Share This Page

Drug Sales Trends for NOVOLIN70/30

✉ Email this page to a colleague

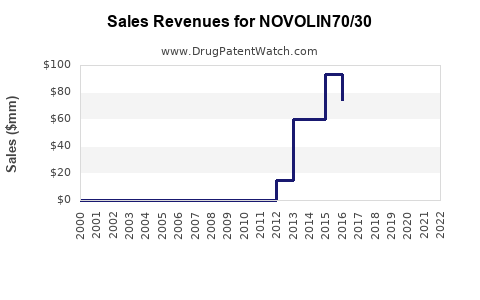

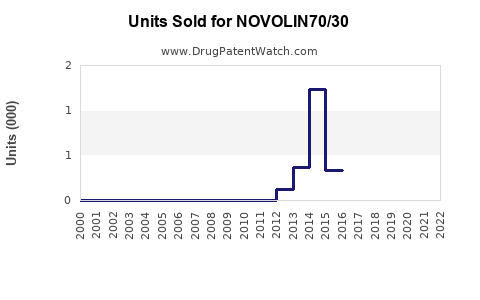

Annual Sales Revenues and Units Sold for NOVOLIN70/30

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| NOVOLIN70/30 | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NOVOLIN70/30

Introduction

NOVOLIN70/30 is a premixed insulin analog designed to improve glycemic control in patients with diabetes mellitus, primarily Type 2. This formulation combines 70% intermediate-acting insulin aspart protamine (NPL) and 30% rapid-acting insulin aspart, intended for patients requiring both basal and prandial insulin coverage. As a product positioned in the rapidly expanding insulin segment, understanding its market potential and sales trajectory is imperative for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Landscape for Insulin Products

The global insulin market is experiencing robust growth, driven by increasing prevalence of diabetes and innovations in insulin formulations. According to Fortune Business Insights, the insulin market was valued at approximately US$44.8 billion in 2021 and is projected to reach US$98.8 billion by 2028, with a compound annual growth rate (CAGR) of around 12.2% [1].

Key drivers include:

- Escalating diabetes prevalence, estimated at over 537 million adults worldwide as of 2021, and projected to hit 643 million by 2030 [2].

- Growing adoption of premixed insulin formulations, favored for their convenience and simplified dosing regimens.

- Increasing awareness and healthcare access in emerging markets.

Within this context, NOVOLIN70/30 targets a significant segment of the insulin market, especially among patients seeking combination therapies for better adherence and glycemic stability.

Market Segmentation and Competitive Dynamics

1. Patient Demographics:

The primary users of NOVOLIN70/30 are Type 2 diabetes patients requiring intensified insulin therapy, especially those transitioning from oral hypoglycemic agents or basal insulin monotherapy. Pediatric and Type 1 diabetes patients also form a niche segment.

2. Competitive Landscape:

NOVOLIN70/30 competes with products such as NovoLog Mix 70/30 (Novo Nordisk), Humalog Mix 75/25 (Eli Lilly), and Sanofi's MixPro, among others. The prefilled pen devices, ease of use, and cost are critical competitive parameters.

3. Regulatory Environment:

Regulatory approvals influence market penetration. Patent protections, licensing agreements, and health authority acceptance (FDA, EMA, etc.) impact product accessibility and growth.

Market Penetration Strategies

Successful commercialization hinges on:

- Physician Education: Highlighting the benefits of premixed insulin for patient compliance.

- Patient Support Programs: Enhancing adherence and self-management.

- Pricing and Reimbursement: Competitive pricing and insurance coverage are pivotal, especially in cost-sensitive markets.

- Distribution Network Expansion: Ensuring availability across urban and rural healthcare settings.

Sales Projections

1. Assumptions:

- The product launches in key markets (U.S., Europe, emerging economies) occur within the next 12 months.

- Initial market share captured is 2% within the premixed insulin segment in year one, growing to 8% over five years due to increased adoption.

- Average unit price aligns with existing premixed insulins, at approximately US$60 per pen.

2. Yearly Sales Estimation (United States):

| Year | Estimated Market Share | Units Sold (millions) | Revenue (USD billions) |

|---|---|---|---|

| 1 | 2% | 4 million | 0.24 |

| 2 | 4% | 8 million | 0.48 |

| 3 | 5.5% | 11 million | 0.66 |

| 4 | 7% | 14 million | 0.84 |

| 5 | 8% | 16 million | 0.96 |

Projected sales in Europe and emerging markets are expected to follow similar patterns, with higher growth potential owing to less saturation and increased prevalence of diabetes.

3. Long-term Outlook:

Considering the global insulin market trajectory, NOVOLIN70/30 has the potential to achieve cumulative revenues exceeding US$5 billion globally within five years, assuming successful market development, competitive pricing, and expanded indications.

Financial and Strategic Considerations

- Pricing Power: The product’s success depends on balancing affordability with profitability, especially amidst reimbursement pressures.

- Market Expansion: Localization strategies and regulatory approvals in emerging countries can significantly amplify sales.

- Innovation and Line Extensions: Developing compatible pen devices, reusable pens, and patient-centric delivery options enhance marketability.

- Partnerships: Collaborations with healthcare providers, payers, and distribution channels are vital.

Risks and Challenges

- Competitive Pressures: Entrenched market leaders with strong brand loyalty pose barriers.

- Pricing and Reimbursement Constraints: In certain markets, reimbursement policies may limit profit margins.

- Regulatory Delays: Challenges obtaining approvals can hinder timely entry.

- Patient Preferences: Preference for newer, ultra-fast-acting insulins may marginalize premixed options.

Regulatory and Market Entry Strategies

To capitalize on growth potential, strategic planning must include:

- Accelerated approval pathways.

- Demonstration of clinical efficacy and safety.

- Engagement with key opinion leaders.

- Evidence-based marketing campaigns emphasizing compliance benefits.

Key Takeaways

- The insulin market's rapid growth offers substantial opportunities for NOVOLIN70/30, especially in markets with rising diabetes prevalence.

- Competitive positioning hinges on affordability, ease of use, and robust distribution networks.

- Sales projections suggest a potential to reach nearly US$1 billion in annual revenue globally within five years, conditional on successful market execution.

- Strategic partnerships, regulatory agility, and innovation are critical success factors.

- Market risks include intense competition, reimbursement challenges, and evolving patient preferences.

FAQs

1. How does NOVOLIN70/30 differentiate from other premixed insulins?

NOVOLIN70/30 combines fast-acting and intermediate-acting insulins in a single formulation, targeting improved glycemic control with the convenience of reduced injections, comparable to competitors but potentially with unique device compatibility or formulation advantages.

2. Which markets present the highest growth opportunities for NOVOLIN70/30?

Emerging economies in Asia, Latin America, and Africa denote high growth potential due to increasing diabetes prevalence, expanding healthcare infrastructure, and rising awareness about insulin therapy options.

3. What regulatory hurdles could impact sales projections?

Delays in approval processes, differences in regulatory requirements across countries, and patent litigations can impede market entry and slow revenue growth.

4. How can pricing influence market share for NOVOLIN70/30?

Competitive pricing aligned with local purchasing power and reimbursement schemes enhances adoption, whereas premium pricing without clear advantages may limit penetration.

5. What role does patient adherence play in sales forecasts?

Higher patient adherence driven by convenience and tolerability directly correlates with increased demand and sustained sales growth.

References

[1] Fortune Business Insights. "Insulin Market Size, Share & Industry Analysis, By Product Type, Application and Regional Forecast, 2021-2028."

[2] International Diabetes Federation. "IDF Diabetes Atlas, 9th Edition," 2019.

More… ↓