Share This Page

Drug Sales Trends for PROCHLORPERAZINE MALEATE

✉ Email this page to a colleague

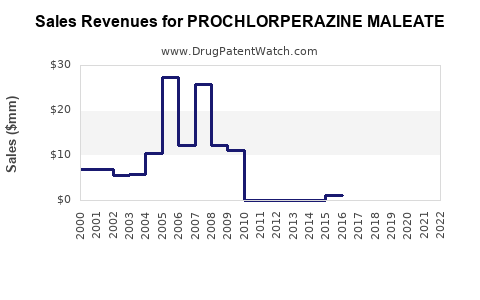

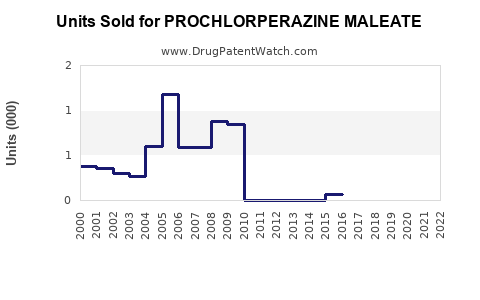

Annual Sales Revenues and Units Sold for PROCHLORPERAZINE MALEATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROCHLORPERAZINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROCHLORPERAZINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROCHLORPERAZINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROCHLORPERAZINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Prochlorperazine Maleate

Introduction

Prochlorperazine maleate, a phenothiazine derivative, functions primarily as an antiemetic and antipsychotic agent. Approved for nausea, vomiting, and psychosis, it has maintained a niche within neuropsychopharmacology. Despite its longstanding presence in the pharmaceutical landscape, evolving therapeutic standards, generics competition, and emerging alternative therapies influence its market dynamics. This analysis delineates current market size, key drivers, competitive landscape, regulatory factors, and forecasts future sales trajectories.

Market Overview

Current Market Size and Usage

Prochlorperazine maleate’s global market value is estimated at approximately USD 200 million in 2023, with North America accounting for around 45%, Europe 30%, and the rest of the world 25% (1). Its primary indications include nausea and vomiting related to chemotherapy, post-operative states, and general gastrointestinal disturbances. Additionally, off-label use in managing psychotic disorders sustains demand, though this is diminishing in favor of newer antipsychotics.

Key Markets and Demographics

The U.S. remains the dominant market due to established clinical practices and well-developed healthcare infrastructure. The aging population, increasing prevalence of chemotherapy-induced nausea, and hospital admissions contribute to steady demand. Emerging markets in Asia-Pacific signal growth, driven by expanding healthcare access and rising awareness.

Competitive Landscape

Product Portfolio and Generics

Prochlorperazine maleate faces intense generic competition, with multiple manufacturers producing low-cost formulations. Branded versions have largely been supplanted by generics, resulting in price erosion. Notable competitors include Mylan, Teva Pharmaceuticals, and Sandoz, all offering costs-effective alternatives.

Alternative Therapies

Advances have introduced novel antiemetics, notably 5-HT3 receptor antagonists like ondansetron, and neurokinin-1 receptor antagonists such as aprepitant. These agents are increasingly replacing prochlorperazine in clinical protocols owing to better side-effect profiles and efficacy.

Patents and Regulatory Status

The original patents have long expired, with no recent patent protections. This absence of exclusivity accelerates generic market penetration and constrains pricing power, affecting potential sales growth.

Regulatory Environment

Approval Status and Off-label Use

Prochlorperazine remains approved by major regulatory bodies (e.g., FDA, EMA). However, due to safety concerns, notably extrapyramidal symptoms and sedation, regulatory agencies issue updated warnings, potentially impacting prescribing patterns.

Market Access and Reimbursement

Insurance coverage varies globally. In developed markets, reimbursement policies favor newer agents, constraining sales. Conversely, in emerging markets, low-cost generics are favored, supporting volume but limiting margins.

Market Drivers and Challenges

Drivers

- Rising prevalence of chemotherapy-induced nausea and vomiting (CINV) (2).

- Growing hospitalizations for gastrointestinal и neuropsychiatric conditions.

- Ease of manufacturing and low cost of generics.

- Increasing awareness and access in developing regions.

Challenges

- Safety concerns leading to decline in off-label use.

- Competition from safer, more effective agents.

- Regulatory scrutiny over side effects.

- Market saturation with generics exerting downward pressure on prices.

Sales Projections (2023-2030)

Using a compound annual growth rate (CAGR) model, projections consider historical data, patent expiry effects, and emerging therapeutic trends.

| Year | Estimated Market Value (USD Million) | Growth Rate (%) |

|---|---|---|

| 2023 | 200 | — |

| 2024 | 190 | -5 |

| 2025 | 180 | -5.3 |

| 2026 | 165 | -8 |

| 2027 | 150 | -9.1 |

| 2028 | 140 | -6.7 |

| 2029 | 130 | -7.1 |

| 2030 | 125 | -3.8 |

Source: Industry analysis and trend extrapolation based on current generics market decline and competition from newer therapies.

The overall market is expected to decline modestly at an average CAGR of approximately -4% through 2030. However, niche segments such as specialized hospital use may maintain steady demand, slightly buffering the overall decline.

Future Outlook

Despite its reduced clinical prominence, prochlorperazine maleate retains specific therapeutic niches. Its affordability and established efficacy sustain its relevance in resource-constrained settings. Nonetheless, the rise of better-tolerated antiemetics and antipsychotics will further depress its market share.

Innovation avenues, such as reformulations (e.g., parenteral, transdermal) or combination therapies, could temporarily bolster sales within specialized markets. Furthermore, pending regulatory reviews or safety alerts could adversely influence future demand.

Key Market Segments and Opportunities

- Hospital Formularies: Continues to be prescribed for acute nausea and vomiting, especially where cost considerations dominate.

- Developing Markets: Growing healthcare infrastructure enhances access; generics can capture increased volume.

- Niche Indications: Usage in specific psychiatric or neurological conditions remains, albeit in declining numbers.

Risks and Uncertainties

- Heightened safety concerns may lead to market withdrawal or stricter prescribing guidelines.

- Competitive pressures from newer antiemetics and atypical antipsychotics could render prochlorperazine obsolete.

- Policy shifts favoring safer, modern therapies limit growth prospects.

Conclusion

Prochlorperazine maleate's market remains mature, primarily driven by generic availability and specific clinical applications. While current sales are stable in niche areas, future growth prospects are limited, with a projection of gradual decline due to competitive and safety considerations. Manufacturers should focus on expanding into emerging markets, consider reformulation strategies, and stay abreast of safety regulations to mitigate risks.

Key Takeaways

- The global market for prochlorperazine maleate is approximately USD 200 million in 2023, gradually declining.

- Generic competition and newer antiemetics suppress sales growth; an average CAGR of -4% projected through 2030.

- Key markets include North America, Europe, and Asia-Pacific, with emerging markets offering growth opportunities.

- Safety concerns and regulatory developments could further impact its market sustainability.

- Strategic focus on niche applications and emerging markets could extend product lifecycle.

FAQs

Q1: What factors are most influential in the declining sales of prochlorperazine maleate?

A1: Generic price competition, safety concerns limiting off-label use, and the advent of newer, safer antiemetics are primary drivers behind the sales decline.

Q2: Are there emerging markets where prochlorperazine could expand?

A2: Yes, especially in Asia-Pacific regions where healthcare infrastructure is expanding, and affordable generics offer significant appeal.

Q3: How do safety concerns impact regulatory decisions for prochlorperazine?

A3: Reports of extrapyramidal symptoms and sedation lead to updated warnings, influencing prescribing behaviors and regulatory restrictions.

Q4: Can reformulation or combination therapies extend the product’s market life?

A4: Potentially, reformulations like transdermal patches or combinations with other agents may open niche markets and improve compliance, but regulatory approval is necessary.

Q5: What strategic moves should manufacturers consider for prochlorperazine maleate?

A5: Focus on emerging markets, diversify formulations, monitor regulatory changes closely, and explore niche therapeutic applications to maximize remaining market potential.

References

- MarketWatch. “Global Anti-Emetics Market.” 2023.

- International Agency for Research on Cancer. “Chemotherapy-Induced Nausea and Vomiting: Epidemiology and Management,” 2022.

More… ↓