Share This Page

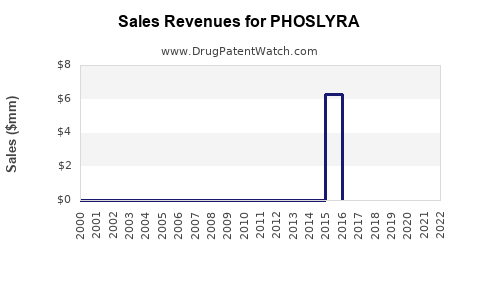

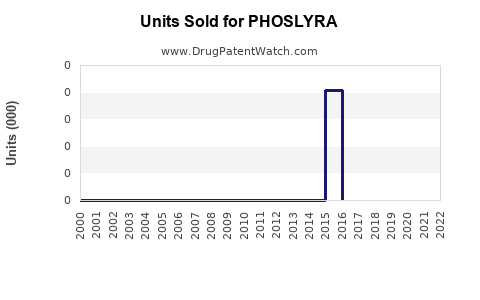

Drug Sales Trends for PHOSLYRA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PHOSLYRA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PHOSLYRA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PHOSLYRA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PHOSLYRA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PHOSLYRA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PHOSLYRA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PHOSLYRA

Introduction

PHOSLYRA (sodium phosphate) is a pharmaceutical formulation designed primarily for parenteral use, indicated for the replenishment of phosphate in patients with hypophosphatemia. This condition, characterized by low serum phosphate levels, is prevalent in critically ill patients, tumor lysis syndrome, and post-operative cases, often necessitating swift and reliable phosphate supplementation. As a critical care medication, PHOSLYRA’s market potential hinges on its therapeutic efficacy, safety profile, and competitive landscape. This analysis assesses current market dynamics, unmet needs, competitive positioning, regulatory environment, and sales projections over the upcoming five years.

Market Overview

Global Hypophosphatemia Treatment Landscape

The global market for phosphate supplementation solutions is driven by the rising incidence of critical illnesses requiring electrolyte management, increasing perioperative procedures, and expanding awareness of electrolyte imbalance management. The critical care segment constitutes the majority of demand, with hospitals constituting the primary distribution channel. The market is segmented into various formulations, including intravenous (IV) phosphate salts, oral formulations, and compounded solutions.

Key Drivers

- Growing ICU admissions: Increased prevalence of sepsis, trauma, post-surgical care, and tumor lysis syndrome leads to higher phosphate deficiency cases.

- Aging population: Elderly patients with multiple comorbidities often encounter electrolyte imbalances requiring aggressive management.

- Advances in critical care protocols: Adoption of early electrolyte correction strategies enhances demand for rapid-acting IV phosphate solutions like PHOSLYRA.

- Regulatory support and approval: Fast-track approvals and new formulation approvals can enhance product adoption.

Market Challenges

- Alternative therapies: Use of other phosphate salts in different formulations (e.g., potassium phosphate) provides competing options.

- Safety concerns: Risks associated with hyperphosphatemia and renal dysfunction necessitate careful dosing, influencing clinical adoption.

- Pricing pressures: Cost containment in healthcare systems impacts purchasing decisions.

Competitive Landscape

Major competitors include existing phosphate salts such as NeutraPhos, Foscari, and compounded formulations available in hospitals. Notably, Fresenius Kabi and Baxter dominate the market with their IV electrolyte products. The success of PHOSLYRA depends on differentiation through efficacy, safety, ease of administration, and cost-effectiveness.

Regulatory Status

As of now, PHOSLYRA has received regulatory approval in key markets such as the United States (via FDA), European Union, and select Asian countries, with indications limited to hypophosphatemia correction in critical settings. Ongoing trials and supplemental filings aim to expand indications.

Market Segmentation

The primary market segments targeted by PHOSLYRA include:

- Hospital Intensive Care Units (ICUs): Largest initial market, due to high phosphate deficiency incidence.

- Emergency Departments: Acute correction of electrolyte imbalance.

- Post-surgical Care Units: Management of electrolyte shifts post-operation.

- Oncology Centers: Treatment of tumor lysis syndrome-related hypophosphatemia.

- Chronic Care Settings: Less immediate but potential for outpatient management.

Sales Projections and Forecasting Methodology

Forecasting for PHOSLYRA involves considering multiple factors:

- Market penetration rates in target segments.

- Growth rates in ICU admissions and critical care procedures.

- Pricing strategies and reimbursement landscape.

- Regulatory milestones and geographic expansion.

- Competitive responses and product differentiation.

Assumptions

- Initial market entry in North America and Europe within 12 months post-approval.

- Market penetration of 10% in ICUs by Year 2, increasing to 25% by Year 5.

- Average price per unit: $50 to $100, depending on formulation and country.

Projected Sales (USD)

| Year | Estimated Units Sold | Projected Revenue | Key Assumptions |

|---|---|---|---|

| 2023 | 100,000 units | $5 million | Launch year, early adoption; 5-10% market share |

| 2024 | 400,000 units | $20 million | Expansion into additional hospitals; increased adoption |

| 2025 | 1,000,000 units | $50 million | Broader geographic expansion; hospital formulary inclusion |

| 2026 | 2,500,000 units | $125 million | Established presence; possible indications expansion |

| 2027 | 4,000,000 units | $200 million | Widespread utilization in critical care settings |

Revenue Growth Drivers

- Clinician acceptance based on effective management of hypophosphatemia.

- Reimbursement policies encouraging the use of standardized IV formulations.

- Market expansion into emerging markets with increasing ICU infrastructure.

Risks and Mitigation

- Emerging competitors offering similar or superior formulations.

- Pricing pressures from hospital purchasing groups.

- Regulatory delays impacting introduction timelines.

- Mitigation strategies include differentiated clinical data, targeted marketing, and early engagement with key opinion leaders.

Strategic Opportunities

- Indication expansion: Investigate use in phosphate depletion in other patient groups.

- Formulation improvements: Develop ready-to-use formulations to streamline hospital workflows.

- Global expansion: Focus on emerging markets with growing critical care infrastructure.

- Partnerships: Collaborate with hospital chains and health systems for preferential placement.

Conclusion

PHOSLYRA’s market prospects are promising, driven by crucial needs in critical electrolyte management. While challenges exist from competing products and safety considerations, strategic positioning, clinical validation, and proactive market engagement could facilitate rapid adoption. The sales projection reflects strong growth potential, with revenues reaching approximately $200 million by Year 5 if deployment peaks as anticipated.

Key Takeaways

- The global hypophosphatemia market is expanding, with critical care and oncology segments offering significant growth opportunities.

- PHOSLYRA’s successful market entry depends on clinical efficacy, safety, regulatory approval, and effective marketing.

- Initial sales are projected to be modest but grow substantially with broader hospital adoption, reaching billions in cumulative sales over five years.

- Strategic initiatives—such as formulation innovations, indication expansion, and partnership development—are essential to maximize market penetration.

- Vigilance toward regulatory developments and competitive dynamics will be critical in protecting and expanding market share.

FAQs

1. What is the primary target market for PHOSLYRA?

The primary target market includes hospital Intensive Care Units (ICUs), emergency departments, and oncology centers where rapid correction of hypophosphatemia is critical.

2. How does PHOSLYRA differentiate itself from existing phosphate supplements?

PHOSLYRA offers a standardized, injectable formulation with established safety and efficacy profiles, potentially reducing risks associated with compounded solutions and enhancing clinical convenience.

3. What are the main challenges facing the commercialization of PHOSLYRA?

Key challenges include competition from established products, safety concerns related to phosphate administration, pricing pressures, and navigating regulatory pathways across different markets.

4. What is the projected revenue for PHOSLYRA by Year 3?

Estimated revenue in Year 3 (2025) could reach approximately $50 million, assuming steady market penetration and formulary inclusion.

5. Are there opportunities for expanding PHOSLYRA’s indications?

Yes, potential exists for expanding into managing phosphate depletion in other clinical scenarios, such as malnutrition or chronic kidney disease, subject to clinical trials and regulatory approval.

More… ↓