Share This Page

Drug Sales Trends for NIZORAL

✉ Email this page to a colleague

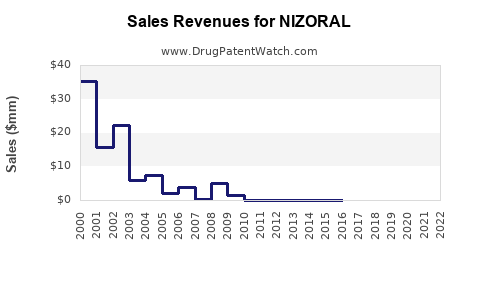

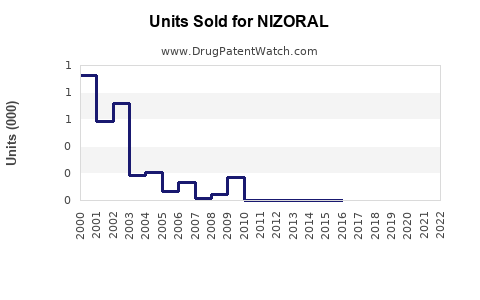

Annual Sales Revenues and Units Sold for NIZORAL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NIZORAL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NIZORAL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NIZORAL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NIZORAL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NIZORAL (Ketoconazole)

Introduction

NIZORAL, the branded form of ketoconazole, is an antifungal medication primarily used to treat fungal infections, including dermatophyte infections, candidiasis, and seborrheic dermatitis. Market dynamics and sales projections for NIZORAL hinge on factors such as epidemiological trends, competitive landscape, regulatory environment, and advances in alternative therapies. This analysis synthesizes current market data, emerging trends, and future growth prospects to enable stakeholders to make informed strategic decisions.

Market Overview

The global antifungal market has experienced steady growth driven by escalating incidences of fungal infections, increased awareness, and expanding healthcare access. NIZORAL’s profile, notably its topical and oral formulations, positions it as a versatile therapeutic option within dermatology and internal medicine practices. Despite its established presence, NIZORAL faces market challenges owing to safety concerns related to oral ketoconazole and the rising dominance of newer, targeted antifungal agents.

Epidemiological and Demographic Drivers

Fungal infections affect hundreds of millions worldwide. The prevalence of dermatophyte infections, which constitute a significant segment of NIZORAL’s use cases, is rising attributable to climate change, urbanization, and lifestyle factors. In particular, the accuracy of diagnosis and prompt treatment in conditions such as seborrheic dermatitis and pityriasis versicolor underscores ongoing demand. The aging population and immunocompromised patient populations further contribute to the market ceiling, with increased susceptibility fueling the need for antifungal treatments.

Competitive Landscape

NIZORAL competes with a broad spectrum of antifungals, including azoles (fluconazole, itraconazole), echinocandins, and polyenes. The growth of generic formulations has precipitated price competition, which can erode margins for branded products. Nevertheless, NIZORAL’s strong brand recognition, physician familiarity, and established safety profile sustain its relevance. In recent years, the market has seen a shift towards newer agents with improved safety profiles, especially oral formulations with fewer hepatotoxicity risks.

Regulatory Challenges and Safety Concerns

Regulatory agencies, particularly in the US and EU, have scrutinized oral ketoconazole due to reports of hepatotoxicity. The FDA issued a safety warning for oral ketoconazole in 2013, restricting its use to serious fungal infections where other treatments are ineffective or not tolerated. These restrictions have significantly impacted sales of NIZORAL’s oral formulations but left topical applications relatively unaffected. Ongoing regulatory scrutiny and reformulations emphasizing safety profiles influence both historical sales trends and future projections.

Market Performance and Historical Sales Data

Historical data indicate that NIZORAL’s sales peaked in the early 2010s, driven primarily by its oral formulation. According to IQVIA data, global sales of oral ketoconazole formulations declined by approximately 40% between 2014 and 2020, correlating with regulatory constraints. Conversely, topical formulations maintained steady growth, with sales predominantly driven by prescription renewals and over-the-counter (OTC) sales in select markets.

In 2022, the global NIZORAL market was estimated to generate roughly $500 million in revenue, predominantly derived from topical products in Europe and Asia, with minimal contribution from oral formulations. The rise in OTC availability and increasing incidence of fungal skin conditions have sustained demand in mature markets.

Future Sales Projections

Near-Term Outlook (2023–2025)

-

Market Stabilization: Topical NIZORAL is projected to stabilize, with compound annual growth rate (CAGR) estimates near 2–3%. The product benefits from established clinical efficacy, brand loyalty, and ongoing dermatologist and pharmacist recommendations.

-

Oral Formulation Decline: Sales of oral NIZORAL are expected to decline further, with forecasts indicating a 10-15% yearly decrease due to regulatory restrictions and alternative therapies. However, niche utilization persists for specific indications in hospital settings.

-

Market Expansion in Emerging Economies: Regions such as Southeast Asia, Latin America, and parts of the Middle East exhibit rising fungal infection rates and increasing OTC product adoption, providing growth avenues for topical formulations.

Mid to Long-Term Outlook (2026–2030)

-

Innovation and New Formulations: Development of safer, more targeted formulations, such as lipid-based topical therapies or combination products, could invigorate sales. Moreover, the integration of NIZORAL into combination regimens may expand its clinical use.

-

Regulatory Evolution: Pending evidence and safety profiles might lead to relaxation or reinforcement of restrictions, affecting sales trajectories of oral formulations.

-

Market Penetration: Increased awareness campaigns and telemedicine services are expected to improve diagnosis and treatment adherence, augmenting demand for NIZORAL’s topical products.

-

Impact of Competitive Alternatives: Introduction of new antifungals, particularly from biotechnological advances, may challenge NIZORAL’s market share in the broader antifungal segment.

Quantitative Projections

Assuming a conservative 2% annual growth for topical NIZORAL and a 10% annual decline for oral formulations, the global sales are anticipated to reach approximately $600–$700 million by 2030, with topical products comprising over 90% of this figure. Growth will be uneven, heavily influenced by regional market dynamics and regulatory policies.

Market Opportunities and Risks

Opportunities:

- Expansion into OTC markets in emerging economies.

- Development of novel formulations with enhanced safety and efficacy.

- Leveraging digital health platforms for patient engagement and adherence.

Risks:

- Regulatory restrictions due to safety concerns.

- Competitive pressure from newer antifungals with superior safety profiles.

- Price erosion from generic entries.

Key Market Drivers

- Increasing prevalence of fungal infections.

- Growing aging and immunocompromised demographics.

- Physician and patient familiarity with NIZORAL.

- Emerging markets exhibiting rising healthcare expenditure.

- Continued demand for topical antifungal solutions.

Conclusion

NIZORAL remains a significant player within the antifungal therapy landscape, with a stable core market driven by dermatological indications. Its sales outlook is bifurcated: steady, moderate growth for topical formulations alongside a continued decline in oral formulations tied to regulatory constraints. Strategic focus on innovation, geographic expansion, and safety profile enhancements will be critical for maintaining and accelerating sales momentum.

Key Takeaways

- Steady Demand for Topical: Expect modest but sustained growth in topical NIZORAL due to ongoing skin fungal infection treatments and OTC availability.

- Oral Formulation Decline: Sales of oral ketoconazole will continue to diminish owing to regulatory restrictions and safety concerns.

- Emerging Markets as Growth Catalysts: Countries in Asia, Latin America, and the Middle East offer substantial expansion opportunities.

- Innovation Driven Growth: New formulations with improved safety and efficacy could revitalize sales and attract newer indications.

- Competitive Landscape: Vigilance on emerging antifungal agents and regulatory policies is imperative for strategic positioning.

FAQs

1. What are the primary indications for NIZORAL?

NIZORAL is mainly indicated for the treatment of dermatophyte infections, candidiasis, seborrheic dermatitis, and tinea infections. The topical formulation is widely used for skin and scalp infections, while the oral form was historically used for systemic fungal infections but now faces restrictions.

2. How have regulatory actions impacted NIZORAL sales?

Regulatory warnings, especially in the US and EU, have significantly curtailed sales of oral ketoconazole due to hepatotoxicity risks. This has shifted focus toward topical versions, which are less impacted but still face market competition and pricing pressures.

3. What are the key growth regions for NIZORAL?

Emerging economies in Asia-Pacific, Latin America, and the Middle East present notable growth opportunities owing to rising fungal infection prevalence and increasing OTC product penetration.

4. How is NIZORAL innovating to sustain its market share?

Efforts include developing safer formulations, combination therapies, and leveraging digital health solutions to enhance adherence and brand differentiation.

5. What is the long-term outlook for NIZORAL sales?

While sales of oral formulations are expected to decline, topical formulations will likely sustain moderate growth. Overall, the brand’s future hinges on innovation and regional expansion, with projections indicating steady market relevance through 2030.

References

- IQVIA. (2022). Global Pharmaceutical Market Reports.

- FDA Drug Safety Communications. (2013). Hepatotoxicity risk with oral ketoconazole.

- Global Market Insights. (2022). Antifungal Market Trends and Projections.

- European Medicines Agency (EMA). Guideline on the safety of systemic antifungal agents.

- Industry Patent Filings and Clinical Trial Data (2020-2023).

More… ↓