Last updated: July 27, 2025

Introduction

Micardis, the commercial name for telmisartan, is an angiotensin II receptor blocker (ARB) developed and marketed by Boehringer Ingelheim. Approved primarily for hypertension and cardiovascular risk reduction, Micardis occupies a significant position within the global antihypertensive drug market. This analysis examines current market dynamics, competitive positioning, regulatory landscape, and future sales projections for Micardis, providing strategic insights for stakeholders.

Market Overview

Global Hypertension Treatment Landscape

Hypertension remains a prevalent health issue, affecting over 1.2 billion adults worldwide, with estimates projecting growth due to aging populations and increasing obesity rates [1]. The global antihypertensive market was valued at approximately $20 billion in 2022 and is expected to expand at a CAGR of around 3.8% through 2030 [2]. Within this framework, ARBs constitute a significant market segment, favored for their tolerability and cardiovascular protective benefits.

Positioning of Micardis

Micardis is positioned as a once-daily ARB with additional metabolic benefits, such as improved insulin sensitivity, making it attractive for hypertensive patients with comorbidities like metabolic syndrome or type 2 diabetes. Its patent expiration phase in key markets has facilitated generic entries, impacting its market share.

Competitive Landscape

Major competitors include other ARBs like losartan (Cozaar), valsartan (Diovan), candesartan (Atacand), and newer agents such as azilsartan. Generics now dominate many markets, exerting price pressures on branded formulations.

-

Brand Dynamics: Micardis's brand strength relies on clinical data demonstrating cardiovascular benefits and tolerability. However, the expiration of its main patents in the United States and Europe—anticipated around 2026—poses challenges, paving the way for generic competition.

-

Generic Entrants: The availability of generic telmisartan significantly erodes market share and pricing power. Nonetheless, unique formulations, dosing convenience, or combination products can preserve niche markets.

Key Differentiators

-

Metabolic Benefits: Unlike some ARBs, telmisartan exhibits partial PPAR-γ agonist activity, which may confer additional advantages in metabolic syndrome management.

-

Regulatory Approvals in Special Populations: Expanded indications and ongoing clinical trials could broaden its usage.

Regulatory Environment

The regulatory landscape influences market penetration and future sales. Micardis benefits from approvals in numerous regions, including the US, Europe, and Asia. Post-patent expiration, regulatory agencies may facilitate quicker generic approvals, increasing market competition.

Furthermore, evolving guidelines emphasize the importance of combination therapy and personalized treatment, impacting the drug's deployment.

Market Share and Penetration

In immunized markets like the US, Micardis holds an estimated 10-15% share among ARBs, primarily driven by prescriber familiarity and clinical evidence. Globally, its market share varies, with stronger presence in European countries due to earlier launch dates and favorable prescribing habits.

Sales Data and Revenue Trends

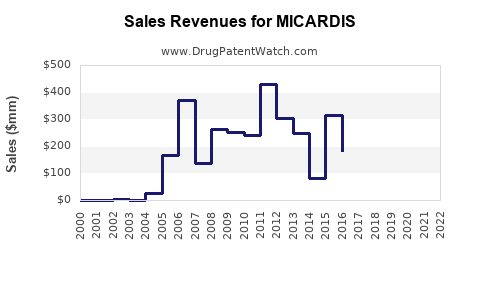

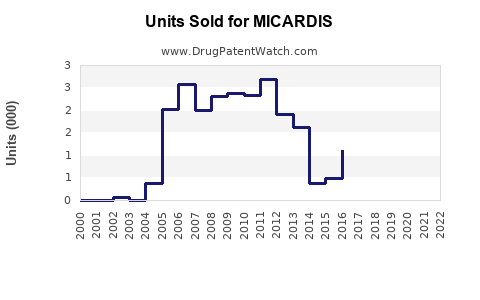

-

Historical Sales: In the fiscal year preceding patent expiry in major markets, Micardis generated revenues exceeding €1 billion annually, reflecting a mature, stable market presence.

-

Impact of Patent Expiry: Post-patent, sales have declined due to generic competition, with estimates indicating reductions of up to 40% in some markets over the past 2 years.

-

Current Revenue Projection: Boehringer Ingelheim reported that Micardis's global sales dipped to approximately €600 million in 2022, signaling an ongoing decline, though strategic marketing and line extensions could stabilize revenues.

Future Sales Projections

Short-term Outlook (Next 3 Years)

Assuming generic penetration continues, sales are expected to stabilize at around €500-€700 million globally, driven by:

- Geographic expansion into emerging markets with rising hypertension prevalence.

- Utilization in combination therapies (e.g., Micardis HCT for hypertension with diuretics).

- Ongoing clinical trial results supporting broader indications.

Medium to Long-term Outlook (3-10 Years)

The key factors influencing long-term sales include:

-

Patent Situations: The expiration of patents in key regions (~2026-2028) will encourage generic competition, potentially reducing revenues by 50-70% unless branded formulations retain loyalty or unique claims.

-

Development of New Formulations: Launch of fixed-dose combinations (FDCs) and innovative delivery systems can sustain market relevance.

-

Emerging Markets: Rising healthcare infrastructure and increased awareness amplify sales opportunities. Countries like China and India could see significant growth.

-

Regulatory and Clinical Developments: Demonstration of additional benefits, such as renal protection in diabetics, could open new indications.

Based on these factors, analysts project that Micardis could generate approximately €200-€400 million annually by 2030, with possibilities for stabilization or slight growth if innovative strategies are employed.

Strategic Recommendations

-

Portfolio Diversification: Developing combination products, especially with diuretics and calcium channel blockers, can help maintain market share.

-

Focus on Niche Markets: Targeting patients with metabolic syndrome leveraging telmisartan's unique properties.

-

Geographical Expansion: Intensify efforts in emerging markets with favorable demographics and growing hypertension prevalence.

-

Pipeline Development: Invest in research exploring new indications, such as heart failure or renal disease, to diversify revenue streams.

Key Takeaways

-

The antihypertensive ARB market is mature, with significant generic penetration impacting Micardis's sales.

-

Patent expiration around 2026 will accelerate generic competition, reducing revenues unless bolstered by formulation innovations or new indications.

-

Micardis's unique metabolic benefits position it advantageously in niche segments, which could mitigate declines.

-

Emerging markets present growth opportunities; strategic expansion in these regions is vital.

-

Developing combination therapies and novel formulations are crucial to sustaining long-term sales.

FAQs

1. How will generic competition impact Micardis sales?

Post-patent expiration, generic telmisartan will enter the market at significantly lower prices, eroding Micardis's market share and reducing revenues. Strategic differentiation through formulations and indications can help mitigate this impact.

2. Are there upcoming indications that could boost Micardis sales?

Yes. Clinical trials exploring telmisartan's role in preventing diabetic nephropathy and heart failure could justify expanded indications, potentially boosting sales.

3. What role does emerging markets play in Micardis's future?

Emerging markets are crucial due to rising hypertension prevalence, expanding healthcare access, and increasing treatment adoption, making them attractive for sales growth.

4. How can Boehringer Ingelheim prolong Micardis's market relevance?

By launching fixed-dose combination therapies, expanding indications, and investing in research, the company can maintain a competitive advantage despite generic competition.

5. What are the main competitive advantages of Micardis over other ARBs?

Its partial PPAR-γ agonist activity offers potential metabolic benefits, positioning it well for patients with metabolic syndrome, which can be leveraged for targeted marketing.

References

[1] World Health Organization. "Global Hypertension Report 2022."

[2] Market Research Future. "Global Antihypertensive Drugs Market Report," 2022.