Last updated: July 29, 2025

Introduction

Neurontin, with the generic name gabapentin, is an anticonvulsant and neuropathic pain medication originally developed by Parke-Davis, now part of Pfizer. Approved by the FDA in 1993, it has become a flagship drug within the neurological and pain management therapeutic classes. Its broad indications, established efficacy, and extensive off-label use have cemented its position in the pharmaceutical landscape. This market analysis examines current trends, competitive environment, regulatory impacts, and explores future sales projections.

Market Overview

Therapeutic Indications and Usage

Gabapentin's primary US-approved indications include epilepsy and postherpetic neuralgia. Off-label, it’s widely prescribed for neuropathic pain, fibromyalgia, anxiety disorders, and several other neurological conditions. Its application across multiple domains has expanded market penetration but has also prompted regulatory scrutiny over off-label marketing practices, impacting its pricing and sales strategies[1].

Global Market Size

The global gabapentin market was valued at approximately USD 1.6 billion in 2022, with North America accounting for over 55% due to high prescription rates and reimbursement policies favorable to branded and generic versions alike. Europe contributes about 20%, followed by Asia-Pacific, where increasing prevalence of neurological disorders and expanding healthcare infrastructure drive growth[2].

Market Dynamics

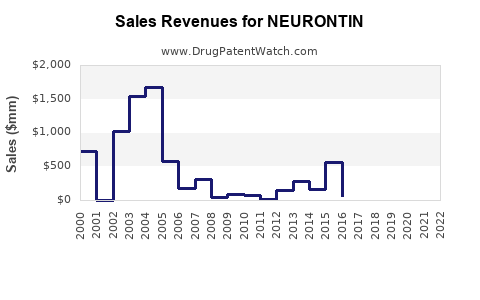

- Patent Status: Patent expiry in many jurisdictions has led to increased generic competition. Pfizer’s patent expiration for Neurontin in 2004 in the US triggered a sharp decline in sales, with generics capturing the majority of the market share[3].

- Pricing Trends: Post-patent, price erosion has been substantial, but branded formulations command premium pricing in certain markets due to brand recognition and physician loyalty.

- Off-label Prescriptions: Despite legal restrictions, prescriber habits sustain high volume sales through off-label indications, especially for neuropathic and anxiety-related conditions[4].

Competitive Landscape

Major Players

- Pfizer (Neurontin, Gralise): Once dominant, now faces generic competition reducing market share.

- Teva Pharmaceuticals, Mylan, Sandoz: Leading generic manufacturers offering gabapentin at lower prices.

- Other Patented Formulations: Such as Gabapentin Enacarbil (Horizant), focusing on specific indications like restless leg syndrome.

Market Share Dynamics

Following patent expiry, generics have dominated the market, with branded Neurontin maintaining a niche—for example, in treating specific pain indications or formulations like extended-release (Gralise). The shift toward generics has resulted in a significant revenue decline for Pfizer, though sales remain substantial in certain regions and indications.

Regulatory and Legal Challenges

The US Department of Justice historically scrutinized Pfizer for alleged off-label marketing practices, resulting in hefty fines and compliance demands that impacted sales strategies[5]. Regulatory bodies also increased oversight of off-labelPromotion, affecting the volume of prescriptions and sales projections.

Sales Projections Analysis

Short-term Outlook (Next 1-2 Years)

- Declining Sales Due to Generic Competition: Pfizer’s branded Neurontin sales are expected to decrease at a compounded annual rate of 10–15% reflecting generic penetration.

- Continued Off-label Prescriptions: Persistent off-label use sustains certain revenues in specific segments, particularly pain management. This offsets some decline.

- Emerging Formulations: Limited impact—though extended-release variants like Gralise offer potential stabilizers in revenue streams, their share remains modest.

Mid-to-Long Term Outlook (3-10 Years)

- Market Maturation and Dosing Trends: As biosimilars and generics saturate markets, revenues for brand Name Neurontin are projected to fall below USD 500 million globally by 2028, assuming no major patent reinstatement or reformulations.

- Pipeline and New Indications: Limited late-stage pipeline activity suggests constrained growth prospects. However, potential approval of novel gabapentin formulations or combination products could stabilize or modestly enhance certain market segments.

- Regional Variability: The Asia-Pacific market shows resilience due to growing neurological disorders prevalence and lower generic competition, potentially offering a growth avenue.

Impact of Alternative Therapies

Emerging therapies, including pregabalin (Lyrica) and newer nerve pain modulators, threaten Neurontin’s niche. The adoption of these alternatives is accelerating, especially in developed markets, further depresses sales.

Key Factors Influencing Future Sales

- Regulatory Environment: Stricter guidelines on off-label use and marketing will impact demand.

- Patent and Formulation Developments: No imminent patent protections for gabapentin are expected; focus might shift toward improved formulations or combination therapies.

- Market Penetration in Developing Countries: Growth opportunities exist in regions with increasing healthcare access and neurological disorder burden.

- Reimbursement Policies: Favorable insurance reimbursement enhances prescriptions, especially in pain management.

Concluding Insights

While Neurontin remains a well-established therapeutic agent with a broad global footprint, its future sales are predominantly dictated by generic competition, regulatory pressures, and evolving treatment standards. Pfizer’s strategic focus may involve diversifying beyond gabapentin, emphasizing niche formulations, or innovative delivery systems. Overall, current projections suggest a continued decline in branded sales, stabilized only by clinical need in specific indications and regional markets with limited generic penetration.

Key Takeaways

- Market consolidation post-patent expiry has significantly diminished Neurontin’s global revenues, with generic competitors dominating.

- High off-label use sustains sales in certain niches but faces increasing regulatory constraints.

- Emerging therapies in neuropathic pain and epilepsy are gaining traction, limiting Neurontin’s future growth.

- Regional variations present underexploited opportunities, especially in emerging markets where neurological disease burdens are rising.

- Innovation in formulations or combination therapies may become necessary to sustain revenue streams.

FAQs

1. Will Pfizer reincarnate Neurontin with a new formulation to boost sales?

Currently, there are no public plans for reformulations or new patent protections. Future strategies may involve proprietary extended-release versions or combination therapies to differentiate from generics.

2. How does the off-label prescribing of Neurontin impact the market?

Off-label use sustains high prescription volumes, especially for neuropathic pain and anxiety. However, regulatory scrutiny may tighten, potentially reducing future off-label sales.

3. What regional markets show the most promise for Neurontin sales in the next decade?

Emerging markets in Asia-Pacific and Latin America, driven by rising neurological disorder prevalence and expanding healthcare access, offer growth prospects.

4. How does competition from newer drugs like pregabalin affect Neurontin’s position?

Pregabalin generally offers improved pharmacokinetic profiles and efficacy for certain indications, thereby capturing significant market share and limiting Neurontin’s growth.

5. Is there potential for gabapentin to regain patent protection or develop new indications?

Reinstating patent protections for existing formulations is unlikely. However, research into new indications or delivery systems could open niche markets but faces regulatory hurdles.

References

[1] MarketResearch.com, “Global Gabapentin Market Report,” 2022.

[2] Grand View Research, “Gabapentin Market Size, Share & Trends Analysis,” 2023.

[3] U.S. FDA, “Patent Status and Market Impact of Gabapentin,” 2004.

[4] Journal of Pain Research, “Off-label Use of Gabapentin: Implications and Trends,” 2021.

[5] Department of Justice, “Pfizer Off-label Marketing Litigation,” 2010.