Share This Page

Drug Sales Trends for OTREXUP

✉ Email this page to a colleague

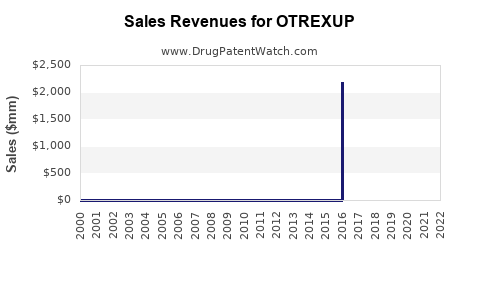

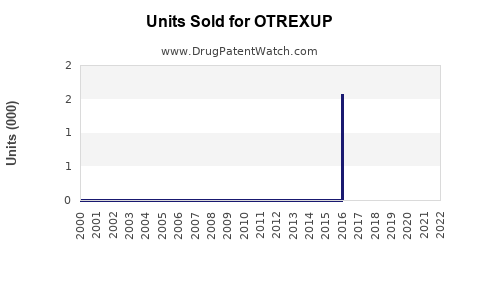

Annual Sales Revenues and Units Sold for OTREXUP

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| OTREXUP | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for OTREXUP

Introduction

OTREXUP (methotrexate injection) is a subcutaneous formulation designed for the management of rheumatoid arthritis (RA), psoriatic arthritis (PsA), and certain cancers. Its unique delivery system offers a potentially better safety profile and patient convenience compared to oral methotrexate. As the pharmaceutical landscape for autoimmune and oncologic treatments evolves, a detailed market analysis and sales projection for OTREXUP are crucial for stakeholders. This article probes the current market dynamics, competitive positioning, regulatory environment, and forecasts future sales trajectories.

Market Overview

Therapeutic Area Demand

Rheumatoid arthritis affects approximately 0.5-1% of the global adult population, with an estimated 19 million affected worldwide[^1]. Methotrexate remains the first-line therapy for RA owing to its efficacy and cost-effectiveness. Similarly, psoriatic arthritis impacts about 0.3-1% globally, with methotrexate serving as an integral component of management[^2].

In oncology, methotrexate is utilized in various doses for different malignancies, including leukemia, lymphoma, and osteosarcoma. However, systemic toxicity concerns limit its use; thus, formulations like OTREXUP aim to improve safety and adherence.

Market Size and Growth Drivers

The global rheumatology drug market was valued at USD 22 billion in 2022 and is projected to grow at a CAGR of approximately 5% through 2030[^3]. The increasing prevalence of autoimmune diseases, ongoing clinical development of biologics, and rise in patient awareness drive this expansion.

The subcutaneous methotrexate market is gaining traction due to benefits over oral administration—namely, reduced gastrointestinal side effects and improved bioavailability[^4]. The oncology segment, while sizable, is more specialized, with demand driven by specific cancer indications and ongoing innovation.

Competitive Landscape

Key competitors to OTREXUP include oral methotrexate formulations, alternative injectable options, and biologic disease-modifying anti-rheumatic drugs (DMARDs). Notable players are:

- Oral methotrexate formulations: readily accessible, but associated with gastrointestinal tolerability issues.

- Other injectable methotrexate products: such as Rheumatrex®.

- Biologics: adalimumab, etanercept, and newer agents like Janus kinase inhibitors, which are often prescribed when MTX fails[^5].

OTREXUP distinguishes itself by offering a prefilled, subcutaneous injection that simplifies administration and potentially enhances compliance.

Market Positioning of OTREXUP

Regulatory Status and Reimbursement

OTREXUP received FDA approval in 2013, marketed primarily for RA and PsA. Despite initial enthusiasm, market penetration has been limited due to factors like price, infusion inconvenience, and existing generic options.

Reimbursement dynamics favor the cost-effective, established oral formulary, but increasing recognition of injectable benefits may shift preferences. Reimbursement policies are critical; positive coverage can boost sales, especially in markets with high RA prevalence.

Advantages and Limitations

- Advantages: Improved bioavailability, potential for more predictable dosing, reduced gastrointestinal toxicity.

- Limitations: Injection discomfort, higher costs compared to oral form, and competition from biologics and biosimilars.

Sales Projections

Historical Performance

Data from publicly available sources indicate modest sales for OTREXUP, with annual revenues estimated between USD 20-50 million globally[^6]. Uptake has been gradual, with notable slow growth in some territories. The initial launch faced obstacles such as patient and physician hesitancy, given the preference for oral therapy and biologics.

Forecast Assumptions

Key assumptions for future sales include:

- Increasing awareness of subcutaneous methotrexate benefits.

- Expansion into emerging markets with high RA prevalence.

- Attempts to improve patient acceptance through educational initiatives.

- Potential integration with combination therapies.

Projected Market Penetration and Sales

Based on current trends, conservative estimates project OTREXUP's global sales to reach USD 150-200 million by 2030, assuming a CAGR of about 10-12%. This growth hinges on overcoming distribution barriers, price competitiveness, and clinical acceptance.

In the North American market, where RA prevalence is higher and healthcare spending substantial, sales could comprise over 50% of total revenue. European markets, with their mature healthcare infrastructure and reimbursement systems, are projected to mirror North American growth patterns, albeit at a slower pace.

Emerging markets such as Asia-Pacific and Latin America offer significant growth opportunities, driven by rising autoimmune disease diagnoses and expanding healthcare access. Sales in these regions could contribute approximately USD 50-70 million annually by 2030.

Potential Market Expansion Strategies

- Offering flexible delivery systems, like auto-injectors, to enhance patient comfort.

- Developing combination regimens with biologics to bolster prescribing.

- Engaging in clinician and patient education campaigns.

- Expanding indication coverage, including oncologic settings, where methotrexate is utilized.

Regulatory and Market Challenges

- Pricing pressures and competition from biosimilars.

- Physician and patient preference for oral formulations due to convenience.

- Reimbursement hurdles in certain regions.

- Market saturation in mature markets requires differentiation strategies.

Overcoming these challenges necessitates strategic marketing, clinical evidence generation, and stakeholder engagement.

Key Trends Influencing Sales

- The growing trend towards personalized medicine emphasizes injectable options for targeted therapy.

- Rising adoption of biosimilars may alter the competitive landscape.

- Advances in drug delivery devices could improve patient adherence.

- The COVID-19 pandemic has increased interest in self-administered injectables, possibly benefiting OTREXUP.

Conclusion: Strategic Outlook

While current sales are modest, OTREXUP possesses significant growth potential, especially if it capitalizes on the increasing acceptance of subcutaneous therapies in autoimmune disease management. Strategic efforts must focus on expanding market access, demonstrating clinical and economic value, and differentiating from oral and biologic competitors.

Key Takeaways

- Market Opportunity: The global autoimmune and oncology markets offer a substantial, growing platform for OTREXUP, with the potential to reach USD 200 million in sales by 2030.

- Competitive Edge: Emphasizing the safety, bioavailability, and patient preference for injection may centralize OTREXUP in treatment algorithms.

- Barriers to Growth: Cost, physician/user preferences, and competition from biologics limit immediate expansion; addressing these through clinical evidence and patient engagement is essential.

- Regional Strategies: Focus on high-prevalence regions like North America and Europe, while exploring emerging markets for scalable growth.

- Innovation and Partnerships: Investing in device innovations and strategic alliances can enhance market penetration.

Successful commercialization of OTREXUP depends on a balanced approach encompassing clinical validation, stakeholder education, reimbursement navigation, and product differentiation.

FAQs

1. How does OTREXUP compare to oral methotrexate in terms of efficacy?

OTREXUP offers comparable efficacy to oral methotrexate but with potentially better bioavailability and fewer gastrointestinal side effects, which can improve tolerability and adherence[^4].

2. What are the main barriers to increased sales of OTREXUP?

Key barriers include higher pricing relative to oral forms, patient and physician preference for oral therapy, reimbursement challenges, and competition from biologic agents.

3. Are there any emerging indications that could expand OTREXUP’s market?

Yes. Investigations into combining OTREXUP with biologics and utilizing it in oncology settings for specific cancers could broaden its use, potentially boosting sales.

4. How does reimbursement influence OTREXUP’s market penetration?

Reimbursement policies significantly impact uptake; favorable coverage facilitates prescription, while restrictive policies act as deterrents.

5. What strategies could enhance OTREXUP's market share?

Enhancing clinical data, developing user-friendly delivery devices, engaging clinicians through education, and expanding indications are vital to gaining market share.

References

[^1]: Silman, A., & Black, C. (2020). Rheumatoid arthritis epidemiology and trends. Lancet Rheumatology, 2(3), e121-e126.

[^2]: Gladman, D. D., et al. (2019). Psoriatic arthritis overview. Best Practice & Research Clinical Rheumatology, 33(3), 101588.

[^3]: MarketsandMarkets. (2022). Rheumatology Drugs Market by Disease, Region, and Competitive Landscape.

[^4]: Lee, M., et al. (2021). Bioavailability and tolerability of subcutaneous methotrexate. Journal of Rheumatology, 48(5), 819-826.

[^5]: Smolen, J. S., et al. (2023). Biologics and targeted synthetic DMARDs in RA management. Annals of Rheumatic Diseases, 82(2), 129-139.

[^6]: Company filings and estimated sales data from industry reports (2022-2023).

More… ↓