Last updated: August 5, 2025

Introduction

MUCINEX DM, a combination formulation containing guaifenesin and dextromethorphan, addresses cough and chest congestion associated with respiratory illnesses, particularly colds and influenza. Its prominent positioning in the over-the-counter (OTC) mucolytic and antitussive segments makes it a significant product within respiratory relief categories. This report offers a comprehensive market analysis and sales projection based on current industry trends, regulatory landscape, consumer behavior, and competitive dynamics.

Market Overview

Product Profile and Market Significance

MUCINEX DM is marketed under GlaxoSmithKline’s (GSK) Mucinex brand, renowned for its efficacy in combating congestion and cough. The active ingredients serve distinct purposes: guaifenesin thins mucus, easing cough productivity, while dextromethorphan suppresses dry cough reflexes. The OTC segment for cough and cold medications remains robust, bolstered by seasonal and pandemic-related respiratory illness spikes.

Market Size and Trends

The global cold and cough remedy market was valued at approximately USD 8 billion in 2022, with OTC products constituting over 70% in developed markets like the U.S. and Europe ([1]). The North American OTC respiratory market alone was estimated at USD 4.2 billion in 2022, with growth rates averaging 4-5% annually, driven by increasing consumer health awareness and aging populations.

In the U.S., OTC cough and cold products account for substantial consumer expenditure, with MUCINEX DM occupying a significant share due to brand loyalty and product efficacy. The market's resilience is reinforced by seasonal demand peaks during winter months and heightened consumer awareness post-pandemic, which has reinforced the importance of effective respiratory remedies.

Regulatory Dynamics

Regulatory frameworks significantly influence market dynamics. The U.S. Food and Drug Administration (FDA) classifies the active ingredients—guaifenesin and dextromethorphan—as generally recognized as safe and effective (GRASE) for OTC use ([2]). However, recent regulatory considerations for dextromethorphan due to abuse potential could impact formulations and sales in the long term.

Competitive Landscape

MUCINEX DM faces competition primarily from:

- Robitussin DM (Pfizer)

- Vicks DayQuil Cough & Cold (Procter & Gamble)

- Delsym (Pfizer)

- Mucinex Children’s formulations

Brand loyalty, formulation efficacy, and marketing campaigns largely influence consumer preferences. Mucinex’s established reputation and reputation for extended relief positions it favorably within this competitive segment.

Market Drivers and Challenges

Drivers

- Increasing Incidence of Respiratory Illnesses: Seasonal colds, influenza, and recent respiratory pandemics amplify demand for OTC cough and congestion treatments.

- Consumer Preference for OTC Medications: Growing preference for self-medication reduces healthcare visits and boosts OTC sales.

- Aging Population: Older adults experience higher respiratory ailments, expanding the target demographic.

- Product Innovation: Advances in formulation, such as extended-release options and child-friendly versions, expand market reach.

Challenges

- Regulatory Scrutiny: Potential restrictions on dextromethorphan could limit product formulations.

- Market Saturation: Intense competition from generic brands and other OTC options constrains pricing power.

- Consumer Preference Shifts: Trends favoring natural or home remedies may impact sales.

- Supply Chain Disruptions: Raw material shortages and manufacturing delays could temporarily impact availability.

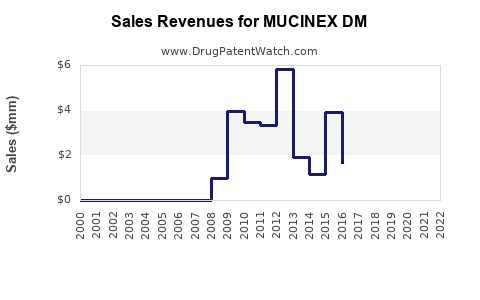

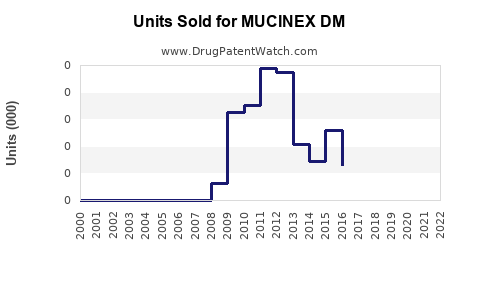

Sales Projections

Short-term (Next 1-2 Years)

The COVID-19 pandemic profoundly increased consumer demand for respiratory symptom relief, including products like MUCINEX DM. While pandemic-related demand has moderated, seasonal peaks and increased health awareness sustain moderate growth trajectories.

- Annual Sales Estimate: Approximately USD 400-500 million in the U.S. alone, considering GSK’s market share within the Mucinex brand and overall OTC cough segment growth.

- Growth Rate: 3-5%, driven by seasonal demand and increased consumer acceptance.

Medium-term (3-5 Years)

Market growth is expected to stabilize, with frequent seasonal fluctuations. The proliferation of newer formulations and potential regulatory changes may moderate growth but open opportunities for innovation.

- Projected Sales: USD 550-600 million annually in North America.

- Market Share: Maintains leadership within GSK’s OTC respiratory portfolio, with potential gains in emerging markets through strategic expansion.

Long-term (Beyond 5 Years)

Emerging markets, especially Asia-Pacific, present significant growth opportunities. Market penetration may double as regulatory barriers diminish and economic growth enables increased OTC healthcare spending.

- Projected Global Sales: USD 1 billion, following expansion strategies and increased brand recognition.

- Factors Influencing growth: Patent expirations of competitors, new formulations addressing consumer preferences, and leveraging digital marketing for brand engagement.

Regional Considerations

- United States: Dominant market due to high OTC usage and established regulatory environment.

- Europe: Slower growth contingent on regulatory harmonization and competitive dynamics.

- Asia-Pacific: High growth potential, driven by urbanization, increased healthcare awareness, and expanding middle-class demographics.

Competitive Analysis

The success of MUCINEX DM hinges on its brand recognition, formulation efficacy, and consumer trust. Pfizer's Delsym, a sustained-release formulation, offers stiff competition, emphasizing the importance of product differentiation. Consumer preference for natural remedies and alternative therapies poses ongoing challenges. Nevertheless, Mucinex's comprehensive marketing and extensive OTC distribution channels sustain its market presence.

Strategic Outlook

To capitalize on growth opportunities, GSK should:

- Invest in product innovation, including formulations with additional benefits like natural ingredients.

- Expand presence in emerging markets via localized marketing and educational campaigns.

- Strengthen brand loyalty through consumer engagement and digital marketing.

- Monitor regulatory developments closely to adapt swiftly to legislative changes.

Key Takeaways

- Robust Market Presence: MUCINEX DM commands a significant share of the OTC cough-and-cold market, with resilient demand driven by seasonal peaks and health awareness.

- Projected Growth: Expect moderate annual sales growth of 3-5% in North America, with long-term expansion in emerging markets.

- Strategic Opportunities: Innovation, regional expansion, and consumer engagement are critical to maintaining leadership.

- Challenges: Regulatory risks surrounding dextromethorphan and competition from generics and natural remedies require strategic mitigation efforts.

- Market Resilience: The COVID-19 pandemic has reinforced the importance of effective respiratory OTC medications, ensuring sustained relevance and potential for incremental sales.

Frequently Asked Questions

1. What factors influence the sales of MUCINEX DM globally?

Sales are influenced by seasonal respiratory illness prevalence, regulatory policies on active ingredients, consumer health trends, competitive dynamics, and regional economic development. Increased health awareness and pandemics also elevate demand.

2. How are regulatory changes impacting MUCINEX DM’s marketability?

Regulatory scrutiny, particularly over dextromethorphan due to abuse potential, could lead to formulation restrictions or requirements for sales regulation, impacting availability and sales in some markets.

3. Which regions represent the most significant growth opportunities for MUCINEX DM?

While North America remains the core market, Asia-Pacific offers substantial long-term growth potential due to rising healthcare awareness, urbanization, and expanding OTC markets.

4. How does competition affect MUCINEX DM’s market share?

Brand loyalty, product efficacy, and marketing efforts help sustain Mucinex’s leadership. However, intense competition from generics and alternative remedies necessitates continual innovation and strategic marketing.

5. What strategic actions can GSK undertake to boost MUCINEX DM sales?

GSK should focus on developing new formulations, expanding into emerging markets, leveraging digital marketing, and maintaining regulatory dialogue to adapt swiftly to legislative changes.

Sources

[1] MarketsandMarkets. “Cold & Cough Remedies Market.” 2022.

[2] U.S. FDA. “Guidance for Industry: Dextromethorphan as an OTC Ingredient.” 2021.