Last updated: July 30, 2025

Introduction

Potassium chloride (KCl) is a ubiquitous chemical compound with extensive applications in medical, industrial, and agricultural sectors. Its therapeutic use as a potassium supplement and electrolyte replenisher marks it as a pivotal drug in healthcare. As a critical ingredient in salting and fertilizer manufacturing, potassium chloride's market dynamics are influenced by both pharmaceutical demand and non-pharmaceutical sectors. This report provides a comprehensive analysis of the current market landscape and projecting future sales trends for potassium chloride, with a focus on pharmaceutical applications.

Market Overview

Pharmaceutical Segment

Potassium chloride's primary pharmaceutical role involves treating and preventing hypokalemia—a condition marked by abnormally low potassium levels. It is available in various formulations, including oral tablets, capsules, and intravenous solutions.

- Market Size: The global pharmaceutical potassium chloride market was valued at approximately USD 2.1 billion in 2022, with an expected compound annual growth rate (CAGR) of 4.5% over the next five years, reaching USD 2.8 billion by 2027 [1].

- Driving Factors: Rising prevalence of cardiovascular diseases, kidney disorders, and increased awareness of electrolyte imbalances are propelling demand. Moreover, the COVID-19 pandemic accentuated the need for electrolyte management in critically ill patients.

Industrial and Agricultural Sector

While not directly tied to pharmaceutical sales, the industrial utilization of potassium chloride in fertilizers significantly influences overall market supply and price stability.

- Global Fertilizer Market: Potassium-based fertilizers constitute approximately 40-45% of global potassium consumption, underlining the importance of KCl in global agriculture [2].

Market Drivers and Restraints

Drivers

- Epidemiological Trends: Aging populations worldwide increase demand for electrolyte supplements.

- Expansion in Healthcare Infrastructure: Emerging markets expanding healthcare infrastructure contribute to rising consumption.

- Innovative Formulations: Development of slow-release and novel delivery systems improve patient adherence.

Restraints

- Pricing Volatility: Fluctuations driven by raw material prices, geopolitical tensions, and supply chain disruptions.

- Regulatory Challenges: Stringent drug approval processes may delay product launches.

- Competitive Market: Presence of multiple generic manufacturers sustains competitive pressure, compressing margins.

Regional Market Analysis

| Region |

Key Trends |

Market Size (2022) |

Outlook |

| North America |

Mature market with high adoption; increasing clinical use |

USD 800 million |

4% CAGR |

| Europe |

Stringent regulations; high healthcare spending |

USD 600 million |

4.5% CAGR |

| Asia-Pacific |

Rapidly growing healthcare and pharmaceutical sectors; emerging markets |

USD 500 million |

6% CAGR |

| Latin America & MEA |

Growing awareness; expanding healthcare infrastructure |

USD 200 million |

5-6% CAGR |

Note: Data based on industry reports and market surveys [1][2].

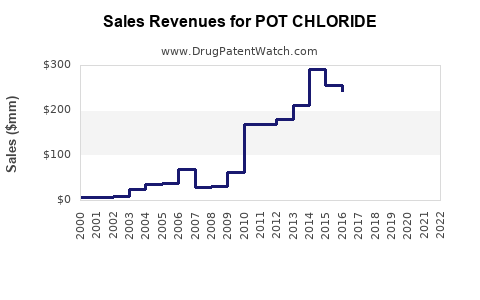

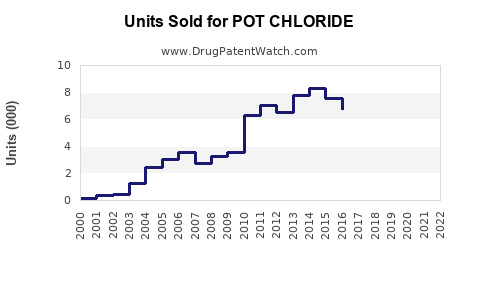

Sales Projections for Potassium Chloride

Forecast Assumptions

- Steady Growth in Clinical Use: The rising incidence of chronic illnesses bolsters demand.

- Market Penetration: Expansion of generic formulations enhances affordability and accessibility.

- Supply Chain Stability: Anticipated stabilization post-pandemic disruptions.

Projected Sales Volume and Revenue

| Year |

Estimated Units Sold (Million Units) |

Estimated Revenue (USD Million) |

| 2023 |

1,200 |

2,150 |

| 2024 |

1,260 |

2,250 |

| 2025 |

1,330 |

2,350 |

| 2026 |

1,410 |

2,470 |

| 2027 |

1,490 |

2,580 |

Note: Assumes average price per unit remains within USD 1.80–1.85, subject to market fluctuations.

Key Market Opportunities and Trends

- Emerging Markets Penetration: Increasing pharmaceutical manufacturing capacity offers growth prospects.

- Innovation in Formulations: Extended-release and combination products facilitate market penetration.

- Regulatory Favorability: Streamlined approval pathways in selected jurisdictions foster faster deployment.

Competitive Landscape

Major players include Pfizer, GlaxoSmithKline, Teva Pharmaceuticals, and Baxter. The market exhibits high generic competition, with pricing strategies focusing on volume-led growth. Strategic collaborations and capacity expansion plans are commonplace to secure supply chain advantages.

Conclusion

The pharmaceutical market for potassium chloride is poised for steady growth, driven by demographic shifts, expanding healthcare infrastructure, and technological advancements. While industry challenges such as price volatility and regulatory constraints exist, strategic positioning and innovation can capitalize on emerging opportunities.

Key Takeaways

- The global pharmaceutical potassium chloride market is projected to grow at approximately 4.5% CAGR through 2027.

- Demand is driven chiefly by increasing healthcare needs associated with chronic and acute conditions.

- Regional shifts highlight Asia-Pacific as a high-growth zone, owing to developing healthcare systems.

- Supply chain stability and price management are critical for sustained profitability.

- Innovation in formulations and strategic partnerships will be key to capturing market share.

FAQs

1. What are the main therapeutic uses of potassium chloride in medicine?

Potassium chloride is primarily used to treat hypokalemia and manage electrolyte imbalances in critically ill patients, especially those with cardiovascular, renal, or gastrointestinal disorders.

2. How does the demand for potassium chloride vary across regions?

Demand is highest in North America and Europe due to mature healthcare systems, with Asia-Pacific experiencing rapid growth due to expanding medical infrastructure and increasing chronic disease prevalence.

3. What factors influence the pricing of pharmaceutical potassium chloride?

Pricing is affected by raw material costs, manufacturing expenses, regulatory compliance, market competition, and supply chain stability.

4. Are new formulations of potassium chloride expected to impact sales?

Yes, innovations such as extended-release tablets and combination therapies improve patient adherence and expand market reach.

5. How do geopolitical events affect potassium chloride markets?

Geopolitical tensions can disrupt supply chains, influence raw material costs, and create pricing volatility, which in turn impacts sales projections.

References

[1] MarketResearch.com, "Global Pharmaceutical Potassium Chloride Market Report," 2022.

[2] International Fertilizer Association, "World Fertilizer Consumption Report," 2022.