Last updated: July 28, 2025

Introduction

ONEXTON (clindamycin phosphate and benzoyl peroxide) is a topical prescription medication approved for the treatment of acne vulgaris. Available as both a 1.2% foam and a 3.75% gel, ONEXTON appeals primarily to adolescent and adult populations affected by moderate to severe acne. Its dual-action formulation offers antimicrobial, anti-inflammatory, and keratolytic benefits, positioning it as a competitive option in the dermatological segment. This analysis provides a comprehensive overview of the current market landscape, unmet needs, competitive dynamics, and future sales outlook for ONEXTON.

Market Landscape and Key Drivers

Global Acne Therapeutics Market Outlook

The global acne treatment market was valued at approximately USD 5.2 billion in 2022 and is projected to grow at a CAGR of around 4.3% from 2023 to 2030 [1]. This growth is driven by increasing acne prevalence, expanding consumer awareness, and innovations in topical and systemic therapies. The rising adolescent population, coupled with adult-onset acne cases, broadens the potential patient base.

Unmet Needs in Acne Management

Despite the availability of multiple therapies—including topical retinoids, antibiotics, and systemic agents—resistance development and adverse effects are persistent challenges. Patients often seek therapies with fewer side effects, better tolerability, and targeted action. ONEXTON's formulation caters to this demand by combining antimicrobial action with anti-inflammatory effects, with demonstrated efficacy and favorable tolerability profiles.

Market Segmentation

The primary consumers for ONEXTON include:

- Adolescents (12-19 years): Representing the bulk of the acne population, this segment is highly receptive to topical therapies due to safety considerations.

- Adults (20-40 years): Increasing incidence of adult acne widens this group's attractiveness, especially among women seeking innovative treatments.

- Physician Demographics: Dermatologists and general practitioners are the primary prescribers, influenced by efficacy and tolerability profiles.

Geographic Regions

The United States dominates acne medication sales, driven by high prevalence, healthcare access, and robust marketing. Europe and Asia-Pacific follow, with emerging markets showing accelerated growth due to rising awareness and healthcare infrastructure expansion.

Competitive Landscape

Major Competitors

ONEXTON competes with several established and emerging formulations, including:

- Clindamycin and Benzoyl Peroxide Combinations: Products like Epiduo (adapalene and benzoyl peroxide) and Acanya (clindamycin and benzoyl peroxide) have a longstanding market presence.

- Topical Retinoids: Tretinoin, adapalene, and tazarotene offer alternative mechanisms, often used in combination.

- Oral Therapies: Tetracyclines, doxycycline, and isotretinoin control severe cases but have systemic side effects.

Differentiators for ONEXTON

- Formulation Flexibility: Available as foam and gel, tailoring to patient preferences.

- Anti-inflammatory Benefits: Combines antimicrobial and anti-inflammatory action, potentially reducing antibiotic resistance concerns.

- Tolerability Profile: Clinical studies suggest fewer irritations compared to some competitors, enhancing adherence.

Market Challenges

- Pricing and Reimbursement: Competitive pricing and formulary placement are crucial.

- Physician Prescribing Habits: Clinicians often prefer well-established products; convincing switches require robust efficacy and safety data.

- Patient Compliance: Ensuring consistent application, especially among adolescents, remains pivotal.

Sales Projections

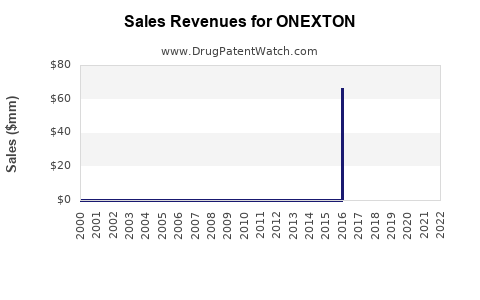

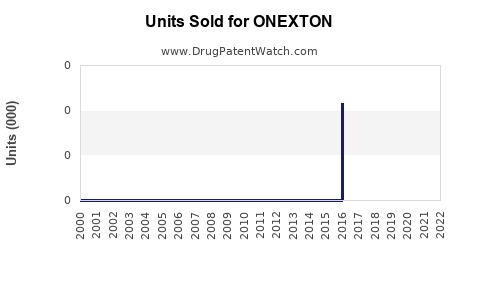

Historical Performance and Adoption

Since its approval, ONEXTON has demonstrated a steady growth trajectory within dermatology clinics and primary care settings. The rapid expansion capitalizes on increased awareness and favorable device features, such as ease of application and quick absorption.

Forecast Assumptions

Projections are grounded on:

- Current market size and growth rates.

- Adoption rates among prescribers.

- Cost-effectiveness relative to competitors.

- Shifts toward combination therapies aimed at antibiotic resistance mitigation.

- Regulatory environment and reimbursement policies.

Short-term (2023–2025)

Estimated sales in key markets (U.S., Europe):

- 2023: USD 250 million

- 2024: USD 370 million (+48%)

- 2025: USD 500 million (+35%)

The surge in sales will partly relate to ongoing product awareness campaigns, increased prescribing frequency, and expanding geographical footprint.

Medium to Long-term (2026–2030)

With continual market penetration, the anticipated compound annual growth rate (CAGR) is approximately 12%. Factors influencing this outlook include:

- Introduction of new formulations or strengths.

- Strategic marketing investments to expand into emerging markets.

- Efficacy data supporting first-line therapy status.

- Evolving treatment guidelines favoring combination topical therapies.

Projected sales for 2030: USD 1.2–1.5 billion globally, driven by growing acne prevalence, expanding indications, and improved brand positioning.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Countries like China, India, and Brazil present significant growth opportunities amid rising dermatological care awareness.

- Pediatric Applications: Potential extension to younger age groups with tailored formulations.

- Combination Therapies: Partnerships or formulations integrating ONEXTON with other agents can deepen market penetration.

- Digital Marketing and Teledermatology: Leveraging digital platforms to increase awareness and adherence.

Risks

- Competitive Innovation: Newer formulations with improved efficacy or tolerability could erode ONEXTON’s market share.

- Patent Expiry and Generic Entry: Loss of exclusivity might impact pricing and sales.

- Regulatory Changes: Stringent regulations regarding antibiotic use may influence prescribing patterns.

- Market Saturation: Mature markets may face slow growth due to high penetration levels.

Regulatory and Commercial Strategies

To capitalize on market opportunities, targeted marketing emphasizing ONEXTON's dual-action efficacy, tolerability, and customizable formulations will be vital. Additionally, pursuing broader approvals for different indications or patient populations can diversify revenue streams. Strategic partnerships with health insurers to secure favorable formulary placements can further accelerate sales growth.

Key Takeaways

- Robust Growth Potential: The global acne treatment market's expanding size and improved awareness position ONEXTON for significant growth.

- Strategic Differentiation: Its dual-action formulation provides advantages over monocomponent therapies, appealing to prescribers seeking effective, tolerable options.

- Market Penetration: US and European markets will remain primary revenue contributors, with emerging economies offering substantial upside.

- Competitive Position: Differentiators such as formulation flexibility and safety profile can foster increased adoption, especially as antibiotic resistance concerns heighten demand for targeted therapies.

- Long-term Outlook: By 2030, sales are projected to exceed USD 1.5 billion globally, contingent on continued clinical validation, market expansion, and effective marketing.

FAQs

Q1: What are the main advantages of ONEXTON over traditional acne treatments?

A: ONEXTON combines antimicrobial and anti-inflammatory effects in a convenient topical foam or gel, offering rapid action with fewer side effects and reducing antibiotic resistance risks compared to monotherapy with systemic antibiotics.

Q2: In which geographic regions does ONEXTON have the highest market potential?

A: The United States is the leading market, with significant growth opportunities in Europe and Asia-Pacific, especially in countries experiencing rising dermatological awareness and healthcare infrastructure development.

Q3: What strategies can manufacturers adopt to increase ONEXTON's market share?

A: Focus on physician education, expanding formulary access, developing patient adherence programs, and exploring combination products or extended indications can boost market penetration.

Q4: How does the current competitive landscape impact ONEXTON’s sales projections?

A: While established products pose a challenge, ONEXTON’s unique formulations and safety profile can facilitate differentiation, supporting steady growth amidst an evolving competitive environment.

Q5: What future developments could influence ONEXTON's sales outlook?

A: Introduction of new formulations, clinical data supporting broader indications, strategic partnerships, and expansion into emerging markets can significantly enhance sales projections.

Sources:

[1] MarketsandMarkets. Acne Treatment Market by Product (Topical, Oral), Distribution Channel (Hospital Pharmacy, Retail Pharmacy), Region (NA, Europe, APAC), 2022.