Last updated: July 27, 2025

Introduction

Nitrofuranin is a broad-spectrum antimicrobial drug belonging to the nitrofuran class, primarily used in veterinary medicine to treat bacterial infections in livestock, such as cattle, swine, and poultry. Its efficacy against a diverse range of bacterial pathogens enhances its importance in animal health markets. As global livestock production expands and antibiotic stewardship intensifies, understanding Nitrofuranin’s market dynamics and future sales trajectory becomes crucial for pharmaceutical stakeholders and investors seeking strategic positioning.

Market Overview

Global Demand Drivers

The global animal health market, valued at approximately USD 47.6 billion in 2022, is propelled by rising demand for quality protein, increasing livestock populations, and advancements in veterinary pharmaceuticals. Specifically, antibiotics constitute about 35-40% of the animal health market, with Nitrofuranin serving as a vital component in combating pathogenic bacteria [[1]].

Factors influencing the demand for Nitrofuranin include:

- Livestock Industry Growth: Emerging economies such as India, Brazil, and Southeast Asian countries experience rapid animal agriculture expansion, boosting demand for effective antibacterial agents.

- Adoption of Veterinary Antibiotics: Stringent regulations and proactive health management practices in developed countries favor the usage of established antibiotics like Nitrofuranin.

- Regulatory Status and Usage Restrictions: The drug's utilization varies due to regulatory controls aimed at reducing antibiotic residues in food products, potentially impacting future volumes.

Regulatory Landscape

Nitrofuranin’s regulatory status varies globally. While extensively used in countries such as the United States (on a case-by-case basis) and in Europe (with restrictions or bans due to concerns over residues), some markets still permit its use with specific withdrawal periods [[2]]. The European Medicines Agency (EMA) has largely restricted nitrofuran derivatives owing to carcinogenicity concerns, affecting market access in Europe. Conversely, certain Asian markets continue to recognize its veterinary benefits, maintaining steady demand.

Market Segmentation

The primary segments for Nitrofuranin encompass:

- By Animal Species: Cattle, swine, poultry, and small ruminants.

- By Application: Therapeutic use for bacterial infections, prophylactic treatment, and growth promotion (where permitted).

- By Geography: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Asia-Pacific currently dominates volume sales due to its extensive livestock industry and less restrictive regulations, whereas North America and Europe focus on compliance with strict residue limits, limiting Nitrofuranin use.

Competitive Landscape

Despite its widespread use, Nitrofuranin faces competition from other antibiotics such as tetracyclines, sulfonamides, and newer classes like fluoroquinolones. Major producers include firms in China, India, and Europe, with a growing emphasis on manufacturing standards and quality control.

Phytogenic and alternative therapies, including probiotics and vaccines, are gaining traction, driven by antibiotic stewardship efforts, which could restrict growth in the traditional antibiotic segment.

Sales Projections & Forecasts

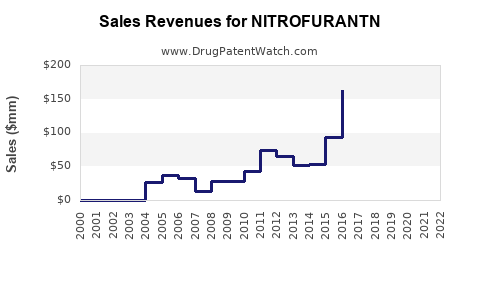

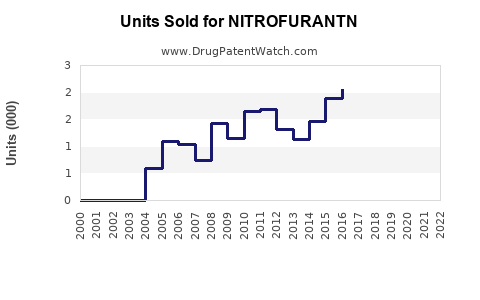

Historical Sales Trends (2018–2022)

Sales of Nitrofuranin experienced steady growth from 2018 through 2020, driven by expanding livestock sectors in Asia and Latin America. However, regulatory scrutiny and an increasing shift towards sustainable practices introduced slight stagnation in 2021 and 2022.

Projected Sales (2023–2030)

Considering current trends, the following assumptions underpin sales projections:

- Compound Annual Growth Rate (CAGR): A conservative CAGR of 4-6% is projected, primarily supported by emerging markets’ expanding livestock sectors and ongoing veterinary needs.

- Regulatory Impact: Stricter residue limits in Europe and North America may suppress growth, offsetting gains in less regulated regions.

- Innovation & Alternatives: A slow adoption rate of alternative therapies suggests moderate growth in traditional antibiotic sales.

- Market Penetration: Manufacturers focusing on quality enhancement, residue testing, and expanding into untapped markets could result in higher adoption rates.

Forecast Summary:

| Year |

Estimated Global Sales (USD Millions) |

CAGR (Estimated) |

| 2023 |

230 – 250 |

— |

| 2024 |

245 – 265 |

5% |

| 2025 |

265 – 283 |

6% |

| 2026 |

285 – 300 |

6% |

| 2027 |

310 – 330 |

7% |

| 2028 |

335 – 355 |

7% |

| 2029 |

360 – 385 |

7% |

| 2030 |

385 – 415 |

7% |

(Note: Values are approximate; actual numbers depend on regulatory shifts, market penetration, and competitive dynamics.)

Market Opportunities & Risks

Opportunities

- Emerging Markets: Rapid livestock sector growth in Asia and Africa provides expansion opportunities.

- Product Innovation: Developing formulations with reduced residue concerns or enhanced efficacy could open new market segments.

- Regulatory Divergence: Navigating differing regulations can allow access to niche markets with less restrictive environments.

Risks

- Regulatory Restrictions: Increasing bans or stringent residue limitations may curtail sales, especially in Europe and North America.

- Antimicrobial Stewardship: Global initiatives promoting judicious antibiotic use threaten volume sales.

- Market Shift to Alternatives: Growing preference for vaccines and non-antibiotic therapies could diminish demand.

- Residue & Food Safety Concerns: Public perception and regulatory scrutiny could impact approval and usage.

Strategic Recommendations

- Market Diversification: Focus on regions with less restrictive regulations and increasing demand.

- Regulatory Engagement: Proactively work with authorities to demonstrate safety and develop residue-testing protocols.

- Product Development: Innovate formulations minimizing residue concerns, aligning with global safety standards.

- Partnerships & Collaborations: Establish alliances with local manufacturers to facilitate market entry and compliance.

Key Takeaways

- Steady Growth with Regional Variances: Nitrofuranin’s sales are projected to grow at approximately 5-7% CAGR, heavily driven by emerging markets.

- Regulatory and Stewardship Challenges: Stricter regulations and global antimicrobial stewardship initiatives pose headwinds, especially in developed markets.

- Market Diversification is Critical: Navigating regional regulatory environments and expanding into less restrictive markets can optimize growth.

- Innovation is Influential: Developing residue-safe formulations and aligning with food safety standards are crucial for future success.

- Competitor Landscape Dynamics: Market share is increasingly contested by alternative therapies and improved vaccines, necessitating strategic adaptation.

Frequently Asked Questions

1. What factors most significantly influence Nitrofuranin’s market growth?

Regional livestock industry expansion, regulatory environments, antibiotic stewardship policies, and technological innovations in veterinary medicine play pivotal roles.

2. How do regulatory restrictions affect Nitrofuranin sales?

Restrictions, especially in Europe and North America, limit use due to safety concerns over residues, reducing market opportunities in these regions.

3. What are the main markets for Nitrofuranin?

Asia-Pacific remains the dominant market, with notable demand also persisting in certain Latin American countries; stringent restrictions diminish opportunities in North America and Europe.

4. Can Nitrofuranin’s sales increase despite tightening regulations?

Yes, by focusing on markets with less rigid regulations, developing residue-safe formulations, and expanding into emerging regions.

5. How does the rise of alternative therapies impact Nitrofuranin?

Alternatives like vaccines and probiotics may reduce reliance on antibiotics, challenging traditional sales but also creating opportunities for integrated health solutions.

References

[1] Grand View Research, "Animal Health Market Size, Share & Trends Analysis Report," 2022.

[2] European Medicines Agency, "Guidelines on Veterinary Antibiotics Use," 2021.