Share This Page

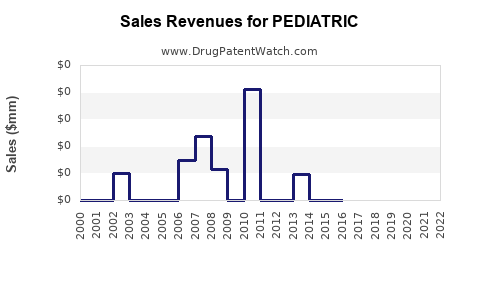

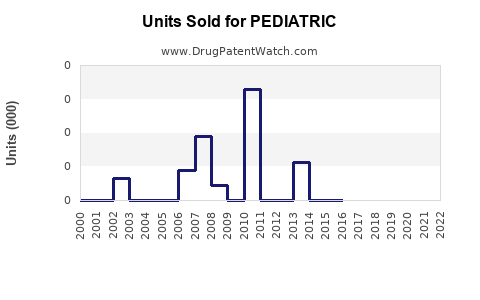

Drug Sales Trends for PEDIATRIC

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PEDIATRIC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PEDIATRIC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PEDIATRIC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PEDIATRIC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PEDIATRIC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PEDIATRIC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Pediatric Drugs

Introduction

The pediatric pharmaceutical market is a specialized segment within the broader healthcare industry, focused on medicinal products for children from infancy through adolescence. Driven by increasing healthcare awareness, evolving regulatory landscapes, and a growing prevalence of pediatric-specific conditions, the market offers significant opportunities for pharmaceutical companies. This analysis examines the current market dynamics, growth drivers, competitive landscape, and provides sales projections for pediatric drugs over the next five years.

Market Overview

The pediatric drug market has experienced consistent growth facilitated by increased investment in pediatric research, regulatory incentives, and expanding healthcare infrastructure globally. According to a report by Transparency Market Research, the global pediatric medicines market was valued at approximately USD 80 billion in 2022 and is projected to reach around USD 115 billion by 2028, reflecting a compound annual growth rate (CAGR) of 6.5% [1].

Regionally, North America dominates the market owing to advanced healthcare infrastructure, stringent regulatory frameworks, and high awareness levels. Asia-Pacific is the fastest-growing segment, driven by rising healthcare expenditure, improving access, and increasing pediatric disease burden.

Key Market Drivers

-

Regulatory Incentives and Orphan Designation: Regulatory bodies such as the FDA and EMA incentivize pediatric research through grants, patent extensions, and orphan drug designations, encouraging companies to develop pediatric-specific formulations [2].

-

Rising Pediatric Disease Incidence: Increased prevalence of pediatric conditions like asthma, diabetes, and congenital disorders prompts higher demand for targeted therapies.

-

Advancements in Drug Formulations: Development of age-appropriate formulations—liquids, dispersible tablets, and pediatric injectables—enhances compliance and broadens market opportunities [3].

-

Growing Awareness and Early Diagnosis: Improved screening and early intervention contribute to increased drug utilization in pediatric populations.

Market Challenges

-

Regulatory Complexity: Varied regulatory requirements across regions complicate market entry strategies.

-

Limited Commercial Viability: Small patient populations and high R&D costs hinder profitability for certain pediatric drugs.

-

Formulation Challenges: Designing palatable, safe, and effective formulations remains a significant hurdle.

Competitive Landscape

Major players include Pfizer, Novartis, GlaxoSmithKline, and Johnson & Johnson, which have established pediatric portfolios. Emerging biotech firms focus on niche therapies for rare pediatric diseases and novel delivery systems.

Partnerships with academic institutions and biotech startups are prevalent, fostering innovation in pediatric drug development. Patent protections and orphan drug statuses serve as strategic assets to sustain competitive advantages.

Sales Projections (2023–2028)

Based on current market trajectories, sales growth, and pipeline developments, the pediatric drug market is expected to expand steadily. The following projections reflect anticipated growth trends:

- 2023: USD 85 billion

- 2024: USD 90 billion

- 2025: USD 97 billion

- 2026: USD 105 billion

- 2027: USD 112 billion

- 2028: USD 115 billion

This reflects an approximate CAGR of 6.3% from 2023 to 2028, consistent with historical data, driven by increased demand for pediatric vaccines, antibiotics, and chronic disease medications.

Segment-specific forecasts:

- Vaccines: Will constitute nearly 40% of the pediatric market, supported by routine immunizations and new vaccine introductions.

- Chronic Disease Medications: Growing use for pediatric asthma and diabetes is expected to see a 7% CAGR.

- Antibiotics and Anti-infectives: Steady growth driven by infectious disease management.

Growth Opportunities

-

Biologic Therapies: Evolving biologics for rare pediatric conditions such as mucopolysaccharidoses and pediatric cancers present lucrative targets.

-

Digital and Smart Delivery Systems: Incorporation of smart devices and digital adherence tools will enhance drug efficacy and patient compliance.

-

Global Expansion: Emerging markets in Asia and Africa, with improving healthcare infrastructure, offer untapped growth potential.

Conclusion

The pediatric drug market remains a robust segment with promising growth prospects. Innovation in formulations, strategic collaborations, and regulatory navigation are critical for maximizing sales opportunities. Companies should prioritize pipeline development aligned with regional disease burdens and evolving healthcare policies to sustain competitive advantage.

Key Takeaways

- The global pediatric pharmaceuticals market is projected to grow at a CAGR of approximately 6.3% through 2028.

- North America maintains market dominance, while Asia-Pacific offers high growth potential.

- Regulatory incentives significantly impact market dynamics, encouraging pediatric drug innovation.

- Emerging therapies, biologics, and smart delivery systems will shape future growth.

- Companies need strategic regional expansion and formulation innovation to capitalize on market opportunities.

FAQs

-

What are the primary drivers behind growth in the pediatric drug market?

Increased regulatory incentives, rising pediatric disease prevalence, advancements in formulation technology, and higher awareness levels primarily catalyze growth. -

Which regions offer the most significant opportunities for pediatric drug sales?

North America leads due to advanced healthcare infrastructure, with Asia-Pacific emerging as a high-growth region driven by expanding healthcare access and rising pediatric healthcare needs. -

What challenges do pharmaceutical companies face in developing pediatric drugs?

Regulatory complexity, high R&D costs with limited financial returns for small populations, and challenges in creating suitable formulations are primary hurdles. -

How significant are biologics and novel therapies in the pediatric market?

They represent a rapidly growing segment, especially for rare conditions and complex diseases, offering high-margin opportunities for innovative companies. -

What role does digital health play in future pediatric drug markets?

Digital adherence tools and smart delivery systems improve treatment efficacy, compliance, and data collection, creating new revenue streams and patient engagement opportunities.

References

[1] Transparency Market Research, "Pediatric Medicines Market," 2022.

[2] U.S. Food and Drug Administration (FDA), Pediatric Drug Development Incentives.

[3] European Medicines Agency (EMA), Advances in Pediatric Formulation Development.

More… ↓