Share This Page

Drug Sales Trends for MULTAQ

✉ Email this page to a colleague

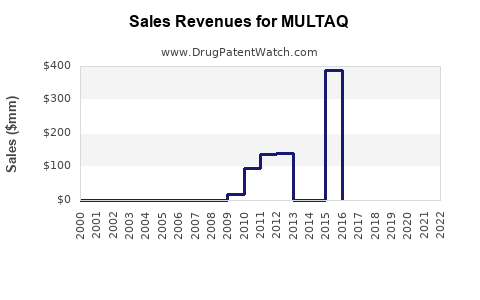

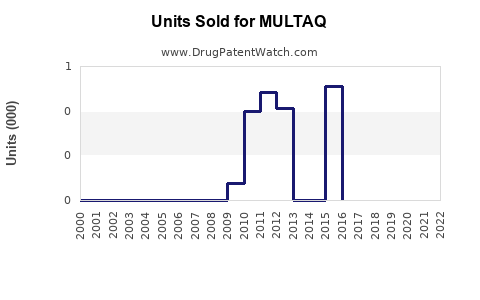

Annual Sales Revenues and Units Sold for MULTAQ

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MULTAQ | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MULTAQ (Dronedarone)

Introduction

MULTAQ (dronedarone) is an anti-arrhythmic medication developed and marketed by Sanofi for the management of atrial fibrillation (AF) and atrial flutter, primarily to reduce the risk of hospitalization associated with these conditions. Since its approval in 2010 by the U.S. Food and Drug Administration (FDA) and subsequent approvals worldwide, MULTAQ has established itself within a niche segment of the cardiovascular drugs market. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future sales forecasts to inform stakeholders and investors.

Market Overview: Therapeutic Context and Indication

Atrial fibrillation affects approximately 33 million individuals globally, with prevalence expected to rise due to aging populations and increasing cardiovascular risk factors [1]. AF is associated with significant morbidity, mortality, and healthcare costs, often necessitating lifelong management strategies including rhythm control. Anti-arrhythmic drugs like MULTAQ are employed to restore and maintain sinus rhythm, ideally reducing hospitalizations for arrhythmic episodes.

MULTAQ is positioned uniquely as a multi-channel blocker, designed to offer effective rhythm control while minimizing proarrhythmic risk, especially compared to other class III anti-arrhythmic agents. Its safety profile and specific therapeutic niche influence its market penetration and sales trajectory.

Competitive Landscape

The market for AF management includes direct competitors such as Amiodarone, Dofetilide, Sotalol, and newer agents like Etrasimod and Vericiguat that address atrial and ventricular arrhythmias differently. Among these, Amiodarone remains the most widely prescribed anti-arrhythmic due to its efficacy despite a complex side-effect profile, limiting MULTAQ's adoption in some regions.

Additionally, catheter-based ablation procedures have gained popularity, potentially reducing reliance on pharmacotherapy. However, not all patients are suitable candidates, preserving a significant role for drugs like MULTAQ. The recent development of novel rhythm-control medications and advances in device therapy will influence MULTAQ’s competitive positioning.

Regulatory and Geographic Market Penetration

Since initial approval, MULTAQ has obtained regulatory clearance in over 80 countries. Its primary markets include the United States, European Union, Japan, and increasingly, emerging markets such as China and Brazil. The drug's adoption varies due to factors such as physician familiarity, licensing, reimbursement policies, and clinical guidelines.

In the U.S., the medication gained moderate acceptance, supported by inclusion in the American College of Cardiology/American Heart Association (ACC/AHA) guidelines, which recommend it as an option for rhythm control in specific patient subsets. In Europe, its use is similarly endorsed, with country-specific variations influencing sales.

Market Dynamics and Growth Drivers

Several factors influence MULTAQ’s market dynamic:

-

Clinical Guidelines: Incorporation into standards of care enhances prescription likelihood. Recent updates emphasizing rhythm control strategies favor MULTAQ when suitable.

-

Safety Profile: Favorable adverse event profile relative to amiodarone promotes physician confidence, especially in patients at risk of thyroid, pulmonary, or hepatic toxicity.

-

Atrial Fibrillation Burden: Rising AF prevalence due to demographic shifts and increased screening amplifies demand. Digitization and wearables also facilitate earlier detection, potentially increasing pharmacological management needs.

-

Reimbursement and Pricing Policies: Favorable reimbursement in advanced economies supports steady sales, whereas price constraints may limit the drug’s appeal in cost-sensitive markets.

-

Competitive Drugs and Technologies: The advent and growth of catheter ablation and newer pharmaceuticals could dampen the demand for traditional pharmacotherapy—unless MULTAQ's safety and efficacy advantages are convincingly demonstrated.

Sales Projections and Forecasting

Based on current market data, historical sales, and projected adoption rates, industry analysts estimate that MULTAQ’s global sales reached approximately \$250–\$300 million in 2022. Over the next five years, several factors could influence the trajectory:

-

Moderate Growth Scenario: Continued steady use driven by existing indications, with sales climbing at approximately 4–6% annually, reaching about \$350–\$400 million by 2027. This assumes stable clinical guidelines, maintained product awareness, and ongoing acceptance in core markets.

-

Optimistic Scenario: Increased market penetration in emerging markets, expanded indications, and supportive clinical data could accelerate sales growth to 8–10% CAGR, pushing revenues past \$500 million by 2027.

-

Conservative Scenario: The growing dominance of ablation therapies and newer pharmacological agents, coupled with pricing pressures, could suppress growth or even lead to stagnation, with sales remaining near current levels.

It is important to note that patent expiration, formulary restrictions, and reimbursement policies will significantly influence actual sales figures. Additionally, regional healthcare infrastructure and physician prescribing behaviors will determine market saturation levels.

Potential Market Expansion Opportunities

-

Additional Indications: Research into MULTAQ’s efficacy for other arrhythmias or combined cardiovascular conditions could unlock new revenue streams.

-

Combination Therapies: Integration with other anti-arrhythmic agents or device therapies to improve patient outcomes may foster increased use.

-

Strategy for Emerging Markets: Targeted focus on countries with rising AF prevalence and developing healthcare systems could catalyze growth, provided regulatory and pricing challenges are managed effectively.

Risks and Challenges

-

Safety and Efficacy Perceptions: Any adverse safety signals or comparative efficacy shortcomings can restrain market expansion.

-

Competitive Innovations: Disruption by gene therapies, personalized medicine approaches, or advanced ablation technologies presents ongoing threats.

-

Regulatory Changes: Stringent approval processes or modifications in clinical guidelines could alter prescribing behavior or limit indications.

-

Market Penetration Barriers: Physician familiarity bias, limited awareness, and reimbursement issues impede rapid adoption in some regions.

Conclusion

MULTAQ’s market outlook remains cautiously optimistic, primarily supported by its targeted role in rhythm control for atrial fibrillation. Continued evolution in clinical practice, technological advancements, and regional market development will shape its sales trajectory. Strategic positioning—emphasizing safety, expanding indications, and entering emerging markets—will be crucial for maximizing revenues. Investors and stakeholders should monitor regulatory updates, clinical trial outcomes, and competitive shifts to refine their forecasts.

Key Takeaways

- Moderate Growth Likely: Expect annual sales growth of 4–6%, with potential acceleration in emerging markets.

- Market Penetration Dependent on Guidelines: Inclusion in clinical protocols bolsters prescription rates.

- Competitive Environment Tightening: Advances in ablation and novel drugs pose ongoing challenges.

- Regulatory and Reimbursement Dynamics Critical: Policies will significantly influence market expansion.

- Innovation and Expansion Strategies Essential: Additional indications and regional focus can enhance long-term growth.

FAQs

1. How does MULTAQ compare to other anti-arrhythmic drugs in efficacy?

MULTAQ offers a balanced efficacy-risk profile, with demonstrated improvements in maintaining sinus rhythm compared to placebo and some existing alternatives, with a potentially lower proarrhythmic risk relative to drugs like amiodarone. However, its effectiveness must be weighed against newer therapies and procedural options such as ablation.

2. What are the main factors limiting MULTAQ’s market growth?

Key limitations include competition from catheter ablation procedures, the emergence of novel drugs, safety concerns reflected in prior regulatory warnings, and regional differences in guideline endorsement and reimbursement policies.

3. Which markets are most promising for MULTAQ going forward?

The U.S. and European Union remain primary markets due to established clinical guidelines and healthcare infrastructure. Emerging markets like China, Brazil, and India offer substantial growth potential due to rising AF prevalence and expanding healthcare access, provided regulatory hurdles are addressed.

4. Can MULTAQ's sales increase through new indications?

Potentially, if ongoing or future clinical trials demonstrate efficacy in additional arrhythmia types or related cardiovascular conditions, regulatory approval could follow, expanding its market base.

5. How might healthcare trends impact MULTAQ’s future sales?

Advances in personalized medicine, wearable health monitoring, and minimally invasive procedures could reduce reliance on pharmacotherapy, posing long-term challenges. Conversely, improved disease detection and management strategies may sustain or increase drug utilization.

Sources:

[1] Camm AJ, et al. "Guidelines for the management of atrial fibrillation." European Heart Journal, 2010.

[2] Sanofi. "Product information — MULTAQ (dronedarone)." 2022.

[3] MarketWatch. "Global anti-arrhythmic drugs market report," 2022.

[4] WHO. "Cardiovascular diseases (CVDs)," 2021.

More… ↓