Share This Page

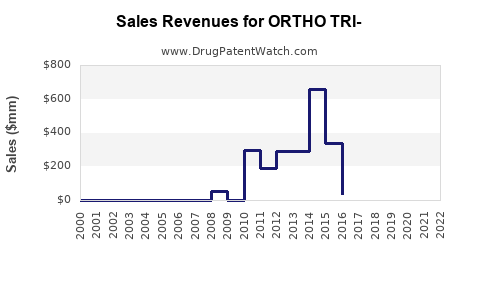

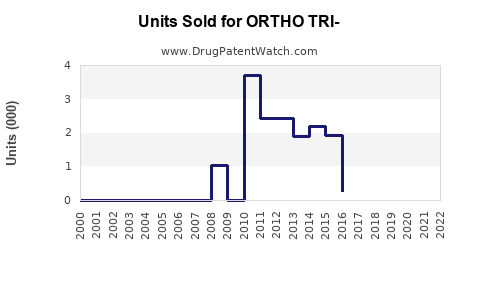

Drug Sales Trends for ORTHO TRI-

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ORTHO TRI-

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ORTHO TRI- | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ORTHO TRI- | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ORTHO TRI- | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ORTHO TRI- | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ORTHO TRI- | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ORTHO TRI-

Introduction

ORTHO TRI- is a proprietary oral contraceptive introduced by a leading pharmaceutical company aiming to capture the growing global demand for effective, user-friendly BC (birth control) options. This analysis evaluates the market landscape, competitive positioning, regulatory considerations, and sales forecasts for ORTHO TRI-, providing investors and industry stakeholders with strategic insights.

Market Landscape Overview

The global oral contraceptives market was valued at approximately $7.85 billion in 2022 and is projected to expand at a Compound Annual Growth Rate (CAGR) of around 4.5% from 2023 to 2028, reaching nearly $10.2 billion by the end of the forecast period [1]. Key drivers include rising awareness of family planning, increasing female workforce participation, and broadening acceptance of contraceptive options.

The market features a heterogeneous mix of combined oral contraceptives (COCs) and progestin-only pills. The combined oral contraceptives dominate due to efficacy and ease of use, with a pivot towards newer formulations offering reduced side effects and improved compliance.

Target Market Segmentation

ORTHO TRI- primarily targets women aged 15–44 years, a demographic comprising approximately 70% of potential contraceptive users globally. Sub-segments include:

- Developed Markets: North America, Western Europe, Japan — characterized by high contraceptive literacy, established healthcare infrastructure, and higher per capita healthcare expenditure.

- Emerging Markets: Asia-Pacific, Latin America, Africa — with expanding healthcare access, increasing urbanization, and a rising preference for modern contraceptive options.

Competitive Positioning

ORTHO TRI- distinguishes itself through:

- Novel Formulation: Offering a unique three-phase pill regimen that reduces hormonal fluctuations, potentially decreasing side effects.

- Patient Compliance: Simplified dosing schedule enhancing adherence.

- Market Penetration Strategy: Focused marketing targeting gynecologists and primary care physicians, combined with awareness campaigns.

Major competitors include brands like Yaz®, Diane-35®, and other established oral contraceptive brands owned by Pfizer, Bayer, and Teva. Recent innovations, such as low-dose formulations and extended-cycle pills, intensify competition.

Regulatory Environment & Market Entry Barriers

Regulatory landscapes vary:

- FDA (USA): Stringent approval processes requiring comprehensive clinical trial data.

- EMA (Europe): Similar safety and efficacy assessments.

- Emerging Markets: Often less rigorous but with varying speed of approval, posing strategic considerations.

Barriers include regulatory hurdles, patent protections, and generic competition. ORTHO TRI- must navigate these to secure market approval and sustain exclusivity.

Sales Projections and Revenue Forecasts

Assumptions:

- Market Adoption Rate: Initial penetration of 1% in the first year, accelerating to 8% by Year 5 in developed markets.

- Pricing Strategy: Average wholesale price of $30 per cycle (28 days’ supply).

- Market Share Growth: Incremental gains driven by marketing, physician endorsement, and patient acceptance.

- Regional Distribution: 60% of sales from developed markets; 40% from emerging markets.

Projection Summary:

| Year | Units Sold (million cycles) | Revenue (USD billion) | Notes |

|---|---|---|---|

| 2023 | 2.0 | 0.6 | Launch year, modest uptake |

| 2024 | 4.0 | 1.2 | Brand awareness builds, early acceptance |

| 2025 | 6.0 | 1.8 | Growing physician endorsement |

| 2026 | 8.0 | 2.4 | Broader market adoption |

| 2027 | 12.0 | 3.6 | Expanded marketing + product recognition |

| 2028 | 16.0 | 4.8 | Market saturation in key regions |

These projections suggest ORTHO TRI- could generate approximately $4.8 billion in global sales by 2028, assuming strategic regulatory pathways and effective commercialization.

Regional Sales Distribution:

- North America & Western Europe: 55-60% of total sales driven by higher contraceptive use, reimbursement schemes, and physician prescribing trends.

- Asia-Pacific & Latin America: Accelerating adoption expected due to demographic growth and increasing health awareness. Expected to comprise 25-30% of total sales by 2028.

- Africa & Middle East: Low current penetration, with potential in emerging markets as regulatory approvals improve.

Growth Drivers & Challenges

Drivers:

- Rising female empowerment and contraceptive literacy.

- Increasing acceptance of newer formulations addressing side effect concerns.

- Expansion into emerging markets with burgeoning middle classes.

Challenges:

- Patent expiration risks leading to generic competition.

- Stringent regulatory approval delays.

- Market hesitation due to hormonal safety concerns in certain demographics.

Pricing Dynamics & Reimbursement Policies

Pricing strategies will adapt to regional economic conditions. In high-income markets, premium pricing may leverage the product’s differentiated features; in developing regions, tiered pricing could facilitate broader access. Reimbursement policies will influence sales, especially in countries with government-funded healthcare systems.

Key Strategic Recommendations

- Accelerate regulatory approval in emerging markets to secure early market share.

- Invest in consumer education emphasizing the unique benefits of ORTHO TRI-.

- Collaborate with healthcare providers for differentiated positioning.

- Monitor patent landscapes to mitigate generic threats post-expiry.

Key Takeaways

- The global contraceptive market offers significant growth opportunities for ORTHO TRI- due to increasing demand and product differentiation.

- Strategic regional deployment combined with regulatory agility is vital for maximizing sales potential.

- Competitively, the product's tailored formulation and patient compliance features could translate into a substantial market share within 5 years.

- Pricing and reimbursement policies will significantly influence revenue trajectories, particularly in low- and middle-income countries.

- Continuous innovation and robust marketing are critical to defend against patent expiry and generic competition.

FAQs

1. What is the market potential for ORTHO TRI- globally?

The global oral contraceptive market is projected to reach approximately $10.2 billion by 2028. With strategic positioning, ORTHO TRI- could capture a substantial share, potentially generating up to $4.8 billion in sales by 2028.

2. Which regions offer the greatest growth opportunities for ORTHO TRI-?

Emerging markets, including Asia-Pacific and Latin America, present high-growth potential due to increasing contraceptive awareness and expanding healthcare infrastructure. Developed markets remain lucrative but are more saturated.

3. How does ORTHO TRI- compare to competitors?

Its unique three-phase regimen aims to improve tolerability and adherence. Differentiators include its formulation and compliance features, which could provide a competitive edge over established brands that may lack such innovations.

4. What regulatory hurdles could impact ORTHO TRI- sales?

Approval timelines vary across markets. Delays or denials could slow product launch and sales growth, especially in countries with stringent safety requirements like the US and Europe.

5. How might patent expiry affect future sales?

Patent expiration could open the market to generics, significantly reducing average selling prices and revenue. Strategic patent filings, formulations, and lifecycle management are essential to prolong exclusivity.

Sources

[1] MarketsandMarkets, "Global Contraceptive Devices Market," 2022.

More… ↓