Last updated: November 16, 2025

Introduction

NEXIUM (esomeprazole) is a proton pump inhibitor (PPI) primarily used for the treatment of gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. Since its initial approval in 2001 by the FDA, NEXIUM has established itself as a cornerstone therapy within the gastroenterology sector, owing to its efficacy and minimal side effect profile. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and future sales projections for NEXIUM, offering strategic insights for stakeholders.

Market Overview

Global Demand for Proton Pump Inhibitors

The global proton pump inhibitor market is projected to grow at a compound annual growth rate (CAGR) of approximately 2-4% through 2030, driven by rising prevalence of acid-related diseases, aging populations, and increasing awareness of GERD complications [1]. PPIs comprise a significant segment of gastrointestinal therapeutics, with key players including esomeprazole (NEXIUM), omeprazole, pantoprazole, lansoprazole, and rabeprazole.

Market Size and Revenue

As of 2022, the global PPI market was valued at approximately $14 billion, with NEXIUM accounting for a substantial share given its early-market entry and reputation for high efficacy. North America historically represents around 40-45% of sector sales, due to high disease prevalence and extensive healthcare infrastructure. The European and Asia-Pacific markets follow, exhibiting growth potential owing to lifestyle shifts and expanding healthcare access.

Competitive Dynamics

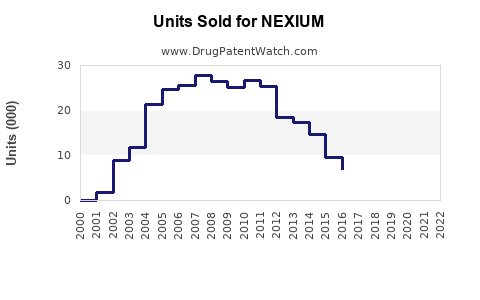

While NEXIUM maintains a strong market presence, the introduction of generic esomeprazole formulations post-patent expiry in 2014 has intensified price competition. Generics have significantly eroded NEXIUM’s premium pricing, especially in regions with robust biosimilar adoption, leading to shifts toward lower-cost alternatives for payers and consumers.

Regulatory and Patent Landscape

NEXIUM’s patent exclusivity concluded in 2014, unleashing a wave of biosimilar and generic competition. Despite this, Novartis (the original manufacturer) sustains brand loyalty through differentiators like formulation options and sustained-release variants. Regulatory bodies continue to oversee approvals for new indications and formulations that could bolster NEXIUM’s market share.

Factors Influencing Future Sales

Increasing Disease Burden

GERD affects approximately 20-30% of Western populations, with prevalence rising globally. Factors such as obesity, dietary habits, and aging amplify the demand for effective acid-suppressing therapies. The growing incidence of Barrett’s esophagus and esophageal adenocarcinoma underscores the need for prolonged and effective treatment options like NEXIUM.

Shift Toward Prescriptive Use and Diagnostic Recognition

Enhanced diagnostic capabilities and clinical guidelines favor initial prescription of potent PPIs like NEXIUM. Physicians’ preference for branded formulations, perceived to offer optimized efficacy and safety, sustains demand despite cost competition.

Technological Innovations and Formulation Improvements

Advancements include orally disintegrating tablets, once-daily dosing formulations, and combination therapies. Such innovations may extend NEXIUM’s utilization into niche markets, further supporting sales.

Market Penetration in Emerging Economies

Rapid economic growth and increased healthcare spending in Asia-Pacific, Latin America, and Middle East regions present lucrative opportunities. The rising middle class, urbanization, and improved health infrastructure facilitate increased prescription rates.

Impact of Biosimilars and Generics

Price erosion due to biosimilars and generics signifies a challenge. However, successful brand positioning and expansion into new indications mitigate revenue loss potential.

Sales Projections (2023-2030)

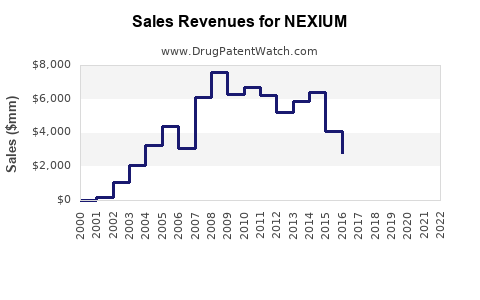

Baseline Scenario

Under current trends, NEXIUM’s global sales are projected to decline modestly by approximately 5-10% annually from its peak in 2013, owing to generic competition. Nevertheless, its entrenched clinical use and brand loyalty contribute to an estimated global revenue of $1.2 billion in 2023.

Optimistic Scenario

If NEXIUM leverages formulation advancements, expands into new indications such as Helicobacter pylori eradication regimens, and sustains strong physician preference, annual revenues could stabilize or grow slightly, reaching approximately $1.5 billion globally by 2030.

Pessimistic Scenario

In a prolonged scenario of intensified biosimilar adoption and pricing pressures, revenues could decline further, potentially dipping below $900 million by 2030.

Regional Breakdown

- North America: Will remain the largest market, with revenues stabilizing around 45-50% of global sales, driven by high GERD prevalence and clinical familiarity.

- Europe: Moderate growth expected, bolstered by aging population and healthcare reforms.

- Asia-Pacific: Fastest growth rate (CAGR of 4-6%), driven by urbanization, increasing medical infrastructure, and rising chronic disease prevalence.

- Latin America & Middle East: Emerging markets with high growth potential owing to expanding access and awareness.

Strategic Considerations

- Differentiation and Value-Added Formulations: Focusing on sustained-release or combination products could sustain premium pricing.

- Expansion into New Indications: Investigating efficacy in adjunct therapies or novel indications can generate additional revenue streams.

- Geographic Expansion: Strengthening market presence in emerging economies offers substantial upside amidst declining core markets.

- Cost Management & Partnerships: Collaborations for biosimilar development or licensing could optimize profitability and market access.

Key Takeaways

- NEXIUM remains a significant player in proton pump inhibitor therapy but faces ongoing price pressures due to patent expirations and biosimilar entries.

- The global PPI market continues to grow, driven by increasing prevalence of acid-related disorders, especially in aging and obese populations.

- Future sales will depend on maintaining physician preference, expanding into new indications, and strategic geographic penetration.

- Despite anticipated moderate declines, NEXIUM’s brand equity and technological enhancements offer avenues for revenue stabilization.

- Stakeholders should focus on innovation, market expansion, and competitive differentiation to maximize ROI in a maturing landscape.

FAQs

1. How has patent expiration affected NEXIUM’s market share?

Patent expiry in 2014 led to the proliferation of generic esomeprazole brands, causing a significant decline in NEXIUM’s market share and revenue, as price competition intensified.

2. What are the main competitors to NEXIUM?

Generic esomeprazole formulations, omeprazole, pantoprazole, lansoprazole, and rabeprazole are primary competitors, especially in markets dominated by low-cost generics.

3. Can NEXIUM sustain premium pricing amid competition?

Yes, through formulation innovations, expanded indications, and maintaining physician loyalty, NEXIUM can sustain higher price points for specific segments.

4. What emerging markets offer growth for NEXIUM?

Asia-Pacific, Latin America, and Middle East/North Africa regions present robust growth prospects due to rising disease prevalence and expanding healthcare infrastructure.

5. What strategies should Novartis pursue to maximize NEXIUM’s future revenue?

Investing in formulation improvements, entering new indications, expanding geographic reach, and forming strategic alliances for biosimilar development are key strategies.

References

[1] Market Research Future. "Proton Pump Inhibitors Market Analysis & Forecast 2022-2030."