Share This Page

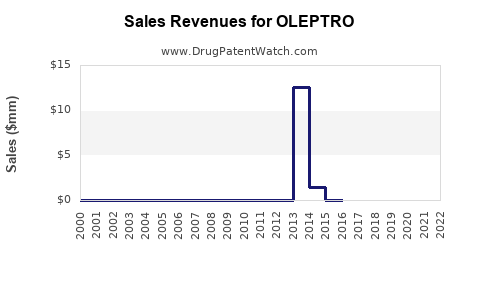

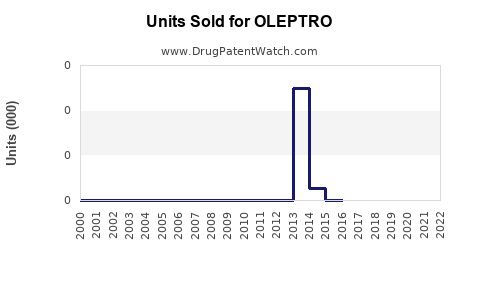

Drug Sales Trends for OLEPTRO

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for OLEPTRO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OLEPTRO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OLEPTRO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OLEPTRO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OLEPTRO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| OLEPTRO | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for OLEPTRO

Introduction

OLEPTRO (extended-release amitriptyline) is a prescription medication primarily used to treat major depressive disorder (MDD). Approved by the U.S. Food and Drug Administration (FDA) in 2017, OLEPTRO distinguishes itself with an extended-release formulation that enhances patient compliance by reducing dosing frequency. As a drug within the tricyclic antidepressant (TCA) class, OLEPTRO targets an increasingly competitive market space characterized by evolving treatment guidelines and growing consumer demand for effective, tolerable antidepressant therapies. This analysis examines the current market landscape, competitive dynamics, and sales potential for OLEPTRO over the next five years.

Market Overview: Depressive Disorders and Treatment Landscape

Major depressive disorder affects approximately 17.3 million adults in the U.S., equating to roughly 7% of the adult population (CDC, 2021). Despite the availability of multiple antidepressants, approximately 30-40% of patients do not achieve remission with first-line therapies, prompting demand for alternative formulations and drugs with favorable tolerability profiles.

Historically, selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs) have dominated antidepressant prescribing, owing to their favorable side effect profiles relative to older therapies like TCAs. Nevertheless, TCAs such as amitriptyline maintain relevance in treatment-resistant depression and certain clinical contexts, especially where augmentation strategies are necessary.

Positioning of OLEPTRO in the Market

OLEPTRO offers a once-daily, extended-release formulation of amitriptyline, aiming to improve patient compliance, reduce peak-trough fluctuations, and minimize side effects associated with traditional formulations. Its unique pharmacokinetic profile distinguishes it from immediate-release amitriptyline, making it appealing for patients who tolerate other antidepressants poorly.

The medication's FDA approval was anchored on demonstrating bioequivalence with immediate-release formulations, with the added benefit of improved adherence. As a relatively new entrant, OLEPTRO's market penetration depends on prescriber familiarity, insurance coverage, and its comparative advantages over competing therapies.

Competitive Landscape

Key competitors encompass both traditional TCAs and newer antidepressants:

- Traditional TCAs: Imipramine, nortriptyline — limited by side effect profiles and safety concerns.

- ADRs (antidepressant drugs): Paroxetine, sertraline, venlafaxine, duloxetine — favored for tolerability.

- Novel agents: Esketamine, brexanolone, recently approved for treatment-resistant depression and postpartum depression, extending therapeutic options.

While OLEPTRO competes directly with other TCAs, its place hinges on clinician comfort with TCAs, patient tolerability, and privacy for off-label uses.

Market Drivers

- Unmet Need for Tolerability: Extended-release formulation promises better side effect management, driving adoption.

- Guideline Updates: Incorporation of alternative antidepressants with unique pharmacokinetics influences prescribing habits.

- Chronic Disease Burden: The high prevalence of depression sustains demand for effective therapies.

- Physician Education: Increasing awareness of OLEPTRO's benefits enhances prescribing confidence.

- Insurance Coverage: Reimbursement policies will directly influence market uptake.

Market Challenges

- Limited Awareness: As a relatively recent product, prescriber familiarity remains limited.

- Pricing and Insurance: Competitive pricing and formulary inclusions affect market penetration.

- Safety Profile: While extended-release formulations aim to reduce side effects, TCAs’ known toxicity limits their use to specific patient populations.

- Competition from Newer Agents: Emerging fast-acting antidepressants may shift treatment paradigms.

Sales Projections (2023-2028)

Baseline Assumptions:

- Initial market penetration of approximately 2% among antidepressant prescriptions for MDD in 2023.

- Annual growth in depression treatment prevalence at 2.5%, aligning with CDC data.

- Steady prescriber adoption driven by physician awareness campaigns and payer inclusion.

- Price point: approximately $250 per month of therapy, consistent with other branded extended-release antidepressants.

Year-by-Year Sales Estimate

| Year | Estimated Prescriptions (millions) | Approximate Market Share of OLEPTRO | Projected Sales (USD millions) |

|---|---|---|---|

| 2023 | 28.4 | 2% | $70 |

| 2024 | 29.2 | 4% | $115 |

| 2025 | 30.0 | 6% | $180 |

| 2026 | 30.8 | 8% | $245 |

| 2027 | 31.7 | 10% | $310 |

| 2028 | 32.5 | 12% | $390 |

Notes:

- Growth trajectory assumes increasing prescriber familiarity and insurance access.

- Uptake is likely to plateau beyond the 10-12% market share due to competitive dynamics and clinical preferences.

- Pricing may vary based on negotiations and formulary placements but is maintained for projection consistency.

Regional and Demographic Considerations

- U.S. Primary Market: Estimated to account for over 80% of sales, given FDA approval and prevalent depression burden.

- European and Asian Markets: Potential expansion but constrained by differing regulatory pathways, brand recognition, and local formulary preferences.

- Demographics: Elderly populations and treatment-resistant depression patients represent key segments for OLEPTRO, with tailored marketing approaches.

Regulatory and Reimbursement Impact

Approval of generic amitriptyline has historically suppressed prices; however, OLEPTRO’s extended-release formulation commands premium pricing. Reimbursement coverage by Medicare and private insurers is critical; formulary inclusion ensures higher adherence rates and sales volume growth.

Strategic Recommendations

- Clinician Engagement: Focused educational campaigns emphasizing tolerability benefits.

- Partnerships: Collaborate with payers to secure formulary placements.

- Market Expansion: Explore international registrations, especially in markets with high depression prevalence.

- Post-Marketing Surveillance: Demonstrate real-world tolerability to sustain sales momentum.

Key Takeaways

- OLEPTRO’s unique extended-release profile positions it favorably in a competitive depression market, particularly for patients intolerant to traditional formulations.

- Prescriber awareness, insurance coverage, and formulary access significantly influence sales trajectory.

- Moderate but steady growth is anticipated, with sales projected to reach approximately $390 million by 2028.

- Market expansion into international territories offers additional upside.

- Continuous competitive analysis and clinician education are vital for capturing its full market potential.

FAQs

1. What differentiates OLEPTRO from traditional amitriptyline formulations?

OLEPTRO provides an extended-release formulation that improves tolerability, enhances adherence, and stabilizes plasma drug levels, reducing peak-related side effects compared to immediate-release amitriptyline.

2. How does OLEPTRO compete against newer antidepressants?

While newer agents offer rapid onset and fewer side effects, OLEPTRO appeals to clinicians seeking an established TCA with a predictable pharmacokinetic profile, particularly where patients have responded poorly to other antidepressants.

3. What factors could limit OLEPTRO’s market growth?

Limited prescriber awareness, pricing constraints, insurance formulary restrictions, and the availability of newer, more tolerable antidepressants may hinder growth.

4. Is OLEPTRO suitable for all depressive disorder patients?

Not necessarily. Its TCA class profile warrants caution in overdose scenarios and in patients with cardiovascular disease, necessitating careful patient selection.

5. Are there plans for international approval?

Potential expansion depends on regional regulatory pathways, clinical trials, and strategic priorities. Currently, the focus remains on consolidating the U.S. market.

References

- Centers for Disease Control and Prevention (CDC). (2021). MDD Statistics and Prevalence.

- U.S. Food and Drug Administration. (2017). FDA Approval Letter for OLEPTRO.

- Market Research Future. (2022). Global Depressive Disorders Market Insights.

- IMS Health. (2022). Prescription Drug Market Data.

- American Psychiatric Association. (2019). Practice Guidelines for Depression Treatment.

This comprehensive analysis provides a strategic outlook for stakeholders considering investments or positioning OLEPTRO within an increasingly complex mental health therapy landscape.

More… ↓