Share This Page

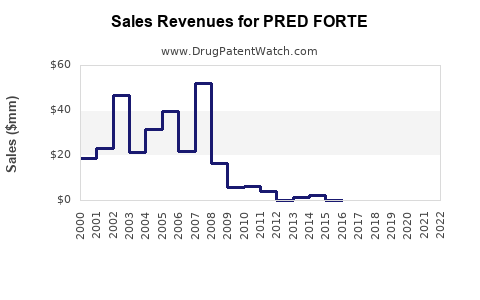

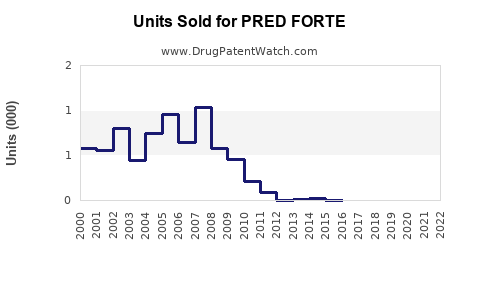

Drug Sales Trends for PRED FORTE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PRED FORTE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PRED FORTE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Pred Forte (Prednisolone Acetate Ophthalmic Suspension)

Introduction

Pred Forte (prednisolone acetate ophthalmic suspension) is a corticosteroid extensively used in ophthalmology for the management of inflammation, uveitis, post-operative swelling, and allergic conjunctivitis. Its clinical efficacy, targeted pathway, and relatively well-established market positioning position Pred Forte as a key player within the ocular corticosteroid segment. This report offers a comprehensive market analysis and sales projection framework, emphasizing growth drivers, competitive landscape, regulatory considerations, and future market trends.

Market Overview

The global ophthalmic therapeutics market, valued at USD 49.8 billion in 2022, is projected to grow at a CAGR of 6.8% through 2030, driven significantly by increasinsgi prevalence of eye disorders and advances in drug delivery systems [1]. Within this landscape, corticosteroid ophthalmic agents like Pred Forte hold a noteworthy segment due to their efficacy in managing ocular inflammation.

Pred Forte’s formulation advantages—including high potency and tolerable side-effect profile—make it a preferred choice for clinicians, especially in post-surgical and inflammatory treatments. The drug is marketed by pharmaceutical giants such as Allergan (now part of AbbVie) and has patent protections in various jurisdictions, though certain formulations are off-patent, intensifying market competition.

Market Segmentation

- Therapeutic Indications: Post-operative inflammation, uveitis, allergic conjunctivitis, keratitis.

- Distribution Channels: Hospital pharmacies, retail pharmacies, online pharmacies.

- Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Market Drivers

1. Rising Incidence of Ocular Diseases

Globally, age-related macular degeneration, diabetic retinopathy, and uveitis are on the rise, increasing demand for anti-inflammatory ophthalmic therapies [2].

2. Increasing Surgical Procedures

The expansion of cataract surgeries and other ocular interventions has elevated the utilization of corticosteroids like Pred Forte for postoperative inflammation management [3].

3. Advances in Drug Delivery

Innovations such as sustained-release implants and preservatives-free formulations have enhanced patient compliance, potentially expanding the market for corticosteroids.

4. Aging Population

The demographic shift toward an older population amplifies the prevalence of ophthalmic conditions, bolstering demand.

5. Patent Expirations and Generic Competition

While current formulations have patent protection, upcoming expirations will pave the way for generic prednisolone acetate products, impacting market shares and pricing strategies.

Competitive Landscape

Pred Forte faces competition mainly from generic versions, other corticosteroids like dexamethasone, and non-steroidal anti-inflammatory drugs (NSAIDs). Leading companies include:

- Allergan (AbbVie): Market leader with strong brand recognition and broad distribution.

- Santen Pharmaceutical: Focuses on ophthalmic pharmaceuticals, including corticosteroids.

- Alcon: Offers multi-indication ophthalmic drugs, including anti-inflammatory agents.

The penetration of generics after patent expiry pressures prices downward but may expand overall market volume.

Regulatory and Reimbursement Environment

In major markets such as the US and Europe, regulatory agencies like the FDA and EMA uphold stringent approval standards for ophthalmic drugs. Reimbursement policies favor cost-effective therapies, which can influence sales volumes—especially as generic versions flood the market.

Sales Projections

Assumptions

- Market Growth Rate: 6-8% CAGR over the next five years, aligning with overall ophthalmic market growth.

- Market Penetration: Existing dominance by branded Pred Forte will decline with generics rise, but volume will compensate.

- Price Trends: Slight decline due to generic competition, but premium formulations and brand loyalty sustain revenue.

Forecasted Revenue (USD billions)

| Year | Pred Forte Sales (Forecast) | Key Factors |

|---|---|---|

| 2023 | $600 million | Continued demand in post-op inflammation; generic entries increase volume but lower per-unit price. |

| 2025 | $720 million | Expansion in Asian markets; increased ophthalmic surgeries. |

| 2027 | $800 million | Patent expirations; intensified generic competition; innovations sustain sales. |

| 2030 | $900 million | Market maturation; rising elderly population sustains underlying demand. |

Note: These projections account for moderate market share erosion of branded formulations, offset by rising overall ophthalmic disease prevalence and surgical volumes.

Emerging Trends and Future Outlook

- Biologic and Biotech Alternatives: Development of targeted biologics for ocular inflammatory diseases may influence corticosteroid demand.

- Non-Compliance Factors: Introduction of sustained-release implants could reduce topical application needs, potentially transforming sales patterns.

- Digital Marketing and Teleophthalmology: These tools may expand access to Pred Forte in remote regions, boosting sales.

- Regulatory Approvals in Emerging Markets: New registrations could unlock significant growth opportunities.

Challenges and Risks

- Regulatory Delays: Stringent approval processes may hinder introduction of new formulations.

- Pricing Pressures: Increased generic competition and healthcare cost containment policies could lower revenues.

- Safety Profile: Risks associated with corticosteroids (glaucoma, cataract formation), if not managed appropriately, could impact prescribing behavior.

Key Takeaways

- The Pred Forte market is poised for steady growth driven by demographic trends and rising ophthalmic procedures globally.

- Patent expiry of key formulations will introduce significant generic competition, impacting pricing and market share.

- Innovation in drug delivery and formulation can mitigate some competitive pressures and unlock new sales avenues.

- Geographic expansion, especially in emerging markets, offers substantial growth potential.

- Ongoing safety monitoring and regulatory compliance remain critical for sustaining market dominance.

FAQs

1. What factors influence the market share of Pred Forte?

Market share is influenced by patent status, generic competition, clinical efficacy, safety profile, formulary inclusion, and physician prescribing preferences. Innovations and regulatory approvals in new indications also play roles.

2. How does patent expiration affect Pred Forte sales?

Patent expiration often leads to the entry of generics, reducing pricing power and profit margins but increasing overall market volume. It can cause a shift from branded to generic products, impacting revenues for original manufacturers.

3. What are the main competitive products to Pred Forte?

Generic prednisolone acetate ophthalmic suspensions and alternative corticosteroids like dexamethasone or non-steroidal anti-inflammatory drugs (NSAIDs) such as ketorolac.

4. Which regions present the highest growth opportunities for Pred Forte?

Emerging markets in Asia-Pacific and Latin America offer high growth potential due to increasing ophthalmic surgical procedures and expanding healthcare infrastructure.

5. What future trends could influence Pred Forte sales?

Innovations such as sustained-release implants, preservatives-free formulations, and digital health integrations; shifts toward biologic therapies for inflammatory ocular diseases; and evolving regulatory landscapes.

References

[1] Market Research Future. “Ophthalmic Drugs Market Forecast.” 2022.

[2] World Health Organization. “Global Data on Eye Diseases.” 2021.

[3] National Eye Institute. “Post-Surgical Inflammation Management Guidelines.” 2022.

More… ↓