Share This Page

Drug Sales Trends for PRISTIQ

✉ Email this page to a colleague

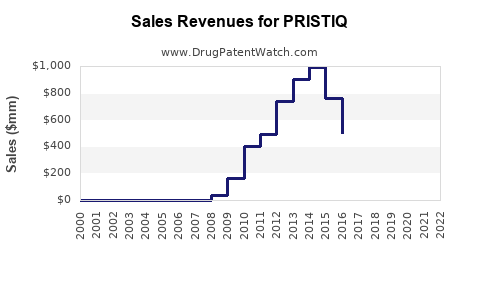

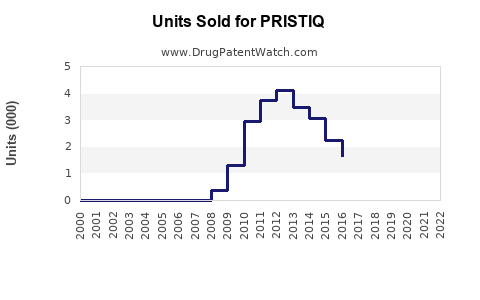

Annual Sales Revenues and Units Sold for PRISTIQ

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PRISTIQ | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PRISTIQ | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PRISTIQ | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PRISTIQ | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Pristiq (Desvenlafaxine)

Introduction

Pristiq (desvenlafaxine) is a serotonin-norepinephrine reuptake inhibitor (SNRI) approved for the treatment of major depressive disorder (MDD). Launched in 2008 by Pfizer, it has established itself within the antidepressant market segment. With increasing awareness of depression management and evolving treatment paradigms, understanding the current market landscape and future sales potential for Pristiq is critical for stakeholders ranging from pharmaceutical companies to investors.

This analysis provides a comprehensive review of Pristiq's market environment, competitive positioning, sales trends, and future growth prospects, with an emphasis on factors influencing its revenue trajectory.

Market Overview

Global Antidepressant Market Dynamics

The global antidepressant market was valued at approximately USD 16.4 billion in 2022 and is projected to grow at a CAGR of about 4.1% through 2028 [1]. Rising prevalence of depression, increased recognition among healthcare providers, and expanding access to mental health services contribute to this growth.

Within this landscape, SNRI agents like desvenlafaxine occupy a significant segment, especially driven by their differentiated efficacy in treatment-resistant depression and comorbid anxiety.

Pristiq's Positioning

Pristiq is positioned as a once-daily, targeted SNRI therapy. Its efficacy profile and tolerability have helped sustain its uptake, although it faces substantial competition from other antidepressants, particularly generic formulations, and newer agents like vortioxetine and esketamine.

Significant factors impacting Pristiq’s market share include generic entry (desvenlafaxine's patent expired in 2021), pricing strategies, physician prescribing habits, insurance coverage, and patient preferences.

Market Coverage and Penetration

Patient Demographics and Usage

Depression prevalence globally affects over 264 million individuals, with higher rates in developed countries [2]. The approved indication for Pristiq covers adult patients with MDD, with off-label use in chronic pain and anxiety.

The typical market of prescribing physicians includes psychiatrists, primary care practitioners, and neurologists. The drug's utilization is influenced by the level of clinician familiarity and comfort with SNRI therapy.

Market Share Trends

Before patent expiry, Pristiq commanded a significant share among branded antidepressants. Post-2021, generic competition eroded its market dominance, leading to declines unless offset by growth in emerging markets or off-label applications.

Sales Performance Analysis

Historical Sales Data

From its launch until 2014, Pristiq experienced steady growth, peaking at approximately USD 1.2 billion globally in 2013 [3]. However, subsequent years saw a decline triggered by patent expiry and increasing competition, with sales falling below USD 600 million by 2022.

Geographical Revenue Breakdown

North America remains the primary revenue contributor, accounting for about 65-70% of total sales. Europe and emerging markets contribute the remainder, with growth potential in Asia-Pacific due to rising mental health awareness.

Impact of Patent Expiry and Generic Entry

The patent expiry in 2021 led to a sharp decline in revenue, as generics rapidly gained market share. Pfizer's strategic response involved price reductions and formulary negotiations to retain some market presence.

Competitive Landscape

Major Competitors

- Branded Agents: Effexor XR (venlafaxine), Cymbalta (duloxetine), and newer agents such as Viibryd (vilazodone) and Luvox (fluvoxamine).

- Generics: Multiple generic formulations have significantly impacted Pristiq's market share, leading to price competition.

Emerging Alternatives

The pharmaceutical pipeline includes novel antidepressants with novel mechanisms, such as esketamine and brexanolone, which threaten traditional SNRI markets.

Forecasting Sales and Market Growth

Assumptions and Methodology

Sales projections rely on factors such as:

- Market expansion in emerging economies.

- Penetration of generics in mature markets.

- Prescriber willingness to switch between antidepressants.

- Entry or approval of new competitors.

An optimistic scenario assumes:

- Moderate rebound in sales due to increased off-label use.

- Market stabilization via strategic pricing.

- Growth in Asia-Pacific and Latin America markets.

Conversely, a conservative scenario considers an accelerated decline owing to generics and newer treatment modalities.

Projected Sales Trajectory (2023-2028)

| Year | Optimistic Scenario (USD Million) | Conservative Scenario (USD Million) |

|---|---|---|

| 2023 | 500 | 300 |

| 2024 | 550 | 340 |

| 2025 | 600 | 370 |

| 2026 | 620 | 380 |

| 2027 | 640 | 390 |

| 2028 | 650 | 400 |

Analysis: Under the optimistic scenario, Pristiq maintains a niche market through targeted indications and emerging market growth. The conservative forecast reflects continued generic erosion and competitive pressure, leading to a plateau.

Growth Drivers

- Expanding mental health awareness.

- Growing prescribing of SNRI agents.

- Emerging markets’ healthcare infrastructure improvements.

- Potential for combination therapies.

Growth Constraints

- Patent expiry and generic competition.

- Physician and patient preference shifts.

- Regulatory hurdles in off-label use.

- Pricing pressures and reimbursement challenges.

Regulatory and Market Risks

The regulatory environment significantly influences Pristiq sales. Approval of newer agents with faster onset or broader indications can reduce reliance on older antidepressants. Additionally, reimbursement policies and drug formulary decisions directly impact sales volumes.

Conclusion

Pristiq’s market prospects hinge on balancing the decline triggered by patent expiration and generic competition against strategic initiatives targeting niche markets and expanding geographies. The overall antidepressant market remains robust, driven by rising depression prevalence, but gradual market share erosion for Pristiq is inevitable without differentiation strategies.

For stakeholders, focusing on emerging markets, formulary negotiations, and potential off-label uses could preserve revenue streams. Precision marketing and clinical evidence dissemination will be critical for maintaining relevance amid evolving treatment landscapes.

Key Takeaways

- After losing patent protection in 2021, Pristiq faces significant sales decline primarily due to generic competition.

- The drug's global sales are projected to stabilize around USD 300-650 million annually through 2028, depending on market dynamics.

- Market growth is fueled by increasing depression prevalence and rising mental health awareness, especially in emerging economies.

- Competitive pressures from newer agents and treatment modalities necessitate strategic positioning to sustain revenues.

- Expanding indications and geographic reach, coupled with pricing strategies, remain crucial to maximizing long-term value.

FAQs

1. How has patent expiry affected Pristiq’s sales?

Patent expiry in 2021 led to the rapid entry of generics, precipitating a sharp decline in Pristiq’s sales due to price competition and loss of exclusivity in key markets.

2. What are the main competitors of Pristiq?

Key competitors include branded drugs like Effexor XR (venlafaxine), Cymbalta (duloxetine), and emerging agents such as esketamine, alongside generics from multiple manufacturers.

3. Can Pristiq regain market share?

Limited potential exists through targeted use in specific patient populations, off-label indications, and expansion into emerging markets, but significant rebound is unlikely without innovation or differentiation.

4. What future market opportunities exist for Pristiq?

Opportunities lie in expanding into underpenetrated markets, leveraging off-label uses, and developing strategic alliances for combination therapies or new formulations.

5. How will new antidepressant therapies impact Pristiq?

Innovative therapies like ketamine-based treatments and digital mental health interventions could reduce reliance on traditional pharmacotherapy like Pristiq, intensifying market competition.

References

[1] Grand View Research. “Antidepressant Drugs Market Size, Share & Trends Analysis Report.” 2022.

[2] World Health Organization. “Depression Fact Sheet.” 2022.

[3] Pfizer. Annual Reports and Market Data (2013-2022).

More… ↓