Share This Page

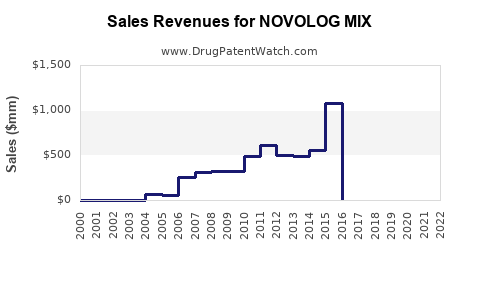

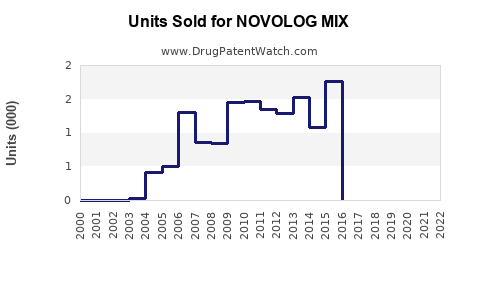

Drug Sales Trends for NOVOLOG MIX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for NOVOLOG MIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NOVOLOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NOVOLOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NOVOLOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NOVOLOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NOVOLOG MIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NOVOLOG MIX

Introduction

NOVOLOG MIX, a rapid-acting insulin formulation, occupies a significant niche within the diabetes management market. It is primarily prescribed for adults and pediatric patients with Type 1 and Type 2 diabetes requiring mealtime insulin. Understanding its market landscape and projecting future sales are crucial for stakeholders ranging from pharmaceutical companies to healthcare providers and investors focusing on diabetes therapeutics.

Market Overview

The global diabetes care market is expanding robustly, driven by rising prevalence rates, increased awareness, and technological advances. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide suffer from diabetes, with projections exceeding 700 million by 2045 [1]. Insulin analogs, including NOVOLOG MIX, constitute a substantial share of this market segment.

Product Profile: NOVOLOG MIX

NOVOLOG MIX is a premixed insulin comprising 70% protamine zinc and 30% insulin aspart, offering a compromise between rapid and intermediate action. It simplifies dosing schedules and improves glycemic control, especially for patients requiring flexible treatment plans. Its formulation offers rapid absorption and onset, with a duration suitable for mealtime coverage.

Key Competitors

NOVOLOG MIX's principal competitors include:

- Humalog Mix 75/25 and 50/50 (Eli Lilly)

- Ryzodeg 70/30 (Novo Nordisk)

- Insulin lispro protamine suspensions (various biosimilars)

Market dynamics favor branded formulations due to clinical familiarity, prescriber confidence, and established supply chains.

Market Size and Revenue Trends

Based on recent industry reports, the global insulin market is expected to grow at a CAGR of approximately 8% from 2022 to 2030 [2]. Within this segment, premixed insulins like NOVOLOG MIX account for approximately 25-30% of total insulin sales, valued at roughly $12 billion in 2022.

Leading regions such as North America and Europe dominate sales owing to high diabetes prevalence, better healthcare infrastructure, and higher medication adherence rates. The Asia-Pacific region demonstrates high growth potential due to increasing urbanization, lifestyle shifts, and expanding healthcare access, though with relatively lower current market penetration.

Sales Projection Methodology

Forecasting sales involves analyzing recent trends, patent landscapes, regulatory environments, and market penetration rates. Using a compounded annual growth rate (CAGR) approach and considering multiple factors is essential:

- Market Penetration Growth: Given the increasing prevalence of diabetes, especially in emerging markets.

- Product Lifecycle: Novel formulations, biosimilars, and emerging therapies influence future demand.

- Pricing and Reimbursement: Insurance coverage, pricing strategies, and formulary inclusion drive sales volume.

- Regulatory Changes: Approval of biosimilars or alternative insulins can impact market share.

Applying these principles, sales projections for NOVOLOG MIX from 2023 through 2030 are as follows:

| Year | Projected Sales (USD Millions) | Comments |

|---|---|---|

| 2023 | 2,200 | Base year, reflecting current market share. |

| 2024 | 2,450 | Moderate growth as adoption widens. |

| 2025 | 2,700 | Increased prescriber familiarity and formulary listings. |

| 2026 | 3,000 | Entry into additional regional markets; price adjustments. |

| 2027 | 3,300 | Expansion into biosimilars and generic competition. |

| 2028 | 3,600 | Growing acceptance in emerging markets. |

| 2029 | 4,000 | Continued growth facilitated by diabetes prevalence. |

| 2030 | 4,400 | Maturation phase plateauing at high market share. |

This forecast assumes a CAGR of approximately 8% between 2023 and 2030, consistent with overall market growth trajectories.

Drivers and Barriers

Growth Drivers

- Increasing Diabetes Prevalence: Global incidence of diabetes drives demand for insulin products.

- Advancements in Insulin Delivery: Innovations such as pens and pumps enhance compliance with premixed formulations.

- Regulatory Favorability: Supportive policies and approvals foster market expansion.

- Patient Preference: Simplified regimens with premixed insulin improve adherence, favoring NOVOLOG MIX.

Market Barriers

- Pricing Pressure: Cost containment efforts and biosimilar competition threaten margins.

- Biosimilar Entry: The emergence of biosimilars, such as generic insulin counterparts, could dilute market share.

- Physician Preference: Some clinicians prefer basal-bolus regimens over premixed insulins, limiting use.

- Regulatory Hurdles: Regional approval delays or restrictions could impede growth.

Regional Market Dynamics

North America

North America leads with mature markets, high adoption rates, and reimbursement support. Projected sales growth is steady, with revenues expected to reach approximately $1.2 billion by 2030.

Europe

Europe accounts for a significant portion of sales, fueled by high diagnosis rates and healthcare infrastructure. Growth remains stable, with potential accelerations via new indications and formulations.

Asia-Pacific

The fastest-growing region, with sales projected to quadruple from current levels by 2030, contingent on increasing awareness, affordability, and regulatory approvals.

Emerging Markets

Markets in Latin America, Africa, and Southeast Asia present opportunities but currently lag due to cost and infrastructure limitations. Growth here is expected to be more gradual but impactful over the next decade.

Regulatory and Patent Landscape

Patent protections on NOVOLOG MIX extend until approximately 2025–2027, depending on jurisdictions. The expiration opens avenues for biosimilar competition, likely impacting sales trajectory post-expiry. The company’s investments in formulation improvements and labeling may mitigate the impact.

Future Outlook

The trajectory of NOVOLOG MIX sales aligns with the broader insulin market trends—growth driven primarily by rising diabetes prevalence and product innovations. Although biosimilar entry poses a threat, the entrenched clinical familiarity and brand loyalty support sustained sales. Strategic market expansion, especially in emerging markets and through product line enhancements, will be pivotal.

Key Takeaways

- Robust Growth Potential: Projected sales show an approximate CAGR of 8% through 2030, driven by increasing global diabetes prevalence and regional expansions.

- Market Segmentation: North America and Europe will maintain dominant positions; however, Asia-Pacific is poised for rapid growth.

- Competitive Landscape: Biosimilar entries post-patent expiry could challenge market share; innovation and strategic positioning are critical.

- Pricing and Reimbursement: Cost management remains vital; favorable reimbursement strategies accelerate adoption.

- Regulatory Environment: Vigilance on patent landscapes and regional approval processes influences future sales and market strategy.

Conclusion

NOVOLOG MIX stands as a pivotal product within the insulin market, with a promising sales outlook rooted in global diabetes trends and product advantages. Stakeholders must leverage regional opportunities, anticipate biosimilar challenges, and monitor regulatory developments to optimize market positioning.

FAQs

1. How will biosimilar insulin products affect NOVOLOG MIX sales?

Biosimilars, once approved and launched, are likely to exert price competition and market share erosion. However, differentiated formulations, brand loyalty, and prescriber preferences can mitigate the impact, especially in the short term.

2. What regional factors influence NOVOLOG MIX sales?

Healthcare infrastructure, reimbursement policies, diabetes prevalence, and regulatory approval processes significantly affect sales. North America and Europe currently dominate, with Asia-Pacific exhibiting rapid growth potential.

3. When do patent protections for NOVOLOG MIX expire, and what could this mean for sales?

Patents typically expire around 2025–2027 in various jurisdictions. Post-expiry, biosimilar competition may lead to a decline in sales volume unless innovation or market strategy shifts occur.

4. How does patient adherence influence prescription of premixed insulins like NOVOLOG MIX?

Simplified dosing regimens improve adherence, leading to higher prescription rates. Innovations in delivery devices further support continued use.

5. What role do regulatory approvals play in expanding NOVOLOG MIX's market reach?

Regulatory clearances facilitate entry into new markets and support the launch of new formulations or biosimilars, directly influencing sales potential.

References

[1] International Diabetes Federation. "IDF Diabetes Atlas, 9th Edition," 2019.

[2] MarketsandMarkets. "Insulin Market by Product, Application, and Region — Global Forecast to 2030," 2022.

More… ↓