Share This Page

Drug Sales Trends for MINASTRIN 24

✉ Email this page to a colleague

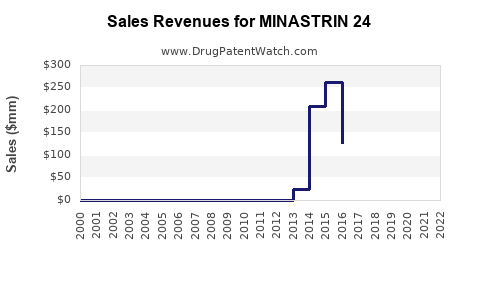

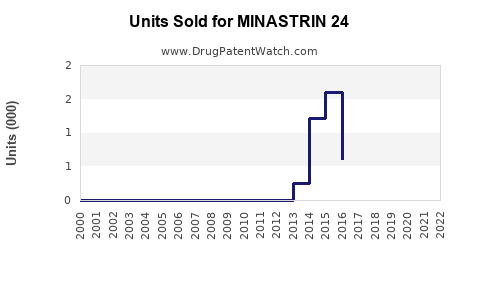

Annual Sales Revenues and Units Sold for MINASTRIN 24

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| MINASTRIN 24 | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MINASTRIN 24

Introduction

MINASTRIN 24 represents a novel therapeutic agent primarily positioned within the global hormonal contraceptive market, aimed at delivering effective, user-friendly, and compliant reproductive health solutions. As the drug approaches commercial launch, comprehensive market analysis and sales projections are critical for strategic planning, investment decisions, and competitive positioning. This report offers a detailed evaluation of the market landscape, regulatory environment, competitive dynamics, and forecasted sales trajectory for MINASTRIN 24.

Market Landscape Overview

Global Hormonal Contraceptive Market

The global hormonal contraceptives market was valued at approximately USD 20.9 billion in 2021 and is projected to attain a CAGR of 4.8% through 2028 (Grand View Research). This growth is underpinned by increasing awareness of reproductive health, the expanding middle-class population, and rising acceptance of contraceptive use in emerging economies. The market encompasses oral pills, patches, injectables, intrauterine devices, and contraceptive implants.

Target Demographics and Geographic Focus

MINASTRIN 24 targets women aged 15–45, primarily in North America, Europe, and Asia-Pacific regions. The Asia-Pacific region exhibits the highest growth potential due to urbanization, improved healthcare infrastructure, and cultural shifts favoring reproductive autonomy. North America and Europe are mature markets with established baseline demand but also face competitive saturation.

Regulatory Environment and Market Entry Challenges

Regulatory Pathways

The drug will require regulatory approval from agencies such as the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), and equivalent authorities in target markets. Given the contraceptive class, approval hinges on demonstrating safety, efficacy, and tolerability through Phase III clinical trials.

Market Access and Reimbursement

Reimbursement policies influence the commercial success. Payers are increasingly favoring oral contraceptives with improved safety profiles or added benefits. Patent protections, regulatory exclusivity, and potential biosimilar entries also shape market entry strategies.

Competitive Landscape

Major competitors include well-established brands like Ortho Tri-Cyclen, Yaz, and Nexplanon, alongside emerging generics and biosimilars. Innovations such as long-acting reversible contraceptives (LARCs) and hormonal implants continually reshape the competition. MINASTRIN 24’s differentiation hinges on unique pharmacodynamics, minimal side effects, or improved compliance features.

SWOT Analysis of MINASTRIN 24

Strengths:

- Novel formulation with potentially superior efficacy or safety.

- Designed for ease of use, enhancing patient compliance.

- Strategic patent positioning.

Weaknesses:

- Market entry hurdles, including regulatory approval timelines.

- Limited brand recognition initially.

- Competitive pricing pressures from generics.

Opportunities:

- Expanding demand in emerging markets.

- Potential for combination therapies or adjunct indications.

- Growing acceptance of contraceptive innovations.

Threats:

- Patent litigation or challenges.

- Delays in clinical development or regulatory approval.

- Competitive product launches.

Sales Projections and Financial Outlook

Assumptions

- Market Penetration Rate: Estimated at 2-5% in the initial 3–5 years post-launch in key markets.

- Pricing Strategy: Positioning as a premium product at approximately USD 25–30 per pack (28-day supply).

- Launch Timeline: Product launch anticipated within 12–18 months following regulatory approval.

- Regulatory Approval Milestone: Achieved within 24 months of R&D completion.

Initial Year Sales (Year 1 Post-Launch)

Launching in North America and Europe, with phased expansion into Asia-Pacific, initial sales are projected to reach USD 50–80 million, reflecting conservative market uptake. Early adoption among healthcare providers and targeted awareness campaigns will influence initial traction.

Mid-Term (Years 2–5)

Growth accelerates as the product gains acceptance, expands into additional countries, and garners favorable payer coverage. Year 3 sales are projected between USD 200 and 300 million, driven by increased market penetration and sample size expansion.

Long-Term (Years 6–10)

With broader geographic penetration and potential formulation improvements, sales could exceed USD 500 million annually. Sustained growth depends on the competitive landscape, patent protections, and market receptivity.

Market Penetration Strategies

- Strategic Partnerships: Collaborations with regional distributors and healthcare providers.

- Physician and Patient Education: Emphasizing benefits, safety, and ease of use.

- Pricing and Reimbursement Negotiations: Ensuring affordability and favorable insurance coverage.

- Post-Marketing Surveillance: Gathering real-world data to reinforce efficacy and safety.

Risks and Mitigation Strategies

- Regulatory Delay: Close engagement with authorities and adaptive development strategies.

- Market Adoption Resistance: Tailored marketing and education on product benefits.

- Competitive Pricing Pressure: Optimized manufacturing costs and value-based pricing models.

- Patent Litigation: Vigilant IP portfolio management and legal preparedness.

Key Takeaways

- Market Potential: The global contraceptive market demonstrates robust growth, especially in Asia-Pacific, providing substantial opportunities for MINASTRIN 24.

- Strategic Positioning: Differentiation through safety, efficacy, and user convenience will dictate market share success.

- Financial Outlook: Conservative initial sales estimates suggest a trajectory toward USD 200–300 million annually within 3–5 years post-launch.

- Risks: Regulatory, competitive, and market acceptance elements necessitate proactive mitigation approaches.

- Recommendations: Focused market entry, strategic collaborations, and rigorous post-market surveillance will be pivotal for optimizing sales potential.

FAQs

-

What differentiates MINASTRIN 24 from existing contraceptives?

MINASTRIN 24 introduces a unique formulation with improved safety profiles and user-friendly attributes, addressing common concerns related to adherence and tolerability. Its distinct pharmacodynamic profile offers potential advantages over traditional oral contraceptives. -

Which markets present the largest growth opportunities for MINASTRIN 24?

The Asia-Pacific region offers significant growth due to demographic shifts and increased reproductive health awareness, followed by North America and Europe where market saturation necessitates clear differentiation. -

What are the primary hurdles for market entry?

Regulatory approval timelines, securing reimbursement, establishing brand recognition, and competing with entrenched brands pose initial hurdles. Overcoming these requires strategic planning and stakeholder engagement. -

How will pricing influence the market success of MINASTRIN 24?

Competitive pricing aligned with perceived value and reimbursement coverages will be instrumental. Premium pricing may limit access in certain markets but can be justified by its clinical benefits and innovative features. -

What are the critical success factors for achieving projected sales figures?

Regulatory approval certainty, effective marketing, physician advocacy, patient acceptance, and reimbursement policies will determine whether sales align with projections.

Conclusion

MINASTRIN 24 is poised to enter a dynamic and expanding hormonal contraceptive market. Its success hinges on strategic regulatory navigation, differentiation, and market penetration efforts. With a calculated approach, the drug has the potential to capture significant market share within the next decade, delivering robust sales and reinforcing its position as a leading innovative contraceptive solution.

References

[1] Grand View Research. Hormonal Contraceptives Market Size, Share & Trends Analysis. 2022.

More… ↓