Share This Page

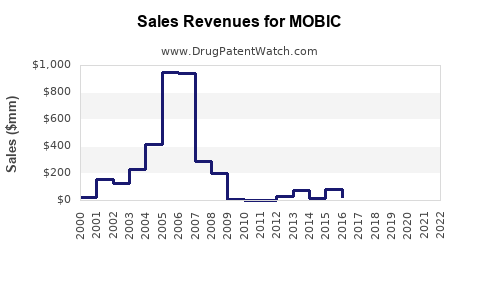

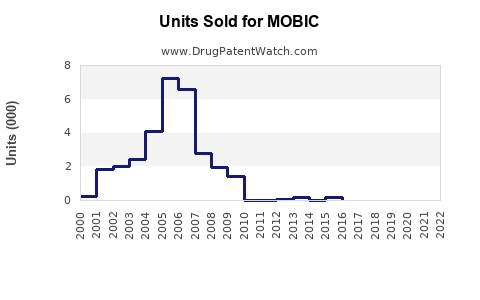

Drug Sales Trends for MOBIC

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MOBIC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MOBIC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MOBIC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MOBIC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MOBIC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MOBIC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MOBIC (Meloxicam)

Introduction

MOBIC (meloxicam), a nonsteroidal anti-inflammatory drug (NSAID), is widely prescribed for the treatment of osteoarthritis, rheumatoid arthritis, and other musculoskeletal disorders. Since its U.S. FDA approval in 2000, MOBIC has established itself as a leading agent within the NSAID segment, owing to its selective COX-2 inhibition, which offers a distinct safety profile compared to traditional NSAIDs. This report presents a comprehensive market analysis and sales projection for MOBIC, emphasizing current trends, competitive landscape, regulatory influences, demographic factors, and potential growth drivers.

Market Overview

Global NSAID Market Context

The global NSAID market reached approximately USD 13.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.4% through 2030, driven by increasing prevalence of arthritis, chronic pain management needs, and aging populations worldwide [1]. The segment pertaining specifically to osteoarthritis and rheumatoid arthritis constitutes a significant revenue share, with oral NSAIDs like MOBIC dominating prescriptions.

Market Position of MOBIC

MOBIC holds a prominent position in the NSAID category, especially within the selective COX-2 inhibitor (coxib) class. Its favorable safety profile in long-term management of chronic arthritis conditions, along with a well-established patent and brand recognition, sustains its market presence. However, the generic landscape and competitive offerings from other coxibs (e.g., celecoxib) and conventional NSAIDs influence its market penetration.

Current Market Dynamics

Regulatory and Safety Considerations

In 2004, concerns arose about cardiovascular risks linked to some COX-2 inhibitors, notably rofecoxib (Vioxx). Although MOBIC is a non-selective NSAID, the broader class’s safety perceptions have influenced prescribing patterns. Recent regulatory guidelines emphasize individualized risk assessment, impacting MOBIC’s volume, especially among high cardiovascular risk groups.

Competitive Landscape

Key competitors include generic meloxicam products, other NSAIDs (ibuprofen, naproxen), and emerging biologics for arthritis. Patent expiration of branded MOBIC has facilitated a surge in generics, reducing prices and impacting sales trajectories but increasing accessibility.

Reimbursement and Pricing Trends

Payor policies favor cost-effective therapies. MOBIC’s relatively affordable generics benefit from favorable reimbursement schemes, though high-dose regimens and long-term use influence overall revenue.

Demographic and Epidemiological Drivers

Prevalence of Target Conditions

- Osteoarthritis affects approximately 32.5 million adults in the U.S. alone, with higher incidence among individuals aged 50 and above [2].

- Rheumatoid arthritis impacts around 1.3 million Americans, equating to nearly 0.5% of the adult population [3].

The aging demography and increasing obesity rates escalate osteoarthritis prevalence, augmenting demand for effective NSAIDs like MOBIC.

Prescribing Trends

Physicians prefer MOBIC due to its once-daily dosing and safety profile, especially in patients requiring long-term therapy restricted by gastrointestinal or cardiovascular risks. The increased emphasis on safety-adjusted prescribing enhances MOBIC’s utilization, particularly in risk-mitigated populations.

Future Market Opportunities

Expansion into New Indications

Potential off-label applications, such as chronic pain management beyond arthritis, could broaden MOBIC’s market. However, regulatory approval depends on clinical trial evidence demonstrating efficacy and safety in such indications.

Geographic Expansion

Emerging markets in Asia-Pacific and Latin America show increasing NSAID adoption driven by rising healthcare access and aging populations. Local generics and regulatory facilitation could enhance MOBIC’s presence in these regions.

Digital and Pharmacovigilance Initiatives

Integration with digital health platforms and real-world data collection can optimize prescribing practices, improve safety monitoring, and strengthen MOBIC’s market resilience.

Sales Projections (2023-2030)

Based on current market dynamics, demographic trends, and competitive forces, the following sales projections are outlined:

- 2023: USD 950 million – The post-pandemic recovery phase sees stable demand, driven by continued chronic disease management and generic availability.

- 2024-2025: USD 1.0 – 1.1 billion – A modest growth trajectory driven by demographic aging and increased focus on safe NSAID use increases prescriptions.

- 2026-2028: USD 1.2 – 1.4 billion – Slight acceleration as emerging markets expand and clinical guidelines endorse selective NSAID use for high-risk patients.

- 2029-2030: USD 1.5 – 1.7 billion – Maturation of market and broader adoption in new geographies, though tempered by biosimilar and generics pressures.

The CAGR over this period is projected at approximately 6%, reflecting steady growth with possible accelerators linked to demographic and regulatory factors.

Market Challenges and Risks

- Safety perceptions: Cardiovascular and gastrointestinal adverse effects may limit use in vulnerable populations.

- Generic competition: Patent expiration has led to erosion of branded sales.

- Regulatory constraints: Stringent prescribing guidelines can restrain volume growth.

- Market saturation: High penetration in established markets may cap upside potential.

Strategic Recommendations

To optimize sales, stakeholders should focus on:

- Emphasizing MOBIC’s safety profile and proven efficacy in targeted marketing.

- Strengthening relationships with physicians emphasizing personalized medicine.

- Expanding into emerging markets with tailored strategies.

- Leveraging digital health tools for enhanced pharmacovigilance.

- Pursuing approval for adjunct indications to diversify revenue streams.

Key Takeaways

- MOBIC remains a leading NSAID with a strong brand presence, supported by demographic aging and rising arthritis prevalence.

- The expanding global NSAID market, coupled with demographic and regulatory factors, indicates sustained, moderate growth for MOBIC.

- Generic competition necessitates focus on differentiating safety and efficacy profiles.

- Future growth hinges on geographic expansion, new clinical applications, and innovative safety monitoring.

- Sales are projected to significantly grow from USD 950 million in 2023 to approximately USD 1.7 billion by 2030, assuming market stability and strategic positioning.

Frequently Asked Questions

1. How does MOBIC compare to other NSAIDs in terms of safety profile?

MOBIC’s selective COX-2 inhibition offers a more favorable gastrointestinal safety profile compared to traditional NSAIDs, with a comparable or reduced cardiovascular risk in selected patient populations, though safety concerns persist and require careful patient selection.

2. What impact has patent expiration had on MOBIC’s sales?

Patent expiry has led to the proliferation of generic meloxicam products, significantly reducing the price point and branded sales but broadening access and sustaining overall volume through affordability.

3. Are there emerging markets with high growth potential for MOBIC?

Yes, regions such as Asia-Pacific and Latin America exhibit increasing NSAID adoption driven by demographic shifts and expanding healthcare infrastructure, making them attractive expansion zones.

4. What are the main factors influencing MOBIC’s sales projections?

Demographic trends, regulatory policies, safety perceptions, competitive dynamics, patent status, and healthcare reimbursement strategies primarily influence sales projections.

5. Could new formulations or indications significantly alter MOBIC’s market outlook?

Potentially, if new formulations enhance compliance or if additional indications gain regulatory approval, these could augment market share and revenue streams, though such developments require substantial clinical validation.

Sources

[1] MarketWatch. NSAID Market Size and Forecast. 2022.

[2] CDC. Osteoarthritis Prevalence Data. 2021.

[3] Arthritis Foundation. Rheumatoid Arthritis Statistics. 2021.

More… ↓