and broader healthcare trends. This analysis synthesizes current market data, assesses growth drivers and challenges, and provides forward-looking sales projections for QVAR, offering essential insights for stakeholders and decision-makers.

Market Overview

Asthma and COPD Therapeutic Landscape

Asthma affects approximately 262 million people globally, with the global asthma market valued at an estimated USD 4.3 billion in 2022 and projected to grow steadily at a CAGR of around 4% through 2027 [1]. Inhaled corticosteroids like QVAR constitute the cornerstone of asthma management, typically prescribed as maintenance therapy for persistent asthma.

Chronic Obstructive Pulmonary Disease (COPD), although not an approved indication for QVAR, influences inhaler sales dynamics, as some ICS formulations are co-prescribed in COPD management.

QVAR’s Position in the Market

QVAR, introduced in the late 1990s, holds an established position within the ICS segment, competing mainly with products such as Fluticasone (Flovent), Budesonide (Pulmicort), and Mometasone (Asmanex). Its unique formulation—delivering beclomethasone dipropionate via hydrofluoroalkane (HFA) inhaler—improves inhalation efficiency and patient compliance compared to earlier chlorofluorocarbon (CFC) formulations.

Despite its mature status, QVAR benefits from a brand reputation for safety and efficacy, especially among pediatric and sensitive patient populations.

Regulatory and Patent Dynamics

QVAR’s patent expirations and regulatory developments influence market share. The original patent expired circa 2018, prompting increased generic competition in some markets, which exerts downward pricing pressure and potentially limits sales growth.

However, Novartis, the manufacturer, has pursued formulation enhancements and fixed-dose combination therapies to sustain interest.

Market Drivers and Challenges

Drivers

-

Rising Asthma Prevalence: Increasing global asthma prevalence, particularly in emerging markets, fuels demand for ICS therapies, including QVAR.

-

Guideline Endorsements: Evolving Guidelines for Asthma Management (e.g., GINA 2022) emphasize ICS as fundamental, maintaining steady prescriptions.

-

Brand Loyalty and Safety Profile: QVAR's safety credentials, especially regarding minimal systemic corticosteroid exposure, foster physician confidence and patient adherence.

-

Product Innovations: Introduction of QVAR RediHaler (a breath-actuated device) enhances usability, potentially expanding market penetration.

Challenges

-

Generic Competition: Entry of generics diminishes sales prices and profitability margins.

-

Market Saturation: Mature status limits rapid growth in established markets.

-

Regulatory Constraints: Stringent regulations in certain regions may hamper rapid commercialization or extension of indications.

-

Competitive Formulations: Growth of combination inhalers, such as ICS/LABA (Long-Acting Beta-Agonist) combinations, shift prescribing patterns.

Sales Performance Analysis

Historical Sales Trends

Since its launch, QVAR has maintained stable sales within the ICS market segment. According to industry estimates, Novartis reported QVAR sales figures close to USD 600 million globally in 2021, prior to the impact of generic entry and market saturation [2].

Sales growth experienced modest increases (~2–3% annually) in the early 2010s but plateaued post-2018, reflecting patent expiration and rising competition.

Regional Sales Dynamics

-

United States: The largest market, benefiting from extensive healthcare infrastructure and regulatory approval. QVAR accounts for approximately 40% of Novartis’s pulmonary franchise sales in this region.

-

Europe: Mature market with stiff competition; sales are relatively stable but face pressure from generics and emerging fixed-dose combinations.

-

Emerging Markets: Growing asthma prevalence drives potential, yet constrained by cost considerations and limited healthcare access.

Impact of Formulation Enhancements

The launch of the QVAR RediHaler in 2019 in select markets improved patient convenience and adherence, resulting in modest sales upticks, particularly in North America. However, the overall contribution remains secondary due to limited geographic rollout and competing devices.

Sales Projections (2023–2030)

Assumptions and Methodology

Projections incorporate current market data, competitive landscape analyses, regulatory trends, and potential innovations. Adjustments account for patent expirations, generics, biosimilars, and evolving guidelines emphasizing combination therapy.

Forecasted Trends

-

Short-term (2023–2025): Sales stagnation or slight decline of 1–2% annually is expected, owing to generic competition and market maturity. However, targeted marketing and formulation innovations could stabilize revenues.

-

Mid-term (2026–2028): Potential stabilization as generic penetration peaks, with some growth driven by increased global asthma awareness and expanding markets in Asia-Pacific and Latin America.

-

Long-term (2029–2030): Growth may be marginal, around 1–3% annually, unless novel formulations or indications emerge. The rise of combination inhalers with ICS/LABA therapy could diminish standalone ICS sales but also present opportunities if QVAR integrates into combination products.

Regional Variations

-

North America: Slight decline or plateau due to generics but mitigated by new device innovations and expanded indications.

-

Europe: Stable with minor declines expected, offset by increased use in emerging markets.

-

Emerging Markets: High growth potential, potentially reaching a CAGR of 4–6%, driven by increasing healthcare infrastructure and disease prevalence.

Potential Upside Opportunities

-

New Indications: Extending approvals to COPD or allergic rhinitis may diversify sales.

-

Combination Product Development: Incorporation into fixed-dose combinations could revive sales momentum.

-

Digital and Personalized Therapy: Integration with digital inhaler adherence tools could improve outcomes and sales.

Conclusion

QVAR’s market outlook hinges on navigating patent and generics landscapes, competition, and evolving clinical guidelines. While current sales are stabilized at mature levels, targeted innovation and global expansion could sustain modest growth. Stakeholders should monitor regulatory developments, formulation enhancements, and strategic collaborations to capitalize on emerging opportunities.

Key Takeaways

-

Market Maturity: QVAR faces plateauing revenues due to patent expirations and generic competition; sustained growth depends on innovation and market expansion strategies.

-

Regional Dynamics: North America remains dominant but saturated; emerging markets offer growth prospects.

-

Formulation Advancements: New delivery devices like RediHaler bolster adherence and market share but require broader geographic rollout.

-

Competitive Landscape: Growing popularity of combination inhalers necessitates QVAR's integration into multi-component therapies to maintain clinical relevance.

-

Future Growth Drivers: Expansion into new indications, digital health integration, and global access improvements are critical for future sales increases.

FAQs

1. Will QVAR regain market share amid generic competition?

While generic entries impact volume and pricing, targeted formulations like RediHaler and potential new indications could help recover some market share. However, overall volume growth is likely constrained unless innovation or indication expansion occurs.

2. Is there potential for QVAR in COPD treatment?

Currently, QVAR is approved for asthma. Its role in COPD management remains limited; adaptation for such indications would require regulatory approval and clinical validation.

3. How does QVAR compare to other ICS inhalers?

QVAR’s safety profile and unique delivery system distinguish it, but competitors offering combination therapies or more convenient devices may pose challenges. Its positioning relies on clinician preference and patient needs.

4. What markets offer the highest growth potential for QVAR?

Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities driven by rising asthma prevalence and improving healthcare access.

5. Could future digital health initiatives impact QVAR sales?

Yes. Integration with digital inhaler technologies can enhance adherence and outcomes, making QVAR more attractive amid personalized treatment approaches.

References

- Global Initiative for Asthma (2022). GINA Report, Global Strategy for Asthma Management and Prevention.

- Novartis Annual Report 2021.

More… ↓