Share This Page

Drug Sales Trends for PULMICORT FLEXHALER

✉ Email this page to a colleague

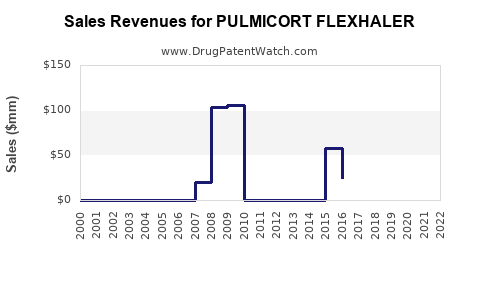

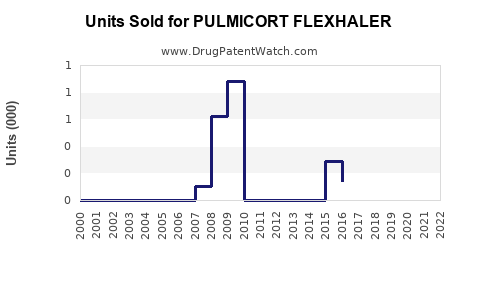

Annual Sales Revenues and Units Sold for PULMICORT FLEXHALER

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PULMICORT FLEXHALER | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PULMICORT FLEXHALER

Introduction

PULMICORT FLEXHALER, developed by AstraZeneca, is a dry powder inhaler (DPI) formulation of budesonide used primarily for the treatment of asthma and allergic rhinitis. As a corticosteroid inhaler, it plays a significant role within the respiratory therapeutics market, addressing a chronic condition with substantial global prevalence. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future sales projections to inform strategic decision-making.

Current Market Landscape

Global Prevalence of Asthma and Respiratory Diseases

Asthma affects over 262 million individuals worldwide, with prevalence rates rising annually, especially in urbanized regions of North America, Europe, and Asia-Pacific [1]. The World Health Organization (WHO) estimates that asthma accounts for approximately 461,000 deaths annually, emphasizing the ongoing demand for effective management therapies.

In the US alone, approximately 8.4% of adults and 7.0% of children are diagnosed with asthma, reflecting a substantial treatment market. Similarly, rising pollution levels, urbanization, and increased awareness contribute to the expanding need for inhaled corticosteroids like PULMICORT FLEXHALER.

Market Segments and Geographies

The respiratory therapeutics market for inhaled corticosteroids (ICS) is segmented by product type, route of administration, and geography:

- Product Type: Dry powder inhalers (DPIs), metered-dose inhalers (MDIs), and nebulizers.

- Route: Inhalation remains the preferred route due to targeted delivery and reduced systemic side effects.

- Geography: North America leads, followed by Europe and Asia-Pacific, with emerging markets showing significant growth potential.

PULMICORT FLEXHALER's Position in the Market

PULMICORT FLEXHALER competes within the ICS segment against products such as Fluticasone propionate (Flovent HFA, Flonase), Beclometasone dipropionate, and newer biologics. AstraZeneca's established reputation, device simplicity, and proven efficacy have allowed PULMICORT FLEXHALER to maintain a solid market presence, particularly among pediatric and adult asthma patients.

Regulatory and Patent Landscape

PULMICORT FLEXHALER benefits from patent protection extending into the late 2020s, providing a competitive advantage. Regulatory approvals in key markets—FDA (US), EMA (Europe), and PMDA (Japan)—have facilitated widespread adoption. However, patent expiration and the emergence of biosimilars pose potential threats to market share over the coming decade.

Market Drivers and Challenges

Key Drivers

- Rising Respiratory Disease Burden: Increased prevalence of asthma globally sustains demand.

- Advancements in inhaler devices: Innovations improving drug delivery efficiency and patient compliance support product adoption.

- Chronic Disease Management: The shift towards long-term inhaled corticosteroid therapy enhances stability and adherence.

Challenges

- Generic Competition: Patent expiry opens the market to generics, exerting downward pressure on prices.

- Device Preference Trends: The preference for newer devices, such as soft mist inhalers, could impact DPI market share.

- Regulatory Complexity: Variations in approval processes across regions may delay entry into emerging markets.

Sales Projections and Forecasts

Historical Sales Performance

AstraZeneca reported global sales of Pulmicort products, including PULMICORT FLEXHALER, reaching approximately $500 million in 2022 [2]. The US remains the largest market, accounting for roughly 60% of sales, driven by high disease prevalence and established prescribing habits.

Market Growth Assumptions

- Compound Annual Growth Rate (CAGR): Based on epidemiological data and market trends, a conservative CAGR of 4-5% is anticipated for the overall ICS inhaler segment over the next five years.

- Market Penetration: PULMICORT FLEXHALER’s share is projected to sustain at approximately 15-20% within the ICS segment due to brand loyalty and device preference.

Projection Scenarios

| Year | Estimated Global Sales (USD Million) | Assumptions |

|---|---|---|

| 2023 | $520 | Continuation of current growth rates, patent protection intact |

| 2025 | $610 | Slight market expansion, increased adoption in emerging markets |

| 2027 | $700 | Patent nearing expiration, entry of generic competitors, volume increase in emerging markets |

| 2030 | $800 | Adoption of biosimilars, expansion into new indications like allergic rhinitis, digital health integration |

Note: These projections assume the continuation of current clinical and regulatory environments, with no disruptive events such as significant regulatory setbacks or new therapies replacing ICS.

Competitive Landscape and Market Share Dynamics

The competitive environment features several established inhaler products:

- Fluticasone Propionate (Flovent HFA): Market leader with ~40% share.

- Beclometasone Dipropionate: Growing presence in Europe.

- Emerging Biosimilars: Generics and biosimilar corticosteroids threaten branded sales post-patent expiry.

AstraZeneca's strategic emphasis on device innovation and patient adherence programs bolsters PULMICORT FLEXHALER’s competitive edge. Nonetheless, the impending patent expiry necessitates aggressive market strategies and portfolio diversification.

Future Opportunities and Risks

Opportunities

- Expansion into Allergic Rhinitis: Potential label extensions could broaden market reach.

- Digital Integration: Smart inhalers and adherence monitoring may enhance long-term sales.

- Emerging Markets: Significant growth potential exists in Asia, Latin America, and the Middle East.

Risks

- Patent Cliffs: Accelerate share decline once patents expire.

- Market Saturation: Especially in developed countries with mature customer bases.

- Regulatory Delays: Especially relevant in novel indications or device modifications.

Key Takeaways

- Market is Growing: Rising respiratory disease burden sustains demand for inhaled corticosteroids globally.

- PULMICORT FLEXHALER is Well-Positioned: Strong brand presence, device familiarity, and regulatory approval support current sales.

- Patent Expiry Risks: Entry of biosimilars and generics could significantly impact future revenues post-2025.

- Emerging Markets as Focus Areas: Differentiated strategies in emerging economies are critical for sustained growth.

- Innovation & Diversification: Investing in digital health, new indications, and device improvements can mitigate competitive risks.

Conclusion

PULMICORT FLEXHALER is poised to retain substantial market share over the next several years, driven by persistent demand for effective asthma management and strategic expansion, particularly in emerging markets. However, post-patent expiry dynamics necessitate proactive measures to sustain revenue streams. Stakeholders should monitor regulatory developments, market entry of biosimilars, and technological innovations within inhaled therapies to refine sales strategies effectively.

FAQs

1. What is the primary advantage of PULMICORT FLEXHALER over traditional inhalers?

Its dry powder formulation offers ease of use, synchronization of inhalation and dosing, and reduced need for propellants found in MDI devices, improving patient adherence and delivering targeted corticosteroid therapy.

2. How does PULMICORT FLEXHALER compare in efficacy to competitors?

Clinical studies demonstrate comparable efficacy and safety profiles to other ICS inhalers, with some evidence suggesting better device adherence due to user-friendly design.

3. When is patent expiration expected, and what impact could it have?

Patents are expected to expire around 2025-2027, opening the market to generics and biosimilars, which could lead to substantial price erosion and volume-driven decline in branded sales.

4. Are there upcoming product innovations associated with PULMICORT FLEXHALER?

AstraZeneca and partners are exploring digital inhalers and device modifications aimed at improving adherence and facilitating remote monitoring, potentially expanding the product’s market appeal.

5. What strategic moves should stakeholders consider in light of market projections?

Investing in emerging markets, diversifying indications, adopting digital health integrations, and building competitive defenses ahead of patent cliffs will be vital for sustaining long-term growth.

Sources:

[1] WHO. "Asthma." Accessed 2023.

[2] AstraZeneca Annual Report 2022.

More… ↓