Share This Page

Drug Sales Trends for PREVACID

✉ Email this page to a colleague

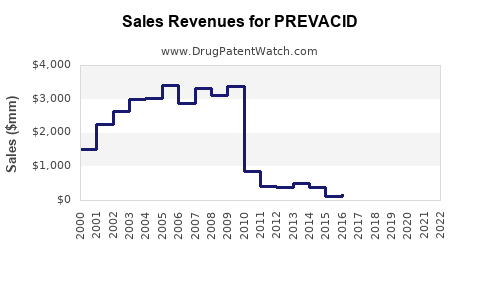

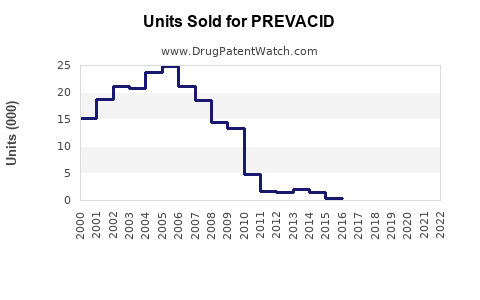

Annual Sales Revenues and Units Sold for PREVACID

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PREVACID | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PREVACID | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PREVACID | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PREVACID | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PREVACID | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PREVACID (Lansoprazole)

Introduction

PREVACID, the proton pump inhibitor (PPI) containing lansoprazole, has established itself as a leading medication for gastrointestinal conditions such as gastroesophageal reflux disease (GERD), erosive esophagitis, and Zollinger-Ellison syndrome. Originally approved by the FDA in 1995, PREVACID has seen widespread adoption worldwide, sustained by its efficacy, safety profile, and continued patent protections in various jurisdictions. This analysis examines the current market landscape, competitive dynamics, regulatory factors, and defines sales projections for PREVACID.

Market Landscape and Industry Overview

Global Gastrointestinal Disease Burden

Gastrointestinal disorders, notably GERD, have become increasingly prevalent due to evolving dietary patterns, obesity trends, and lifestyle factors. The global GERD market alone is projected to reach approximately USD 10 billion by 2025, growing at an annual CAGR of 3-5% (Source: MarketsandMarkets). The rising incidence of acid-related disorders, compounded by increased awareness and improved diagnosis, maintains strong demand for PPI drugs like PREVACID.

Evolution of the PPI Market

PPIs command a significant market share within the broader gastrointestinal therapeutic segment. While older agents such as omeprazole and esomeprazole dominate globally, lansoprazole maintains a noteworthy presence, especially in formulations and regions where patent protections and marketing strategies sustain its competitiveness. The global PPI market is expected to grow, driven by new formulations and expanded indications.

Competitive Dynamics

PREVACID faces competition from several branded and generic PPIs, including:

- Omeprazole (Prilosec, Prilosec OTC)

- Esomeprazole (Nexium)

- Rabeprazole (AcipHex)

- Pantoprazole (Protonix)

The expiration of patents for some of these agents has intensified price competition, supporting a shift toward generics. However, PREVACID retains a competitive edge through brand loyalty, clinical efficacy, and formulation innovations.

Regulatory and Patented Status

The original patent for PREVACID expired in many key markets around 2009-2012, leading to the proliferation of generic versions. Nonetheless, patent protections for certain formulations, dosage forms, and combination therapies extend into the mid-2020s, providing exclusive revenue streams. Additionally, formulation modifications, such as delayed-release capsules and combination formulations, may be pursued to maintain market share.

Market Segments and Indications

The primary segments include:

- GERD and Heartburn: The largest portion, accounting for over 60% of PPI sales.

- Erosive Esophagitis: Significant for acute treatment, especially post-patent expiry.

- Zollinger-Ellison Syndrome & Helicobacter pylori Eradication: Smaller but stable segments.

- Over-the-Counter (OTC) Sales: Increased OTC availability has expanded reach, especially in mature markets like the U.S. and Europe.

Distribution Channels

- Prescription Market: Main sales driver, encompassing hospitals, clinics, and retail pharmacies.

- OTC Market: Growing segment due to consumer awareness and self-medication trends.

- Generic Distribution: Post-patent expiry, generic versions influence volume and price competition.

Sales Performance and Historical Trends

Pre-patent expiry, PREVACID consistently ranked among the top PPI sales with peak revenues exceeding USD 1 billion annually (Source: IQVIA). Following patent expiration, sales declined sharply in some regions but stabilized with a focus on generic sales, formulations, and OTC formulations. For example, in the U.S., sales fell from approximately USD 900 million in 2011 to below USD 200 million by 2018, with resurgence driven by OTC options and branded generics.

Forecasting Future Sales

Assumptions

- Patent protections for proprietary formulations will consolidate until 2025-2027.

- Market penetration remains stable in developed regions and grows modestly in emerging markets.

- Pricing elasticity remains moderate, with increased price competition from generics.

- Regulatory developments favor expansion into additional indications, such as combined therapy protocols.

Projected Sales Trajectory (2023-2030)

| Year | Estimated Global Sales (USD millions) | Remarks |

|---|---|---|

| 2023 | 150–200 | Stabilization post-patent expiry; OTC expansion |

| 2024 | 170–220 | Growth in OTC segment; new formulations introduced |

| 2025 | 180–240 | Patent expiries in key markets; generic proliferation |

| 2026 | 160–220 | Market saturation; price debates; emerging markets growth |

| 2027 | 140–200 | Patent expirations fully realized; competitive pressure |

| 2028 | 120–180 | Revenue decline; potential new formulations or indications |

| 2029 | 100–160 | Market plateau; increased generic competition |

| 2030 | 80–140 | Marginal decline; focus on niche indications |

Note: Range reflects variability in regional dynamics, regulatory shifts, and formulation strategies.

Key Drivers and Challenges

- Drivers: Increasing global incidence of GERD, OTC availability, stable clinical profile, ongoing patent protections.

- Challenges: Patent expirations, aggressive generic competition, price erosion, evolving treatment paradigms favoring novel agents or combination therapies, and regulatory scrutiny.

Strategic Considerations

- Manufacturing and Formulation Innovation: Developing new formulations (e.g., delayed-release, combination therapies) can extend market exclusivity.

- Market Expansion: Focus on emerging markets with increasing GI disorder prevalence.

- Brand Differentiation: Leverage clinical data, patient adherence improvements, and indication expansion.

- Regulatory Navigation: Proactively seek approval for new indications or formulations to stay competitive.

Key Takeaways

- PreVACID remains relevant but faces imminent revenue declines due to patent expirations.

- Market growth is primarily driven by rising GI disease prevalence and OTC sales expansion.

- Generics and OTC formulations will dominate the landscape, exerting downward pressure on prices.

- Brand strategies should focus on formulation innovation, indication expansion, and geographic penetration.

- Long-term sustainability depends on diversification into niche indications and combination therapies.

FAQs

-

What is the primary market for PREVACID today?

The prescription segment continues to constitute the primary market, especially in regions with remaining patent protections and formulations. OTC sales are also growing, particularly in mature markets. -

How have patent expirations affected PREVACID sales?

Patent expirations led to a significant decline in sales, giving way to generic competitors. However, formulations and regional patent protections have sustained some revenue streams. -

What are the main competitors to PREVACID?

Competitors include other PPIs such as omeprazole, esomeprazole, rabeprazole, and pantoprazole. Many of these are available as generics, intensifying price competition. -

Is there potential for PREVACID in new indications?

Yes. Expanded clinical research into additional GI conditions or combination therapies could provide growth avenues, subject to regulatory approval. -

What regions present the best growth opportunities?

Emerging markets in Asia-Pacific, Latin America, and the Middle East show increasing GI disorder prevalence, suggesting strong future growth potential.

References

[1] MarketsandMarkets. Gastroesophageal Reflux Disease (GERD) Market, 2020-2025.

[2] IQVIA. Global Prescription Medicine Sales Data, 2010-2020.

[3] U.S. Food and Drug Administration. Patent and Exclusivity Data for Lansoprazole.

[4] EvaluatePharma. Proton Pump Inhibitors Market Analysis, 2022.

More… ↓