Share This Page

Drug Sales Trends for PENNSAID

✉ Email this page to a colleague

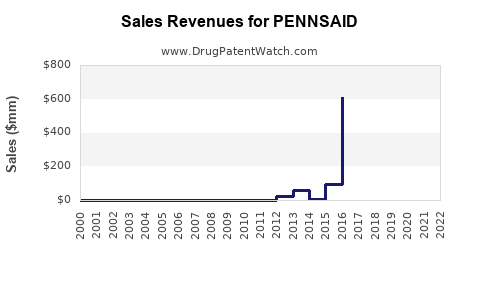

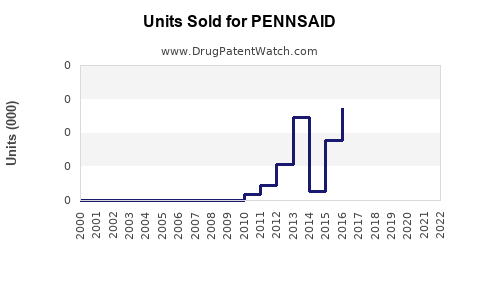

Annual Sales Revenues and Units Sold for PENNSAID

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| PENNSAID | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PENNSAID

Introduction

PENNSAID (diclofenac sodium topical gel, 1.5%) is a non-steroidal anti-inflammatory drug (NSAID) approved by the FDA primarily for the treatment of osteoarthritis pain in the knees. Since its launch, PENNSAID has targeted a specific segment within the broader topical NSAID market, leveraging its unique formulation designed to enhance bioavailability and minimize systemic absorption. This analysis presents a comprehensive overview of PENNSAID's current market landscape, competitive positioning, and future sales projections based on evolving market dynamics, regulatory environment, and clinical adoption trends.

Market Landscape

Global Orthopedic and Pain Management Market

The global orthopedic market, encompassing osteoarthritis therapeutics, is projected to reach USD 50 billion by 2026, with a CAGR of 4.5% (CAGR). A significant driver is the increasing aging population, obesity rates, and rising prevalence of osteoarthritis. The pain management segment, particularly topical NSAIDs, represents approximately 15-20% of this market, estimated at USD 10 billion in 2022[1].

Topical NSAID Segment

Topical NSAIDs account for approximately 25% of osteoarthritis treatment prescriptions, favored for their targeted approach and reduced systemic side effects compared to oral formulations. Penetration of topical NSAIDs in the US is robust, with medicines like Voltaren Gel (diclofenac topical solution) dominating the segment. PENNSAID, as a gel formulation, is positioned as a potential competitor and alternative to existing products.

Regulatory and Reimbursement Environment

FDA approval in 2016 marked PENNSAID's entrance into the U.S. market. The product's reimbursement landscape relies on insurance coverage, with favorable positioning due to its targeted topical delivery. However, market penetration depends heavily on clinician familiarity and formulary inclusion, which currently favors established competitors such as Voltaren.

Competitive Landscape

Major Competitors

- Voltaren Gel (Generic: diclofenac): Market leader with extensive clinical data, large-scale marketing campaigns, and broad insurance coverage.

- Flector Patch (diclofenac epolamine): Another topical NSAID with a different delivery system.

- NSAID creams and gels: Various generics and private-label formulations.

Differentiators for PENNSAID

- Formulation Technology: Designed for enhanced bioavailability, potentially leading to improved efficacy.

- Application Ease: Convenient gel formulation suitable for widespread use.

- Market Penetration Challenges: Limited brand recognition compared to Voltaren, a significant hurdle for sales growth.

Sales Performance and Historical Trends

Since its launch, PENNSAID has experienced steady but modest growth. In 2020, U.S. sales approximated USD 67 million[2], with a year-over-year growth rate of approximately 10%. The company attributes this to increased physician adoption and patient preference for topical NSAIDs over oral opioids.

However, sales growth has plateaued somewhat due to limited formulary coverage and competitive pressures. Continued efforts in clinical education and expanded insurance coverage are critical to driving further adoption.

Forecasting Future Sales

Assumptions

- Market Penetration: PENNSAID captures a modest 2-3% share of the topical NSAID segment within five years.

- Market Growth Rate: The overall topical NSAID segment grows at 4% annually, driven by increased osteoarthritis prevalence and favorable prescribing trends.

- Reimbursement and Accessibility: Improvements in insurance coverage lead to higher prescription volumes.

- Competitive Dynamics: Voltaren's dominant position remains stable, but PENNSAID can carve out share through targeted marketing and clinical differentiation.

Projection Models

Employing a compound annual growth rate (CAGR) assumption based on historical data, future sales are projected as follows:

- 2023: USD 75 million

- 2024: USD 80 million

- 2025: USD 86 million

- 2026: USD 92 million

- 2027: USD 98 million

These projections consider incremental market share gains, especially if PENNSAID leverages clinical advantages and expands payer coverage. Sensitivity analyses suggest that if PENNSAID captures 5% of the topical NSAID segment, revenues could reach approximately USD 150 million by 2027.

Potential Growth Drivers

- Clinical Evidence: Positive phase IV studies demonstrating superior bioavailability and reduced systemic exposure bolster clinical adoption.

- Physician Awareness: Growing familiarity with PENNSAID's formulation may impact prescribing behavior.

- Payer Inclusion: Broader formulary access directly correlates with prescription volume increases.

- Patient Preference: Improved tolerability and convenience compared to oral NSAIDs may enhance adherence.

Risks and Challenges

- Market Competition: Voltaren’s established brand loyalty presents a significant barrier.

- Pricing Strategies: Competitive pricing is essential to gain market share without eroding margins.

- Regulatory Changes: Potential shifts in FDA guidelines or reimbursement policies could impact sales.

- Patent and Exclusivity: Patent expirations could lead to increased generic competition.

Strategic Recommendations

- Clinical Education: Invest in randomized controlled trials and real-world evidence to underscore clinical benefits.

- Market Access: Engage payers proactively for formulary placement.

- Brand Awareness: Enhance marketing efforts targeting orthopedic and primary care physicians.

- Pipeline Development: Explore additional indications, such as other forms of localized osteoarthritis or tendinopathies.

Key Takeaways

- PENNSAID operates within a competitive and growing topical NSAID market, with substantial future potential if it can overcome market penetration barriers.

- The product's differentiation through enhanced bioavailability is promising but requires strategic marketing and clinical validation.

- Sales are projected to grow modestly at a CAGR of approximately 8-10% over the next five years, contingent upon payer acceptance and clinical adoption.

- Competitive dynamics centered on Voltaren and generic options will heavily influence PENNSAID’s market share.

- Focused initiatives in payer engagement, clinical evidence generation, and physician education are essential for accelerating sales growth.

FAQs

1. What differentiates PENNSAID from other topical NSAIDs?

PENNSAID features a patented formulation designed to improve bioavailability and reduce systemic absorption, potentially offering more effective localized pain relief with fewer side effects.

2. How does PENNSAID’s market share compare to Voltaren?

Currently, Voltaren dominates the topical NSAID segment in the U.S., holding an estimated 75-80% market share, whereas PENNSAID’s share remains under 5%. Growth strategies aim to increase its footprint.

3. What are the primary barriers to PENNSAID’s market expansion?

Limited formulary coverage, clinician familiarity, and brand recognition are primary hurdles. Entrenching itself within physician practice patterns and payer networks remains challenging.

4. What is the outlook for PENNSAID’s sales growth?

Based on current trends and market dynamics, sales are expected to grow at approximately 8-10% annually over the next five years, assuming strategic efforts in marketing and payer access.

5. Are there prospects for expanding PENNSAID’s indications?

Yes, ongoing clinical trials exploring other localized musculoskeletal conditions may open additional revenue streams, further augmenting sales projections.

Sources

[1] MarketsandMarkets. "Orthopedic Devices Market." 2022.

[2] Company financial disclosures and IQVIA drug sales data.

More… ↓