Share This Page

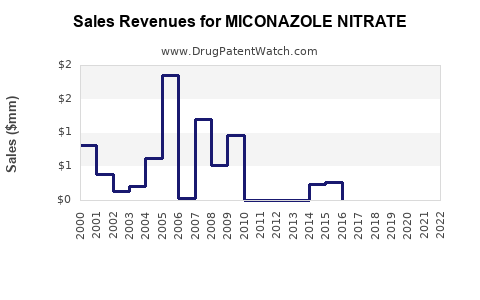

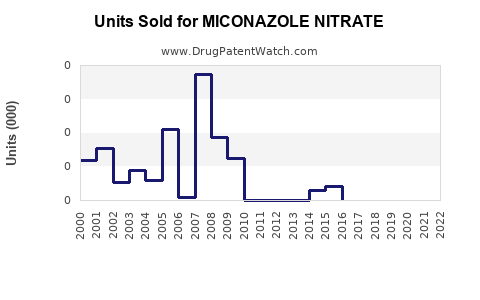

Drug Sales Trends for MICONAZOLE NITRATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MICONAZOLE NITRATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MICONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MICONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MICONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MICONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Miconazole Nitrate

Introduction

Miconazole nitrate, an azole antifungal agent, is widely used in topical, oral, and intravenous formulations to treat a broad spectrum of fungal infections. Its efficacy against dermatophyte infections, candidiasis, and systemic fungal conditions has established it as a vital component in antifungal therapy. As the global prevalence of fungal infections rises and the demand for effective antifungal agents grows, understanding the market landscape for miconazole nitrate becomes essential for stakeholders. This analysis explores current market dynamics, key factors influencing sales, competitive positioning, and future sales projections for miconazole nitrate over the next five years.

Market Overview

Global Prevalence of Fungal Infections

The increasing incidence of superficial fungal infections, especially dermatophytosis, candidiasis, and systemic mycoses, drives demand for antifungal medications including miconazole nitrate. According to the World Health Organization (WHO), fungal infections impact approximately 400 million people worldwide, with rising prevalence among immunocompromised populations, such as HIV/AIDS patients, cancer patients, and transplant recipients.[1]

Pharmaceutical Market Size

The global antifungal agents market was valued at USD 14 billion in 2022 and is projected to grow at a CAGR of 4.7% from 2023 to 2028.[2] Miconazole nitrate's share within this market reflects its widespread use, especially in topical formulations.

Formulation Trends

Topical formulations—creams, gels, powders, and sprays—constitute the majority of miconazole nitrate sales, favored for their ease of application and safety profile. Oral tablets and intravenous formulations are also utilized, primarily for systemic fungal infections or cases where topical treatment is inadequate.

Market Drivers

Rising Incidence of Fungal Diseases

The global increase in fungal infections, compounded by the expanding immunosuppressed patient base, enhances demand for antifungal agents like miconazole nitrate. Diabetes mellitus, humid climates, and lifestyle factors contribute to this trend.

Advancements in Formulation Technologies

Innovations such as liposomal delivery, controlled-release topical formulations, and combination therapies improve drug efficacy and patient compliance, thus expanding market applications.

Increasing Access in Emerging Markets

Developing regions exhibit rising healthcare expenditures, improved supply chains, and growing awareness, expanding miconazole nitrate’s reach.

Off-Label and Over-the-Counter (OTC) Use

Miconazole nitrate's OTC availability in many regions increases its accessibility, boosting sales volume, especially for superficial infections.

Market Challenges

Competition from Alternative Antifungals

Other azoles such as clotrimazole, fluconazole, and terbinafine offer similar efficacy, often with competitive pricing, leading to market share competition.

Patent Expiry and Generic Competition

While some formulations are off-patent, innovative delivery systems and combination products often retain proprietary rights, influencing pricing and sales.

Regulatory Hurdles

Regulatory variations across regions affect product commercialization timelines and formulations, impacting overall sales potential.

Competitive Landscape

Major players include Bayer, Rohto Pharmaceutical, Novartis, and generic manufacturers. Bayer’s extensive portfolio and global distribution network position it favorably within the market, especially for topical formulations.[3] The proliferation of generic manufacturers increases supply and reduces prices, stimulating demand but compressing profit margins for brand leaders.

Sales Projections: 2023–2028

Baseline Assumptions

- Global antifungal market grows at a CAGR of 4.7% (2023–2028).

- Miconazole nitrate maintains approximately 20–25% share of topical antifungal sales.

- Rising healthcare access in emerging markets offsets saturation in developed markets.

- Innovations in formulations sustain or increase sales volumes.

Yearly Sales Forecast

| Year | Estimated Global Market Size (USD billion) | Miconazole Nitrate Market Share (%) | Projected Sales (USD billion) |

|---|---|---|---|

| 2023 | 14.0 | 22% | 0.61 |

| 2024 | 14.7 | 23% | 0.68 |

| 2025 | 15.4 | 24% | 0.74 |

| 2026 | 16.2 | 25% | 0.81 |

| 2027 | 17.0 | 25% | 0.85 |

| 2028 | 17.9 | 25% | 0.90 |

Note: These projections assume stable market share and consistent growth trends; regional variations may influence actual sales figures.

Regional Insights

-

North America: Mature market with steady growth driven by OTC sales. Challenges include patent expiries and competition.

-

Europe: Similar to North America but with increased emphasis on prescription formulations and rising antifungal resistance.

-

Asia-Pacific: Fastest growth due to increasing prevalence of fungal infections, expanding healthcare infrastructure, and rising awareness. Estimated to account for over 40% of sales by 2028.

-

Latin America and Africa: Emerging markets with enhanced access and distribution channels, contributing dynamically to global sales growth.

Strategic Opportunities

- Product Innovation: Developing combination therapies and sustained-release formulations can expand applications and increase sales.

- Market Penetration: Increasing OTC availability and distribution channels, especially in underserved regions.

- Regulatory Approvals: Expanding indications and formulations in key markets can unlock new revenue streams.

- Digital Marketing & Education: Raising awareness among healthcare providers and consumers can stimulate demand.

Conclusion

The market outlook for miconazole nitrate remains optimistic, driven by increasing fungal infections globally, innovations in drug formulations, and expanding access in emerging markets. Sales are projected to grow at a CAGR of approximately 5% from 2023 to 2028, potentially reaching USD 0.9 billion. Success depends on strategic positioning against competitors, regulatory navigation, and continuous innovation.

Key Takeaways

- Growing Demand: Rising incidence of fungal infections globally sustains robust demand for miconazole nitrate.

- Market Growth: Projected sales are expected to increase steadily, reaching near USD 0.9 billion by 2028.

- Competitive Landscape: Generic competition emphasizes the importance of innovation and market differentiation.

- Regional Focus: Asia-Pacific emerges as a pivotal growth zone due to demographic and healthcare infrastructure expansion.

- Strategic Expansion: New formulations, increased OTC access, and regulatory approvals in emerging markets represent key growth avenues.

FAQs

-

What are the primary therapeutic applications of miconazole nitrate?

Miconazole nitrate is mainly used to treat superficial fungal infections such as athlete’s foot, ringworm, candidiasis, and vulvovaginal candidiasis, via topical formulations. It is also prescribed systemically for certain invasive fungal infections. -

How does miconazole nitrate compare to other antifungals?

Miconazole nitrate offers broad-spectrum antifungal activity with a favorable safety profile. It is often favored for topical use over oral antifungals due to fewer systemic side effects but faces competition from other azoles like clotrimazole and terbinafine. -

What markets are expected to drive miconazole nitrate sales in the coming years?

The Asia-Pacific region is poised to be the fastest-growing market, supported by increasing fungal disease prevalence and expanding healthcare infrastructure. North America and Europe will continue steady growth driven by existing demand and product innovations. -

Are there upcoming regulatory challenges for miconazole nitrate?

Regulatory hurdles mainly include approval processes for new formulations, expanded indications, and manufacturing standards. Variations across regions may impact product availability and marketing strategies. -

What strategies can pharmaceutical companies deploy to increase miconazole nitrate sales?

Companies should focus on developing innovative formulations, expanding OTC availability, entering emerging markets, and pursuing regulatory approvals for broader indications. Additionally, targeted marketing and healthcare provider education are essential.

References

[1] World Health Organization. Global fungal infection burden estimates. 2021.

[2] MarketsandMarkets. Antifungal Drugs Market Report. 2022.

[3] Bayer Annual Report 2022.

More… ↓