Share This Page

Drug Sales Trends for NIFEDICAL XL

✉ Email this page to a colleague

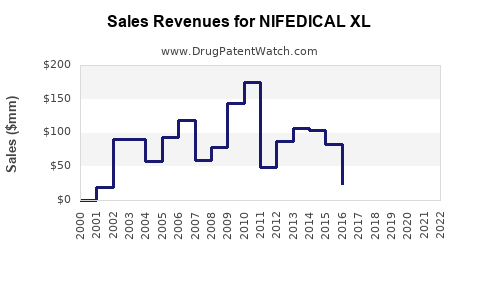

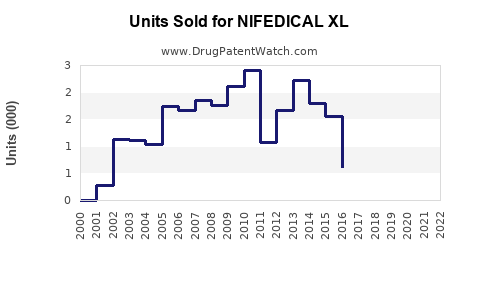

Annual Sales Revenues and Units Sold for NIFEDICAL XL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NIFEDICAL XL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NIFEDICAL XL

Introduction

NIFEDICAL XL, a sustained-release formulation of nifedipine, is utilized primarily for managing hypertension and angina pectoris. As a calcium channel blocker, it plays a vital role in cardiovascular therapy, aligning with the global rise in cardiovascular disease prevalence. This market analysis evaluates the current landscape, competitive positioning, regulatory environment, and sales forecasts to inform strategic decision-making.

Market Overview

Global Cardiovascular Disease Burden

Cardiovascular diseases (CVDs) remain the leading cause of death worldwide, accounting for approximately 17.9 million deaths annually [1]. The increasing prevalence of hypertension and ischemic heart disease drives demand for effective pharmacotherapies such as nifedipine. The rising aging population, coupled with lifestyle factors like obesity and sedentary behavior, sustains an expanding market for antihypertensive agents.

Pharmacological Landscape

Nifedipine is among the most prescribed calcium channel blockers, with formulations including immediate-release, sustained-release, and controlled-release variants. NIFEDICAL XL's extended-release profile offers improved compliance and consistent plasma levels, addressing previous dosing limitations associated with immediate-release versions.

Market Segments

- Geographies: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

- Indication-based: Hypertension, angina pectoris, and off-label uses.

- Customer segments: Hospitals, outpatient clinics, pharmacies, and institutional procurement.

Competitive Landscape

Key Market Players

The market features established pharmaceutical companies producing nifedipine formulations, including Pfizer, Bayer, and Sun Pharma. NIFEDICAL XL's differentiation hinges on its release mechanism, bioavailability, and tolerability profile.

Differentiators

- Formulation: Extended-release, once-daily dosing enhances adherence.

- Regulatory Position: As a branded product, it benefits from regulatory approvals, but generics encroach on market share due to cost advantages.

- Patent Status: Patent exclusivity, if applicable, influences pricing and market control.

Challenges

- Generic Competition: Expiration of patents for nifedipine ER formulations leads to increased generic availability.

- Pricing Pressure: Payor and healthcare provider push for cost-effective alternatives.

- Market Saturation: Especially in mature markets with established therapies.

Regulatory Environment

Approval pathways in major markets (FDA in the U.S., EMA in Europe, and PMDA in Japan) govern market entry. Patent protections and exclusivity periods critically affect sales planning. Recent trends favor faster approvals for biosimilar and generic versions, compressing profitability windows for branded formulations.

Sales Projections

Assumptions

- Market Penetration: Initial rapid uptake in developed regions, followed by gradual expansion into emerging markets.

- Competitive Dynamics: Moderate generic competition emerging within 3-5 years post-launch.

- Pricing Strategies: Premium pricing maintained in early years, with gradual reduction due to generics.

Short-term (1-3 Years)

In launch markets such as North America and Europe, initial sales are projected to reach $50 million to $75 million annually, driven by existing demand for nifedipine ER formulations, physician acceptance, and patient compliance benefits.

Medium-term (4-7 Years)

As the product gains market share and expands into emerging economies (e.g., India, Brazil, China), global sales could reach $200 million to $350 million, contingent on commercialization strategies and local regulatory approvals.

Long-term (8-10+ Years)

Genuine growth prospects depend heavily on patent status and competition. Assuming patent exclusivity persists, sales may stabilize around $300 million to $400 million, while post-patent expiration, revenues could decline by 40-60%, aligning with historical patterns observed for similar drugs [2].

Growth Drivers

- Growing global hypertensive population.

- Increased awareness and diagnosis of CVD risks.

- Enhanced formulations improving patient adherence.

- Strategic partnerships expanding access in emerging markets.

Risks

- Accelerated generic entry diminishes revenue.

- Regulatory hurdles delaying approvals.

- Pricing pressures and reimbursement cuts.

Strategic Recommendations

- Diversify Portfolio: Invest in pipeline drugs or combination therapies to mitigate patent expiry risks.

- Geographic Expansion: Prioritize markets with high CVD burdens and favorable regulatory environments.

- Pricing Strategy: Balance premium positioning in early years with cost competitiveness post-generic entry.

- Real-World Evidence: Leverage post-marketing data to demonstrate efficacy and safety, underpin billing and reimbursement negotiations.

Key Takeaways

- The global demand for antihypertensive therapies underpins NIFEDICAL XL’s market potential.

- Competitive pressures from generics necessitate strategic branding and market expansion.

- Patents provide a sales window of approximately 3-5 years; proactive planning is essential for sustained revenue.

- Emerging markets offer significant growth opportunities, especially where hypertension control remains suboptimal.

- Continuous innovation and diversification are critical to mitigating revenue erosions due to competition.

FAQs

1. What factors influence the market success of NIFEDICAL XL?

Market success depends on product differentiation, regulatory approvals, competitive pricing, clinician acceptance, and coverage by healthcare payers.

2. How does patent expiration impact sales projections?

Patents typically secure exclusivity for 5-10 years. Post-expiry, generic competitors increase price competition, often leading to a 40-60% sales decline unless differentiated by formulation or branding.

3. Which emerging markets present the highest growth opportunities?

Countries like China, India, Brazil, and Southeast Asian nations exhibit rising hypertension prevalence and expanding healthcare infrastructure, making them high-growth targets.

4. How does competition from generics affect profitability?

Generic entry reduces market prices significantly, compressing margins. Companies must strategize through branding, patient support programs, and expanding indications to retain market share.

5. What regulatory considerations should companies account for when planning to market NIFEDICAL XL internationally?

Understanding regional approval pathways, patent laws, registration requirements, and post-marketing surveillance obligations is vital for timely market entry and sustained sales.

References

[1] World Health Organization. (2021). Cardiovascular diseases. Retrieved from https://www.who.int/news-room/fact-sheets/detail/cardiovascular-diseases

[2] IMS Health Data. (2019). Patent expiry impact on cardiovascular drugs.

Note: All figures are estimates based on industry reports and market trends; actual sales may vary due to external factors.

More… ↓