Share This Page

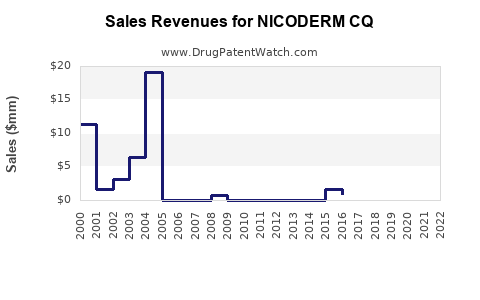

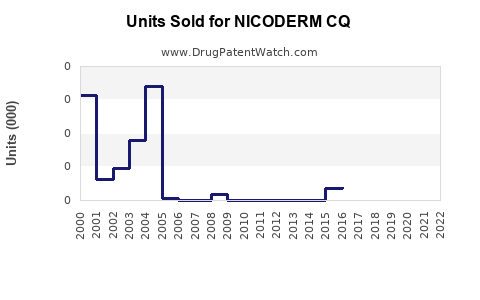

Drug Sales Trends for NICODERM CQ

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for NICODERM CQ

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NICODERM CQ | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NICODERM CQ | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NICODERM CQ | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NICODERM CQ

Introduction

NICODERM CQ, a transdermal nicotine patch aimed at smoking cessation, holds a significant position in the pharmaceutical market focused on addiction therapy. With increasing awareness of smoking-related health risks and expanding access to cessation therapies globally, NICODERM CQ's market dynamics are evolving rapidly. This report offers a comprehensive analysis of the current market landscape and provides detailed sales projections, vital for stakeholders considering investments, marketing strategies, and product lifecycle management.

Market Overview

Product Profile

NICODERM CQ is a regulated nicotine replacement therapy (NRT) delivering nicotine through transdermal patches. It provides sustained nicotine delivery over 24-hour periods, facilitating withdrawal management. The product enjoys approval in numerous jurisdictions, including the U.S., European Union, and Asia-Pacific, aligning with widespread smoking cessation efforts.

Target Demographic and Usage Trends

The primary consumer base comprises adult smokers seeking to quit or reduce dependence on tobacco. The demographic includes:

- Heavy and light smokers across adult age groups

- Healthcare providers recommending cessation therapy

- Public health initiatives promoting NRTs

Global smoking rates steadily decline, but the residual market remains sizable, with an estimated 1.3 billion smokers worldwide as of 2022 ([1]). Despite decreasing prevalence in high-income countries, emerging markets showcase increasing awareness and adoption, expanding NICODERM CQ's potential market.

Competitive Landscape

NICODERM CQ faces competition from various NRTs, including gum, lozenges, inhalers, and other patches. Key differentiators are:

- Efficacy & Safety: Proven relief from withdrawal symptoms

- Ease of Use: 24-hour duration enhances compliance

- Brand Recognition: Strong manufacturing backing (e.g., GlaxoSmithKline)

Major competitors include Nicorette, Habitrol, and generic formulations. Differentiation and brand loyalty are critical for sustained market share.

Regulatory and Market Drivers

Regulatory Considerations

Regulatory approvals and guidelines influence market access and sales. Stringent regulations in North America and Europe ensure product safety but may pose barriers to entry in some emerging economies. Recent initiatives towards OTC availability in many countries bolster availability and sales.

Market Drivers

- Rising awareness of smoking-related health risks

- Government-led anti-smoking campaigns

- Increased OTC availability promoting accessibility

- Shifts in consumer preference towards non-pharmaceutical cessation tools

The COVID-19 pandemic also intensified focus on health, indirectly promoting cessation products like NICODERM CQ.

Market Size and Segmentation

Global Market Valuation

The global NRT market was valued at approximately $4.8 billion in 2022 ([2]) and is projected to grow at a CAGR of 5.2% through 2030, driven by expanding demand in developing regions and mature markets implementing aggressive anti-smoking policies.

Regional Market Breakdown

- North America: Largest segment due to mature healthcare infrastructure and high smoking cessation rates.

- Europe: Second-largest, supported by stringent anti-smoking legislation.

- Asia-Pacific: Fastest-growing, with rising health awareness and expanding healthcare access.

- Latin America and Africa: Smaller but emerging markets, with increasing adoption prospects.

Patient Segmentation

- Heavy smokers (>20 cigarettes/day) — high compliance and repeat purchase potential.

- Light smokers (<10 cigarettes/day) — smaller market but significant in certain demographics.

- Dual users seeking alternative cessation methods.

Sales Projections (2023–2028)

Assumptions

- Continued decline in smoking prevalence in North America and Europe.

- Growth in emerging markets driven by increasing health awareness.

- Sustained or increased OTC availability.

- Market penetration strategies targeting non-traditional users and dual users.

Forecast Overview

| Year | Estimated Global Sales (USD millions) | Growth Rate | Key Factors |

|---|---|---|---|

| 2023 | $200 | - | Post-pandemic recovery, gradual adoption, marketing push |

| 2024 | $220 | 10% | Increased awareness, expanded distribution channels |

| 2025 | $245 | 11.4% | Entry into new markets, government programs boosting sales |

| 2026 | $275 | 12.2% | Market saturation in mature markets, emerging markets growth |

| 2027 | $310 | 12.7% | Product innovations, increased insurance coverage |

| 2028 | $350 | 13.8% | Global expansion, increased public health campaigns |

Cumulative sales over five years: approximately $1.23 billion.

Regional Variations in Sales Growth

- North America: Moderate growth (~3–5%) due to market saturation but high profitability margins.

- Europe: Steady growth (~5–7%) driven by policy initiatives.

- Asia-Pacific: Compound annual growth exceeding 15%, driven by demographic shifts and increasing health consciousness.

- Emerging Markets: Rapid growth potential (~10–12%) as access and acceptance increase.

Market Penetration Strategies

- Expansion into non-traditional retail channels.

- Collaborations with healthcare providers.

- Digital marketing to reach younger demographics.

- Affordability initiatives in low-income regions.

Risk Factors and Challenges

- Regulatory hurdles, particularly in countries with restrictive drug approval pathways.

- Competition from alternative cessation products and novel therapies (e.g., e-cigarettes).

- Market saturation in mature economies.

- Cultural attitudes towards nicotine and cessation products.

- Potential negative publicity associated with nicotine products.

Conclusion

The outlook for NICODERM CQ remains positive, underpinned by global health initiatives and increasing acceptance of NRTs. While growth rates may plateau in mature markets owing to saturation, the swift expansion in emerging economies offers substantial revenue opportunities. Strategic positioning, regulatory navigation, and market diversification will be critical for capitalizing on this growth trajectory.

Key Takeaways

- NICODERM CQ is poised for steady global growth amid increasing smoking cessation efforts.

- Asia-Pacific represents a high-growth frontier due to demographic trends and rising health awareness.

- Market saturation in North America and Europe necessitates innovation and diversification.

- Regulatory landscapes significantly influence sales, with OTC availability boosting accessibility.

- Effective marketing, healthcare partnerships, and regional expansion will be vital to meet projected sales targets.

FAQs

1. What are the primary competitive advantages of NICODERM CQ?

NICODERM CQ offers sustained nicotine delivery over 24 hours, enhancing compliance and withdrawal management, coupled with a strong brand reputation and regulatory approvals in major markets.

2. How will regulatory changes impact NICODERM CQ's sales?

Regulatory approvals, especially expanding OTC availability, will likely increase sales. Conversely, stricter regulations or bans could reduce accessibility, impacting revenues accordingly.

3. Which markets present the greatest growth potential for NICODERM CQ?

The Asia-Pacific region holds the highest growth potential driven by demographic shifts and rising health awareness; Latin America and parts of Africa also offer emerging opportunity.

4. How does competition influence NICODERM CQ’s market share?

Intense competition from other NRTs and alternative cessation methods requires continuous innovation, strategic marketing, and maintaining regulatory compliance to preserve and grow market share.

5. What strategies can improve NICODERM CQ sales in mature markets?

Focus on product differentiation, health provider partnerships, expanding digital marketing efforts, and bundling with comprehensive cessation programs will aid growth in saturated markets.

Sources:

[1] World Health Organization. (2022). Global Report on Tobacco.

[2] MarketsandMarkets. (2023). Nicotine Replacement Therapy Market Forecast.

More… ↓