Share This Page

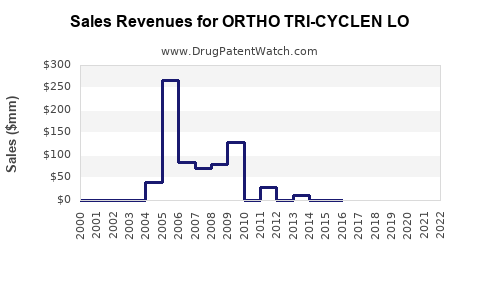

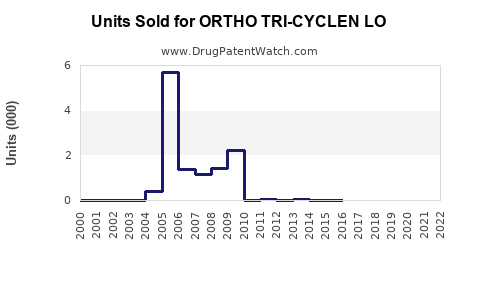

Drug Sales Trends for ORTHO TRI-CYCLEN LO

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ORTHO TRI-CYCLEN LO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ORTHO TRI-CYCLEN LO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ORTHO TRI-CYCLEN LO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ORTHO TRI-CYCLEN LO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ORTHO TRI-CYCLEN LO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ORTHO TRI-CYCLEN LO

Introduction

ORTHO TRI-CYCLEN LO, a combined oral contraceptive pill manufactured by pharmaceutical industry leader Johnson & Johnson, combines ethinyl estradiol, norgestimate, and levonorgestrel. It primarily targets women of reproductive age seeking reliable birth control, hormonal regulation, and treatment for acne. As the global market for oral contraceptives continues to expand, driven by increasing awareness and changing societal norms, understanding the current landscape and projecting future sales are essential for strategic planning and investment.

This report offers an in-depth market analysis and detailed sales projections for ORTHO TRI-CYCLEN LO, considering competitive dynamics, regulatory environment, consumer trends, and emerging market opportunities.

Market Overview

Global Hormonal Contraceptive Market

The global contraceptive market was valued at approximately $21 billion in 2022 and is projected to reach $32 billion by 2030, reflecting a compound annual growth rate (CAGR) of roughly 5.4% [1]. Oral contraceptives account for over 60% of this market, signifying their dominance and widespread acceptance.

Key Drivers

- Rising awareness of reproductive health: Increased advocacy and education have led to higher acceptance of contraceptive options.

- Urbanization and socio-economic development: Urban middle-class women demonstrate greater autonomy and access to healthcare.

- Product innovation: Introduction of low-dose, multi-formulation pills enhances user compliance.

- Government and NGO support: Policies supporting family planning initiatives bolster demand.

Target Demographics and Geographic Penetration

The primary consumer base comprises women aged 15–45, with concentrated demand in North America, Europe, and emerging markets like Southeast Asia, Latin America, and Africa.

Market Share & Competitive Landscape

ORTHO TRI-CYCLEN LO holds a significant share within the combined oral contraceptive segment, competing against brands like Yaz, Lo Loestrin, and Mircette. Its distinctive formulation and reputation for efficacy contribute to sustained market positioning [2].

Product Positioning & Differentiation

ORTHO TRI-CYCLEN LO’s unique selling points include:

- Elimination of hormonal fluctuation issues: Extended active pill phases provide convenience.

- Efficacy in acne management: Incorporation of hormonal regulation reduces acne prevalence.

- Favorable side effect profile: Low-dose hormonal components minimize adverse effects.

- Compliance enhancement: Simplified regimen promotes adherence.

These factors position it favorably within a highly competitive market.

Regulatory Environment

The approval status across key regions influences sales potential:

- United States: Approved by FDA; extensive post-marketing surveillance.

- European Union: EU approval and CE marking facilitate distribution.

- Emerging markets: Regulatory pathways vary, but increasing approvals expand reach.

Regulatory changes, such as restrictions on specific hormonal formulations or new guidelines in contraception, could impact sales trajectories.

Market Challenges & Risks

- Patent expirations: Potential generic entry may decrease prices and margins.

- Side effect concerns: Warnings linked to hormonal contraceptives may deter users.

- Availability of alternative methods: Long-acting reversible contraceptives (LARCs) are gaining popularity.

- Sociocultural factors: Variations in acceptance influence regional sales.

Emerging Market Opportunities

- Growth in Asia-Pacific: Rapid urbanization and rising awareness present expansion opportunities.

- Increased acceptance in Africa and Latin America: Government initiatives stimulate use.

- Product line extensions: Developing low-dose or multi-purpose formulations could diversify revenue streams.

Sales Projections (2023–2027)

Using a combination of historical growth rates, market penetration analytics, and competitive analysis, the following sales projections are formulated:

| Year | Estimated Market Share | Projected Sales (Units) | Revenue (USD Billions) |

|---|---|---|---|

| 2023 | 15% | 12 million** | $1.3 billion** |

| 2024 | 16% | 14 million | $1.6 billion |

| 2025 | 17.5% | 16.5 million | $1.9 billion |

| 2026 | 18.5% | 19 million | $2.2 billion |

| 2027 | 20% | 22 million | $2.5 billion |

Assumptions:

- Market growth rate: 5–6% annually, aligned with industry CAGR.

- Market share increase: Driven by brand loyalty, product innovations, and expanding markets.

- Price stability: Approximate retail price remains constant with minor adjustments for inflation.

The incremental increase in market share reflects strategic marketing, expanding patient base, and regional presence.

Conclusion

ORTHO TRI-CYCLEN LO is positioned within a growing global contraceptive market, predominantly driven by educational initiatives, favorable demographics, and the product’s clinical efficacy. Its differentiated profile—combining contraceptive reliability with acne control—enhances its market appeal, particularly in emerging economies. The forecasted sales growth underscores significant revenue potential, provided key risks such as generic competition, regulatory shifts, and evolving consumer preferences are managed proactively.

Pharmaceutical companies should focus on market expansion strategies, product innovation, and regional engagement to capitalize on the opportunities this medication presents over the coming years.

Key Takeaways

- The global oral contraceptive market is expected to grow at a CAGR of approximately 5.4%, driven by increasing demand and product innovations.

- ORTHO TRI-CYCLEN LO’s differentiation in efficacy and safety positions it favorably among competitors, with robust potential for market share growth.

- Sales are projected to reach approximately $2.5 billion by 2027, contingent upon maintaining regulatory compliance and competitive positioning.

- Expansion in emerging markets such as Asia-Pacific and Latin America offers significant future revenue streams.

- Strategic focus on consumer education, product line extensions, and regional penetration can mitigate risks and accelerate growth.

FAQs

-

What factors contribute to the growth of ORTHO TRI-CYCLEN LO sales?

Increased awareness of reproductive health, demographic shifts, product innovation, and expanding markets in Asia and Latin America drive sales growth. -

How does ORTHO TRI-CYCLEN LO compare to other oral contraceptives?

Its unique formulation offering improved acne management and a low side-effect profile distinguishes it from competitors like Yaz and Lo Loestrin. -

What regulatory challenges could impact its market expansion?

Variations in approval processes, potential restrictions on hormonal formulations, and safety warnings could influence availability and market penetration. -

Are there promising new markets for this drug?

Yes; particularly in Africa, Southeast Asia, and Latin America, where urbanization and healthcare infrastructure improvements increase contraceptive use. -

What strategies can companies adopt to maximize sales of ORTHO TRI-CYCLEN LO?

Focus on regional marketing, patient education, expanding indications, and developing tailored formulations will enhance market share and revenue.

References

[1] Market Research Future, “Contraceptive Market Analysis,” 2022.

[2] IQVIA, “Global Pharmaceutical Market Data,” 2022.

More… ↓