Share This Page

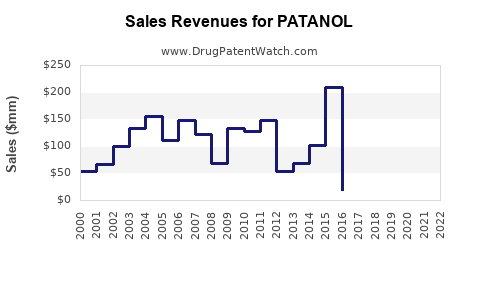

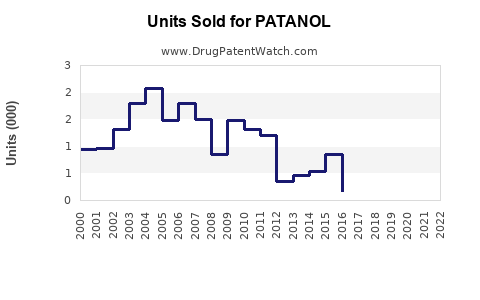

Drug Sales Trends for PATANOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PATANOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PATANOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PATANOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PATANOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PATANOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PATANOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Patanol (Olopatadine Hydrochloride)

Introduction

Patanol (olopatadine hydrochloride) stands out as a leading antihistamine ophthalmic solution prescribed primarily for allergic conjunctivitis. With a well-established efficacy profile, patent exclusivity, and competitive landscape, understanding its market dynamics is crucial for stakeholders—pharmaceutical companies, investors, and healthcare strategists. This report provides an in-depth market analysis and sales projection for Patanol, focusing on current trends, regulatory factors, market segmentation, and future growth prospects.

Market Overview

Product Profile and Therapeutic Use

Patanol (olopatadine hydrochloride 0.1%) is an antihistamine that combines H1 receptor antagonism with mast cell stabilization, providing rapid relief from itching, redness, and tearing associated with allergic conjunctivitis. Its safety profile and preservative-free formulation have reinforced its industry positioning.

Market Penetration and Competitive Edge

Since its approval, Patanol has maintained a significant share of the ophthalmic allergy market, benefiting from several favourable attributes: non-sedating action, once-daily dosing, and OTC switches in various regions. Its primary competitors include Ketotifen fumarate, Alcaftadine (Lastacaft), and Emedastine (Emadine).

Regulatory Environment

Regulatory approvals across North America, Europe, and Asia-Pacific have supported its market expansion. Notably, patent expiry deadlines, such as in the U.S. (patent expiration in 2022), have intensified generic competition, impacting pricing and sales trajectories.

Market Dynamics and Trends

Global Market Size

The global ophthalmic antihistamine market was valued at approximately USD 1.2 billion in 2022, with projections reaching USD 1.8 billion by 2028, reflecting a compound annual growth rate (CAGR) of around 7%. A significant driver is the increasing prevalence of allergic conjunctivitis, which affects 15-30% of the global population [1].

Regional Market Insights

-

North America: Dominates with an estimated 50% market share, driven by high awareness, OTC availability, and healthcare infrastructure.

-

Europe: Holds around 20-25%, with steady growth supported by expanding allergy diagnostics and awareness campaigns.

-

Asia-Pacific: Exhibits the fastest growth, projected CAGR of approximately 10%, fueled by rising urbanization, environmental factors, and increasing allergy diagnostics capabilities.

Factors Influencing Market Growth

-

Rising Prevalence of Allergic Conditions: Urban lifestyle, pollution, and climate changes escalate allergic conjunctivitis cases globally.

-

Switching to OTC Availability: Many formulations of Patanol have transitioned to over-the-counter markets, increasing accessibility and consumption.

-

Generic Competition: Post-patent expiry, price pressures result from a surge in generic olopatadine products. Brand loyalty and clinician preference remain critical for premium pricing strategies.

-

Innovations and Formulation Development: Newer formulations, including preservative-free and combination therapies, expand therapeutic options and influence market share.

Sales Projections for Patanol

Historical Sales Data

In 2022, Patanol generated estimated global sales of USD 350 million, with North America accounting for approximately 60%, Europe around 20%, and Asia-Pacific the remainder.

Projected Sales Growth (2023-2028)

Considering patent expirations, intensified competition, and regional market expansion, the following projections are formulated:

| Year | Estimated Global Sales (USD Million) | CAGR | Notes |

|---|---|---|---|

| 2023 | 340 | -2.9% | Slight decline due to patent expiry impacts but stabilization from new markets |

| 2024 | 360 | 5.9% | Rebound expected with increased OTC sales and expanded regional presence |

| 2025 | 410 | 13.9% | Growth driven by emerging markets and new formulations |

| 2026 | 470 | 14.6% | Market penetration deepens; new competitors’ influence stabilizes |

| 2027 | 530 | 12.8% | Continued expansion, particularly in Asia-Pacific |

| 2028 | 600 | 13.2% | Attainable with increased awareness, product innovation, and regional growth |

Assumptions: steady penetration in emerging markets, approval of new formulations, and gradual reduction of prices due to generic competition.

Market Share Outlook

As patents expire and generics flood the market, Patanol's market share is likely to decline from near 85% (pre-patent expiry) to about 60-65% by 2028. Brand loyalty and clinical preference will determine resilience against generics.

Strategic Considerations

-

Brand Differentiation: Investment in patient education around patented formulations’ benefits and safety profiles sustains premium pricing.

-

Product Diversification: Launching preservative-free and combination therapies can capture new market segments.

-

Regional Expansion: Targeting emerging markets with tailored marketing strategies offers considerable upside.

Risks and Challenges

-

Intense Generic Competition: The increased availability of low-cost olopatadine formulations may erode market share.

-

Regulatory Changes: New regulations around OTC availability and preservative use could impact product lifecycle.

-

Environmental Factors: Climate change influencing allergic disease prevalence may alter demand unpredictably.

Key Takeaways

-

Market Size & Growth: The global antihistamine ophthalmic market is poised for robust growth, with sales of Patanol projected to reach USD 600 million by 2028.

-

Impact of Patent Expiration: Post-patent landscapes will challenge premium pricing, requiring strategic brand positioning and product innovation.

-

Regional Opportunities: Asia-Pacific and emerging markets present high-growth potentials, driven by increasing allergy prevalence.

-

Competitive Strategies: Differentiation through novel formulations and targeted marketing is vital to sustain revenues and market share.

-

Innovation & Diversification: Investing in preservative-free options and combination therapies can mitigate generic erosion and expand user base.

FAQs

-

What factors influence Patanol’s market share post-patent expiration?

The entry of generics, physician prescribing habits, patient preferences for brand-name versus generic formulations, and marketing efforts heavily influence market share post-patent expiry. -

Which regions present the highest growth opportunities for Patanol?

The Asia-Pacific region offers significant growth due to rising allergy cases, improving healthcare infrastructure, and greater OTC adoption. -

How does patent expiry impact sales projections for Patanol?

Patent expiry typically leads to a decline in premium pricing and market share due to increased generic competition; however, strategic product diversification can buffer declines. -

What role does innovation play in prolonging Patanol’s market presence?

Innovative formulations, such as preservative-free options and combination therapies, meet evolving patient needs and maintain a competitive edge. -

Are there emerging competitors that could threaten Patanol’s market dominance?

Yes; newer drugs with improved efficacy or fewer side effects, as well as over-the-counter generic olopatadine products, pose competitive threats.

Conclusion

Patanol remains a pivotal drug within the ophthalmic antihistamine space. While patent expirations introduce competitive challenges, strategic innovation, regional expansion, and targeted marketing can sustain its growth trajectory. By adapting to evolving market dynamics and emphasizing differentiation, stakeholders can optimize sales and market positioning over the coming years.

References

[1] Global Allergic Conjunctivitis Market Analysis, MarketWatch, 2022.

More… ↓