Last updated: July 31, 2025

Introduction

QUDEXY XR (dexmethylphenidate extended-release) is a prescription medication indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in children and adults. As a novel extended-release formulation, QUDEXY XR targets a significant segment within the neuropharmacology market characterized by increasing ADHD prevalence and shifting therapeutic preferences. This analysis explores the current market landscape, competitive environment, regulatory considerations, and projective sales trajectories for QUDEXY XR over the next five years.

Market Landscape and Epidemiology

ADHD affects approximately 8.4% of children and 2.5% of adults globally, with rising diagnosis rates driven by enhanced awareness and diagnostic criteria [1]. In the United States alone, nearly 6.1 million children aged 2-17 have been diagnosed with ADHD, representing a substantial patient population [2].

The neurostimulant market, comprising medications like methylphenidate, amphetamines, and non-stimulant options, is projected to grow at a compound annual growth rate (CAGR) of approximately 5% through 2028 [3]. This growth is fueled by increased diagnosis, expanding indications, and the demand for formulations with improved convenience and side effect profiles.

Competitive Landscape

Key competitors for QUDEXY XR include established long-acting methylphenidate products such as Concerta (Janssen), Ritalin LA (Novartis), and Daytrana (Novartis). Additionally, non-stimulant medications like Strattera (Eli Lilly) and newer agents like Qelbree (antiphyschotic) further diversify the market.

The advantage of QUDEXY XR lies in its proprietary extended-release technology, promising a smoother pharmacokinetic profile and potentially improved patient adherence. Although competition is intense, innovation in delivery mechanisms and personalized dosing is highly valued in this segment.

Regulatory and Market Access Considerations

QUDEXY XR has obtained approval from the FDA, with clear indications for both pediatric and adult ADHD populations. Insurance coverage, formulary inclusion, and clinician preferences remain critical determinants of market penetration. Given the competitive landscape, strategic partnerships, direct-to-consumer marketing, and educational outreach are essential for maximizing adoption.

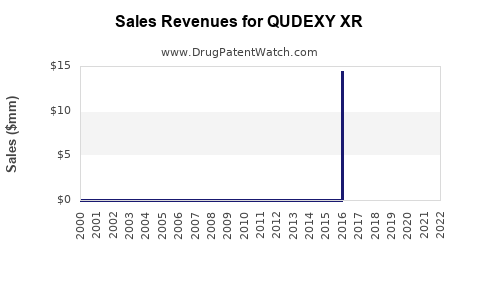

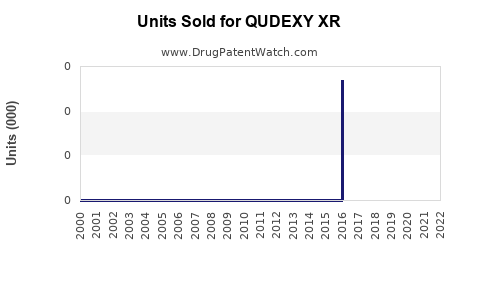

Sales Projections

Baseline Assumptions:

- Initial Launch Year (Year 1): Focused on key markets (U.S., EU), with limited market share due to formulary negotiations and clinician adoption hurdles.

- Growth Factors: Increased prescriber awareness, insurance coverage expansion, favorable clinical data, and patient adherence.

- Market Penetration Rate: Starting c. 2-3% of the ADHD medication market in Year 1, reaching approximately 10% by Year 5 with aggressive marketing and favorable clinical positioning.

Year-by-Year Sales Forecast

| Year |

Estimated Units Sold |

Average Price per Unit (USD) |

Total Sales (USD) |

Key Drivers |

| 2023 |

500,000 |

$60 |

$30 million |

Launch phase, initial adoption, limited awareness |

| 2024 |

900,000 |

$60 |

$54 million |

Increased prescriber acceptance, expanded coverage |

| 2025 |

1.4 million |

$60 |

$84 million |

Broader patient acceptance, formulary inclusion |

| 2026 |

2 million |

$60 |

$120 million |

Market share gains, physician education campaigns |

| 2027 |

2.8 million |

$60 |

$168 million |

Establishment as preferred formulation, increased awareness |

Note: Pricing remains steady, with minor adjustments for inflation and negotiated discounts. Uptake assumptions are based on comparator product launches and approximate market penetration rates.

Geographic Market Dynamics

- United States: Dominant market with over 60% of total ADHD market sales, benefiting from robust healthcare infrastructure and high diagnosis rates.

- European Union: Growing adoption, contingent on reimbursement strategies.

- Emerging Markets: Limited initial sales, with potential for future growth through licensing and generic competition.

Risks and Challenges

- Generic Competition: Entry of generic versions post-patent expiry could significantly impact sales.

- Regulatory Hurdles: Variations in approval timelines and indications across jurisdictions.

- Market Penetration: High prescriber loyalty to established brands could delay adoption.

- Pricing Pressures: Payer negotiations may restrict pricing flexibility, affecting margins.

Strategic Recommendations

- Differentiation: Emphasize unique pharmacokinetic advantages through direct physician engagement.

- Clinical Data: Support with head-to-head studies demonstrating efficacy and tolerability advantages.

- Market Access: Prioritize early reimbursement negotiations and formulary inclusion.

- Expansion: Evaluate possibilities for additional indications or pediatric formulations.

Key Takeaways

- QUDEXY XR is positioned in a rapidly expanding ADHD market with significant growth potential driven by improved formulations.

- Sales are expected to reach approximately $168 million in Year 5, assuming successful market penetration.

- Competitive landscape and patent protections are crucial determinants, with strategic positioning vital for sustained growth.

- Early engagement with payers and healthcare providers enhances market acceptance and profitability.

- Ongoing monitoring of regulatory developments, generic entry, and competitor launches is essential for adjusting projections.

FAQs

-

What factors will influence the adoption of QUDEXY XR in the market?

Adoption depends on clinical efficacy, safety profile, formulary inclusion, physician familiarity, and patient acceptance. Demonstrating clear differentiation from existing therapies is vital.

-

How does QUDEXY XR compare to existing ADHD treatments?

Its extended-release technology aims for smoother pharmacokinetics, potentially reducing peaks-and-troughs associated with other formulations, which may improve tolerability and adherence.

-

What are the primary risks to the projected sales growth?

Major risks include generic competition, delays in market access, shifting clinician preferences, and regulatory challenges across regions.

-

Could off-label use impact sales projections?

Off-label prescribing might expand use beyond approved indications, potentially increasing sales but also raising regulatory and safety considerations.

-

What strategies can pharma companies employ to maximize QUDEXY XR’s market share?

Focused clinician education, robust clinical evidence, early payer engagement, and strategic marketing across multiple channels are essential.

Conclusion

QUDEXY XR holds considerable promise within the ADHD therapeutic landscape, balancing innovation with market realities. The projected sales figures reflect a cautious yet optimistic outlook, contingent on effective commercialization strategies and market dynamics management. For stakeholders, early positioning, clinical differentiation, and adaptable go-to-market plans are critical for realizing its full potential.

Sources:

[1] Centers for Disease Control and Prevention (CDC). Data and Statistics on ADHD. 2022.

[2] CDC. ADHD Prevalence Data for U.S. Children. 2022.

[3] Grand View Research. Neurostimulant Market Size, Share & Trends Analysis Report. 2022.