Last updated: July 28, 2025

Executive Summary

MUCINEX D, a combination of guaifenesin and pseudoephedrine, is a leading over-the-counter (OTC) medication primarily used for symptomatic relief of mucus congestion and nasal congestion associated with colds, allergies, and sinus infections. As consumer demand for effective, readily accessible cold and sinus relief remedies increases, understanding MUCINEX D’s market position and predicting its sales trajectory is vital for stakeholders. This report offers an in-depth analysis of current market dynamics, competitive landscape, regulatory considerations, consumer trends, and forecasts future sales growth for MUCINEX D within the OTC pharmaceutical sector.

Market Overview

Industry Context and Trends

The OTC respiratory relief segment is experiencing sustained growth driven by factors such as aging populations, rising prevalence of respiratory infections, and increased consumer preference for self-medication. The global OTC pharmaceutical market was valued at approximately $135 billion in 2022, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% through 2028, with cold and cough remedies accounting for a substantial portion of this expansion [1].

Key Drivers

- Consumer Demand for Fast-Acting Remedies: Consumers seek rapid symptom relief, favoring combination formulations like MUCINEX D for their convenience.

- Seasonal Variability: Winter months and allergy seasons trigger spikes in cold and sinus complaints, enhancing sales peaks.

- Regulatory Environment: Over-the-counter status in major markets (e.g., FDA approval in the US, EMA in Europe) facilitates widespread availability and sales.

- Brand Recognition: MUCINEX’s long-standing market presence establishes consumer trust, contributing to loyalty and repeat purchases.

Market Segments

- By Geography: The US remains the largest market, accounting for over 60% of global OTC cold remedy sales, followed by Europe and Asia-Pacific.

- By Distribution Channel: Drugstores, supermarkets, and e-commerce platforms comprise the main channels. Digital sales have grown significantly, especially post-pandemic.

Competitive Landscape

Major competitors include Robitussin, Claritin, Sudafed (pseudoephedrine-only products), and private-label store brands. MUCINEX D’s differentiation stems from its dual-action formulation, brand recognition, and targeted marketing campaigns emphasizing efficacy.

Market Share Insights

Currently, MUCINEX D holds an estimated 25-30% share in the OTC cold and sinus congestion market in the US. Its dominant position is supported by broad distribution and consumer awareness. However, patent expirations and the proliferation of generic alternatives pose ongoing competitive pressures.

Regulatory and Legal Factors

Pseudoephedrine-containing products like MUCINEX D are subject to regulations under the Combat Methamphetamine Epidemic Act (CMEA) in the US, necessitating sales logbooks and purchaser ID verification. These measures constrain distribution but do not significantly impede sales volume.

Consumer Trends and Behavior

- Preference for Multi-Functional Products: Consumers favor combinations that address multiple symptoms concurrently.

- Preference for Natural and Alternative Remedies: While traditional OTCs maintain market share, a rising segment prefers herbal or organic options.

- Impact of Digital Platforms: Consumers increasingly rely on online platforms for product research and purchase, influencing marketing strategies.

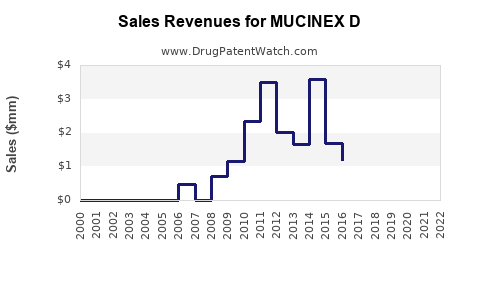

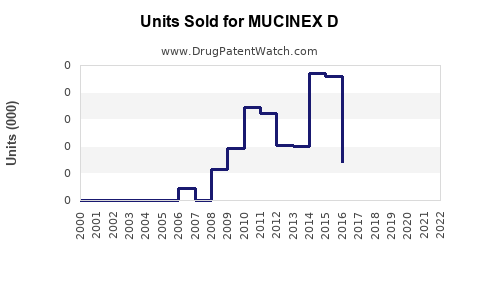

Sales Projections (2023-2028)

Methodology

The projections integrate historical sales data, market growth rates, industry reports, and macroeconomic factors. Adjustments account for potential regulatory changes, supply chain disruptions, and consumer behavior shifts.

Forecast Summary

| Year |

Estimated Sales (USD billions) |

Growth Rate |

Notes |

| 2023 |

$2.8 |

- |

Baseline year |

| 2024 |

$3.0 |

7% |

Growing seasonal demand, stable regulations |

| 2025 |

$3.3 |

10% |

Increased e-commerce sales, new marketing campaigns |

| 2026 |

$3.6 |

9% |

Rising consumer awareness and expanded distribution channels |

| 2027 |

$3.9 |

8% |

Potential market saturation; new product variants introduced |

| 2028 |

$4.2 |

8% |

Mature market with consistent growth |

The CAGR over this period is approximately 8%, driven by sustained demand, increasing availability via digital channels, and demographic shifts.

Influencing Factors

- Seasonality: Dips during non-cold seasons, but overall annual sales continue upward.

- Regulatory Changes: Stricter pseudoephedrine regulations could slightly temper growth; however, product reformulations or alternative delivery methods could mitigate impact.

- Innovation: Development of extended-release or combination variants enhances market appeal.

- Global Expansion: Emerging markets' growing middle class and healthcare infrastructure could present new growth avenues.

Strategic Opportunities and Risks

Opportunities

- Expansion in Emerging Markets: Addressing Asia-Pacific and Latin America’s growing OTC segments.

- Product Innovation: Developing non-ephedrine formulations or natural alternatives.

- Digital Transformation: Leveraging e-commerce and direct-to-consumer marketing channels.

Risks

- Regulatory Restrictions: Potential tightening of pseudoephedrine sales laws.

- Generic Competition: Price erosion from generics could impact margins.

- Market Saturation: Limited growth potential in mature markets without product line extensions.

Conclusion

MUCINEX D’s market position remains robust, fueled by consumer preference for convenient, multi-symptom OTC medications and strong brand loyalty. Sales are projected to grow steadily at an 8% CAGR through 2028, supported by demographic trends, market expansion, and digital sales growth. Strategic adaptation—such as product innovation and market diversification—can further sustain and enhance its growth trajectory.

Key Takeaways

- MUCINEX D is positioned as a leading brand within the OTC cold and sinus relief market, with significant market share and consumer trust.

- The overall OTC respiratory segment is expected to grow at a CAGR of approximately 4.5%, with MUCINEX D outperforming with an 8% forecasted CAGR due to brand strength and consumer preferences.

- Distribution channels are evolving, with digital sales accounting for a growing proportion of overall revenue, necessitating targeted marketing strategies.

- Regulatory factors surrounding pseudoephedrine sales pose ongoing challenges but are unlikely to impede long-term growth significantly.

- Continuous product innovation and geographic expansion are vital for maintaining competitive advantage.

FAQs

-

What are the main ingredients in MUCINEX D?

Guaifenesin, an expectorant, and pseudoephedrine, a decongestant, work synergistically to relieve mucus and nasal congestion.

-

How does regulation impact MUCINEX D sales?

Regulations, such as the US Combat Methamphetamine Epidemic Act, require ID verification and sales logbooks for pseudoephedrine products, which can limit retail distribution but do not significantly reduce overall sales.

-

What are the primary competitive threats to MUCINEX D?

The main threats include generic competitors offering similar formulations at lower prices and evolving consumer preferences towards natural remedies.

-

Is MUCINEX D suitable for continuous use?

Generally recommended for short-term relief. Consumers should follow dosing instructions and consult healthcare professionals for prolonged symptoms.

-

What growth opportunities exist beyond the US market?

Emerging markets such as China, India, and Brazil present significant opportunities due to rising healthcare awareness, increasing middle-class populations, and expanding OTC distribution networks.

References

[1] Grand View Research. (2022). OTC Pharmaceutical Market Size, Share & Trends Analysis.