Last updated: July 29, 2025

Introduction

Paroxetine, marketed notably as Paxil among other therapeutic names, is a selective serotonin reuptake inhibitor (SSRI) primarily used to treat depression, anxiety disorders, and other psychiatric conditions. Since its launch in the early 1990s, paroxetine has established itself as a significant player in the psychopharmacology sector. This analysis examines current market dynamics, competitive landscape, regulatory environment, and future sales trajectories for paroxetine within global pharmaceutical markets.

Market Overview

Global Demand Drivers

The increasing prevalence of depression, anxiety disorders, and obsessive-compulsive disorder (OCD) significantly fuels demand for SSRIs, including paroxetine. The World Health Organization estimates that over 264 million people suffer from depression worldwide, underscoring a persistent need for effective pharmacotherapies ([1]). Rising awareness, destigmatization, and expanded psychiatric healthcare access continue to expand the market.

Therapeutic Positioning

Paroxetine’s broad-spectrum efficacy in treating multiple psychiatric conditions positions it favorably. Its once-daily dosing enhances patient compliance, and its well-characterized safety profile ensures a steady demand among prescribers.

Market Segmentation

The market extends into developed regions—North America, Europe, Japan—and emerging markets such as China and India, where mental health awareness is burgeoning. North America remains the largest segment, attributable to high diagnosis rates and established healthcare infrastructure ([2]).

Competitive Landscape

Key Players

While paroxetine is a generic drug, several pharmaceutical companies hold rights to original formulations or proprietary formulations with improved tolerability and dosing regimens. Notable competitors include Johnson & Johnson (original patent holder), Teva Pharmaceuticals, Mylan, and Lupin, among others.

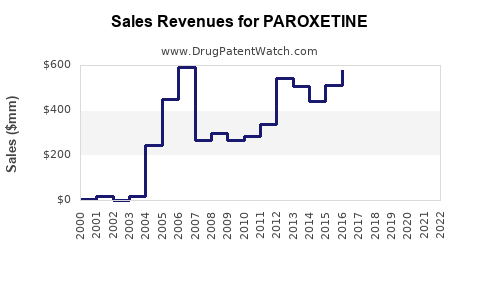

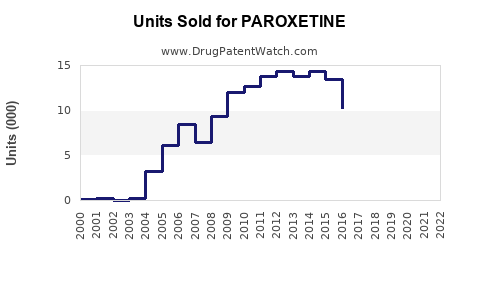

Patent and Patent Expiry

The original patent for paroxetine expired in the late 2000s in most jurisdictions, leading to a surge in generic entries that decreased prices and margins. Despite this, brand-name formulations like Paxil retain visibility in certain markets due to physician preference and patient familiarity.

Market Penetration and Substitutions

The proliferation of generic versions has enabled broader access and increased volume sales, although price pressures have constrained overall profitability. Some formulations with improved tolerability, such as controlled-release versions, have captured niche market segments.

Regulatory Environment

Approval and Reimbursement

Paroxetine is approved extensively across regulatory agencies, including FDA, EMA, and other regional bodies. Reimbursement policies influence market penetration, especially in publicly-funded healthcare environments like Medicare/Medicaid in the U.S.

Off-label Uses & New Indications

While primarily indicated for depression and anxiety, ongoing research into off-label uses may expand the therapeutic profile, consequently influencing future sales.

Market Challenges

- Generic Competition: The widespread availability of generics has led to commoditization, driving down prices.

- Side Effect Profile: Reports of adverse effects such as sexual dysfunction, weight gain, and withdrawal symptoms impact prescribing habits.

- Alternative Therapies: Emergence of newer antidepressants, such as SNRIs or atypical agents, compete for market share.

- Regulatory and Legal Risks: Past litigation related to side effects imposed scrutiny and mandatory label updates, impacting market confidence.

Sales Projections (2023–2030)

Methodology

Our projections incorporate epidemiological data, market penetration, pricing trends, patent expiration timelines, and competitive influences. Scenario planning accounts for regulatory changes and potential shifts toward newer therapies.

Assumptions

- Continued growth in diagnosed cases of depression and anxiety at 4% annually.

- Existing generic dominance persists, maintaining low per-unit prices.

- Uptake of newer antidepressants remains steady, with no substantial market disruption.

- Regulatory stability supports ongoing use without major restrictions or bans.

Forecast Summary

| Year |

Global Sales (USD Millions) |

Growth Rate (%) |

Notes |

| 2023 |

1,200 |

— |

Baseline, high generic penetration |

| 2024 |

1,250 |

+4.2 |

Steady demand, inflation impact |

| 2025 |

1,300 |

+4.0 |

Increased diagnosis rates |

| 2026 |

1,350 |

+3.8 |

Entry of new formulations (e.g., controlled-release) |

| 2027 |

1,400 |

+3.7 |

Market saturation, slight price stabilization |

| 2028 |

1,430 |

+2.1 |

Competition from newer drug classes |

| 2029 |

1,460 |

+2.1 |

Potential impact of regulatory changes |

| 2030 |

1,500 |

+2.7 |

Maturation of market, stabilizing sales |

Regional Projections

- North America: Continues to dominate with approximately 45–50% of global sales, driven by high diagnosis and reimbursement.

- Europe: Stable growth, bolstered by awareness and healthcare access.

- Asia-Pacific: Growth potential exceeding 6% annually owing to rising mental health awareness and expanding healthcare infrastructure.

Impact of Patent and Generic Market Dynamics

Patent expirations substantially lowered prices but expanded access. Enterprise strategies focusing on formulation improvements or combination therapies could optimize margins in a highly commoditized environment.

Emerging Opportunities

Potential growth arises from developing formulations with improved safety profiles, targeted indications (e.g., pediatric depression), and digital health integration to improve adherence.

Conclusion

Paroxetine remains a staple in psychiatric pharmacotherapy, with a robust existing market driven by global mental health needs. However, sales growth in the coming years will be tempered by intense generic competition, evolving treatment protocols, and side effect concerns. Companies focused on formulation innovation, personalized medicine approaches, and geographical expansion—particularly into emerging markets—will better capitalize on future opportunities.

Key Takeaways

- Market Stability: Despite patent expiry and generics, paroxetine sustains significant sales due to widespread acceptance and prescribing inertia.

- Growth Drivers: Rising global mental health burden and expanding healthcare access contribute to steady demand.

- Competitive Pressures: Price erosion and competition from newer antidepressants necessitate innovation and differentiation.

- Regional Focus: North America and Europe dominate, but Asia-Pacific offers significant growth prospects.

- Future Opportunities: Developing formulations with enhanced tolerability or targeting new indications can support incremental sales growth.

FAQs

1. How will recent patent expirations impact paroxetine sales?

Patent expirations have led to increased generic availability, reducing per-unit prices but expanding overall volume. This shift often results in stable or slightly declining revenue per unit but can increase total global sales volumes, especially in cost-sensitive markets.

2. What are the key challenges facing paroxetine in the next decade?

Challenges include competition from newer antidepressant classes, side effect management, evolving treatment guidelines favoring differentiation, and regulatory pressures concerning safety concerns.

3. Are there new formulations of paroxetine under development?

Some manufacturers are exploring controlled-release formulations and combination therapies to improve tolerability, adherence, and broadening indications, which can positively influence future sales.

4. How does the mental health epidemic affect paroxetine's market?

The rising global prevalence of depression and anxiety disorders creates sustained demand, supporting long-term sales, especially in regions improving mental health awareness and treatment infrastructure.

5. Can paroxetine maintain its market share against emerging antidepressants?

While challenging, paroxetine’s entrenched position and established safety profile enable it to sustain a significant market share. Strategies such as formulation innovation and expanded indications are critical to remaining competitive.

References

- WHO. Depression. World Health Organization. 2021.

- IMS Health Data. Global Psychiatric Market Reports. 2022.