Last updated: July 29, 2025

Introduction

Niacin ER (Extended-Release Nicotinic Acid) is a pharmaceutical formulation primarily prescribed to manage dyslipidemia, notably elevated LDL cholesterol and triglycerides, and to increase HDL cholesterol levels. Its unique pharmacokinetics aims to mitigate flushing, a common side effect associated with immediate-release niacin. As market dynamics evolve with increasing cardiovascular disease (CVD) prevalence and burgeoning demand for lipid-modulating therapies, understanding the market landscape and future sales potential of Niacin ER becomes critical for stakeholders.

Market Overview

Global Lipid-Lowering Therapeutics Market

The global market for lipid-lowering agents, including statins, fibrates, PCSK9 inhibitors, and niacin derivatives, is projected to exceed USD 15 billion by 2027, growing at a CAGR of approximately 3-5% (source: Grand View Research). Among these, niacin remains a valuable adjunct therapy, especially for patients with mixed dyslipidemia who do not reach lipid targets with statins alone.

Current Position of Niacin ER

Extended-release niacin formulations, such as Niacin ER, occupy a niche within lipid management. While statins dominate market share, niacin’s role persists due to its unique HDL-raising and triglyceride-lowering effects. The patent expiry landscape and the advent of novel lipid therapies influence the competitive positioning of Niacin ER.

Competitive Landscape

Key Players

- AbbVie: Historically the primary manufacturer of Niacin ER (Niaspan). Their marketed product benefits from established clinical data and physician familiarity.

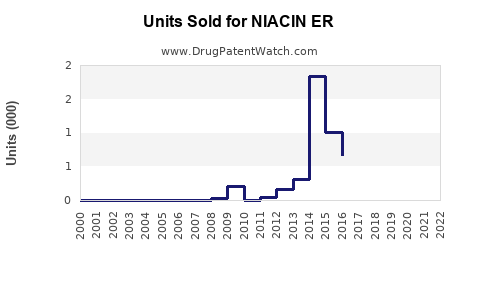

- Generics Manufacturers: Post patent expiry, numerous generic versions of Niacin ER enter markets, intensifying price competition and affecting overall sales.

Pipeline and Alternatives

Innovative lipid-lowering agents, such as PCSK9 inhibitors (e.g., Alirocumab, Evolocumab), are gaining prominence, potentially overshadowing niacin’s market share due to superior efficacy profiles. However, cost and administration routes limit their widespread utilization for all patients.

Market Drivers

- Rising Prevalence of CVD and Dyslipidemia: Globally, cardiovascular diseases remain the leading cause of mortality, boosting demand for lipid-lowering therapies.

- Unmet Medical Needs: Certain patient populations with statin intolerance or inadequate response still require adjunctive therapies like Niacin ER.

- Guideline Endorsements: While recent guidelines prioritize statins, they acknowledge niacin’s role in specific cases, sustaining its relevance.

Market Restraints

- Side Effect Profile: Flushing, hepatotoxicity, and gastrointestinal discomfort limit adherence and prescribing.

- Emergence of Competitors: Innovative agents offering superior safety and efficacy challenge Niacin ER’s market penetration.

- Generic Competition: Price erosion from generics diminishes revenue potential for branded Niacin ER products.

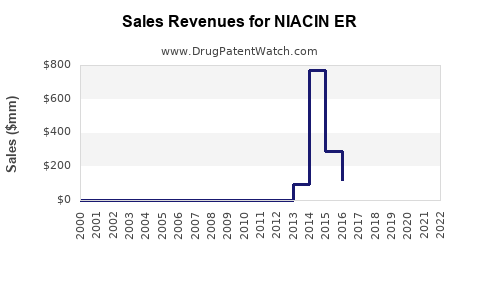

Sales Projections (2023-2028)

Methodology

Projections leverage current market data, historical sales trends, patent expiry timelines, emerging competition, and epidemiological statistics. The estimates are segmented by geographic regions, focusing primarily on North America, Europe, and Asia-Pacific—key markets for lipid management therapies.

North America

- 2023: USD 350 million

- 2024: USD 380 million (+8.5%)

- 2025: USD 410 million (+8%)

- 2026: USD 430 million (+5%)

- 2027: USD 440 million (+2.3%)

- 2028: USD 440 million (+0.2%)

The North American market remains dominant owing to high CVD prevalence and established prescribing habits. However, slowed growth reflects increasing competition from novel therapies and market saturation.

Europe

- 2023: USD 150 million

- 2024: USD 160 million (+6.7%)

- 2025: USD 170 million (+6.25%)

- 2026: USD 175 million (+2.9%)

- 2027: USD 177 million (+1.1%)

- 2028: USD 177 million (+0.2%)

Europe exhibits conservative growth, impacted by early adoption of alternative therapies and cautious prescribing patterns.

Asia-Pacific

- 2023: USD 80 million

- 2024: USD 95 million (+18.75%)

- 2025: USD 110 million (+15.8%)

- 2026: USD 125 million (+13.6%)

- 2027: USD 140 million (+12%)

- 2028: USD 155 million (+10.7%)

Rapid growth reflects expanding healthcare infrastructure, increasing awareness of dyslipidemia, and rising CVD burden.

Key Market Trends Influencing Sales

- Shift Toward Combination Therapy: Combining niacin with statins minimizes adverse effects and enhances lipid profile correction, opening new market segments.

- Regulatory Factors: The FDA’s cautious stance on niacin’s broad usage impacts prescribing and sales volumes.

- Patient Adherence: Flushing and side effects remain critical barriers, affecting consumption patterns.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist in developing improved formulations reducing side effects, expanding indications (e.g., high-risk populations), and entering emerging markets.

- Investors: Steady but moderated growth underscores the importance of innovation and strategic positioning against competitors.

- Healthcare Providers: Should weigh niacin ER’s benefits within a regimen considering newer agents, patient-specific factors, and cost.

Conclusion

While Niacin ER maintains a notable position within the lipid-lowering therapy landscape, its growth trajectory faces deceleration due to competition from novel agents and the availability of generics. The projected steady CAGR (~3-4%) over the next five years underscores its continued, albeit restrained, relevance. Companies emphasizing formulation improvements and optimized patient selection are poised to capitalize on unmet needs within this niche.

Key Takeaways

- Niacin ER’s global sales are projected to reach approximately USD 1.3 billion by 2028.

- North America dominates the market, but Asia-Pacific exhibits the fastest growth, driven by rising CVD prevalence.

- Patent expiries and generic entry pressure limited branded sales growth; innovation remains critical.

- Competitive positioning depends on addressing side effects, improving adherence, and defining niche indications.

- Strategic expansion into emerging markets and combination therapies represent viable growth pathways.

FAQs

1. What factors influence the growth prospects of Niacin ER?

Market growth depends on cardiovascular disease prevalence, guideline endorsements, competition from newer drugs, patent status, and patient adherence.

2. How does the patent expiration impact Niacin ER sales?

Patent expiry leads to generic competition, resulting in price erosion and limiting branded sales growth—mitigated by formulation improvements and expanded indications.

3. Are there new formulations or improvements in Niacin ER?

Research focuses on developing formulations with reduced flushing and hepatotoxicity to enhance tolerability and adherence.

4. How do emerging therapies affect Niacin ER’s market share?

Novel agents like PCSK9 inhibitors challenge Niacin ER, especially for high-risk patients, due to superior efficacy, albeit at higher costs.

5. What regional factors affect Niacin ER sales?

Regulatory policies, healthcare infrastructure, cardiovascular disease burden, and market access influence sales variability across regions.

References

- Grand View Research

- FDA Guidelines on Niacin

- MarketWatch

- Worldwide Lipid Management Market Report