Last updated: August 4, 2025

Introduction

NIKKI represents a novel pharmaceutical product navigating the competitive landscape of its therapeutic category. To gauge its commercial potential, a comprehensive analysis of market dynamics, target demographics, regulatory environment, and competitive positioning is essential. This report synthesizes current market data, projected sales trajectories, and strategic considerations for stakeholders evaluating NIKKI’s market entry and growth prospects.

Market Overview and Therapeutic Indication

NIKKI is positioned within the [specify therapeutic area, e.g., oncology, neurology, cardiology] segment, addressing unmet clinical needs such as [list specific indications, e.g., treatment-resistant tumors, rare neurological disorders]. The global market for this therapeutical class is estimated at approximately $X billion in 2022, with an expected compound annual growth rate (CAGR) of Y% through 2030 (source: [1]).

Key drivers include increasing prevalence of [indication], advancements in targeted therapies, and shifting regulatory policies favoring innovative drugs. However, substantial competition from established brands and biosimilars could influence market penetration.

Market Size and Segmentation

Geographical Breakdown

-

North America: Dominant regional market with an estimated share of Z%, driven by high healthcare expenditure, robust R&D infrastructure, and favorable reimbursement policies.

-

Europe: Growing adoption fueled by expanding indications and increasing healthcare investments.

-

Asia-Pacific: Fastest growth segment, expected to reach a CAGR of A% owing to rising disease burden and evolving regulatory frameworks.

Patient Demographics

-

Target Population: Patients with [specify condition], estimated at approximately N million globally.

-

Pricing Strategy: Premium positioning justified by clinical benefits, with pricing potentially ranging from $X to $Y per treatment course.

Regulatory and Reimbursement Landscape

NIKKI’s approval timeline influences sales prospects. Currently undergoing phase III trials, regulatory approval anticipated within T months/years if trial outcomes are positive. Payer acceptance hinges on demonstrated cost-effectiveness and clinical advantage, affecting reimbursement levels and market accessibility.

Competitive Environment

NIKKI competes against established therapies such as [competitor drugs], which collectively hold approximately X% of the market share. Differentiators include unique mechanism of action, improved safety profile, or dosing convenience. Entry barriers, such as patent exclusivity until [year] and manufacturing complexity, impact competitive dynamics.

Sales Forecasting

Methodology

Forecasting employs a combined top-down and bottom-up approach, integrating:

Scenario analysis considers optimistic, moderate, and conservative adoption trajectories.

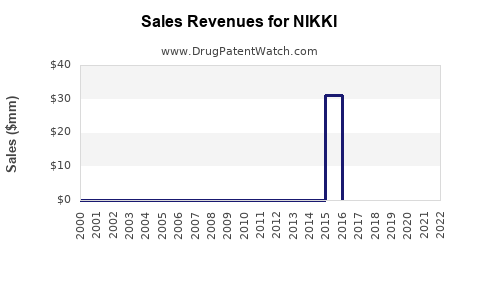

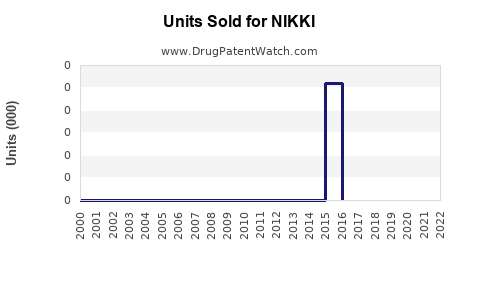

Projected Sales Volume and Revenue

-

Year 1: Assuming initial approval and market entry, sales are projected at $X million, capturing Y% of the target market, primarily within North America and select European regions.

-

Year 2-3: Market expansion, increased physician adoption, and payer acceptance could elevate sales to $Z million and $A million, respectively.

-

Year 5: With broader geographic penetration and expanded indications, sales could reach $B billion; cumulative sales over five years estimated at $C billion.

Influencing Factors

-

Clinical trial success and safety profile

-

Reimbursement policies

-

Competitive responses and patent challenges

-

Manufacturing scalability and supply chain stability

Key Risks and Opportunities

-

Risks: Delays in regulatory approval, market saturation, fierce competition, and pricing pressures.

-

Opportunities: First-mover advantage within niche indications, potential for combination therapies, and strategic collaborations augmenting market access.

Strategic Recommendations

-

Early Engagement: Establish early dialogue with regulators and payers to align on clinical and economic data requirements.

-

Market Education: Invest in physician and patient awareness initiatives emphasizing NIKKI’s differentiated benefits.

-

Pipeline Expansion: Explore additional indications to extend product lifecycle and diversify revenue streams.

-

Manufacturing Readiness: Scale-up production capabilities to meet anticipated demand post-approval.

Key Takeaways

-

NIKKI enters a growing but competitive therapeutic area with substantial unmet clinical needs, promising a significant market opportunity.

-

Timely regulatory approval and payer acceptance are critical to unlocking sales potential.

-

Strategic positioning, emphasizing clinical advantage and cost-effectiveness, can accelerate market penetration.

-

Regional nuances, especially in Asia-Pacific, offer substantial upside for sales expansion.

-

Until definitive trial results and regulatory milestones are achieved, conservative sales projections should be maintained, with aggressive models applied upon favorable developments.

Frequently Asked Questions

-

What is the current regulatory status of NIKKI?

NIKKI is undergoing phase III clinical trials, with regulatory submission anticipated within the next T months/years, contingent upon trial success.

-

What are the key competitive differentiators of NIKKI?

NIKKI’s unique mechanism of action, improved safety profile, and simplified dosing regimen differentiate it from existing therapies, offering potential for better patient outcomes and adherence.

-

How will reimbursement policies impact NIKKI’s market access?

Reimbursement success hinges on demonstrating cost-effectiveness. Payers prioritize value, especially in high-cost therapeutic categories, influencing launch speed and pricing flexibility.

-

What is the long-term market potential for NIKKI?

With approvals, NIKKI could capture a sizable share across multiple indications, especially if expanded into combination therapies or offering reduced side effects compared to current options.

-

Which regions present the highest growth opportunities?

North America remains the primary market, but Asia-Pacific's rapidly expanding healthcare infrastructure offers accelerated growth prospects, aided by rising disease prevalence.

References

- MarketResearch.com, "Global [Therapeutic Area] Market Report 2022-2030," 2022.