Last updated: July 28, 2025

Introduction

Metronidazole, a nitroimidazole antibiotic and antiprotozoal agent, is used primarily to treat bacterial infections, protozoal infections, and certain parasitic diseases. Since its initial approval in the 1960s, it has become a staple in antimicrobial therapy, owing to its efficacy, affordability, and broad-spectrum activity. With the expanding landscape of infectious diseases and emerging resistance patterns, an evolving demand for metronidazole persists, prompting a thorough market analysis and sales projection for the coming decade.

Market Overview

Global Market Size & Growth

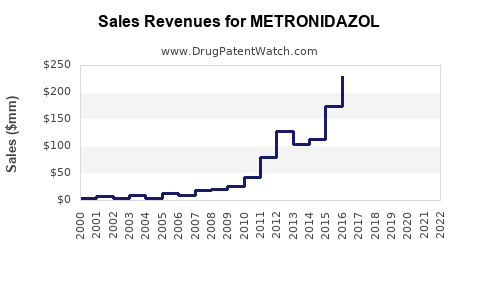

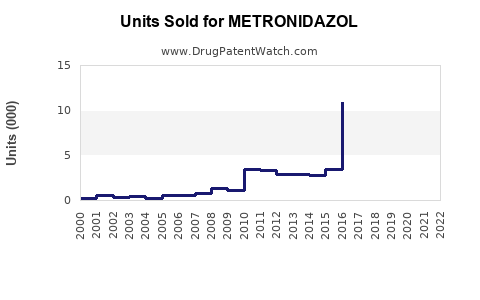

The global metronidazole market was valued at approximately USD 600 million in 2022, with expectations of a compound annual growth rate (CAGR) of about 3.2% through 2030. The steady growth is driven by increasing prevalence of bacterial colon infections, gynecological and digestive system disorders, and the rising adoption of combination therapies involving metronidazole.

Key Regional Markets

-

North America: Dominates the market due to high healthcare expenditure, widespread antibiotic use, and well-established pharmaceutical infrastructure. The U.S. represents a significant share owing to its large patient pool with conditions such as H. pylori infections, bacterial vaginosis, and anaerobic bacterial infections.

-

Europe: Exhibits stable growth driven by aging populations and routine use in gastrointestinal and gynecological infections. Regulatory frameworks in the EU support continued off-patent sales, while local manufacturing sustains competitiveness.

-

Asia-Pacific: The fastest-growing region, with a CAGR exceeding 4%, driven by rising infection rates, increasing healthcare accessibility, and urbanization in countries like India, China, and Southeast Asia.

-

Latin America and Middle East & Africa: Moderate growth fueled by improving healthcare infrastructure and increasing disease burden, albeit constrained by affordability issues.

Market Drivers

-

Prevalence of Infectious Diseases

The persistent global burden of bacterial and parasitic infections such as bacterial vaginosis, Giardia, Entamoeba histolytica, and H. pylori establish a continuous demand for metronidazole.

-

Antibiotic Resistance Patterns

The emergence of resistance among other antibiotics sustains the reliance on established agents like metronidazole, which maintains efficacy in first-line treatments.

-

Rising Awareness & Diagnostic Capabilities

Enhanced diagnostic techniques facilitate targeted therapy, increasing reliance on metronidazole strategic use.

-

Expansion in Combination Therapies

Increased utilization of combination regimens involving metronidazole with other agents diminishes recent shifts away from monotherapy and sustains sales.

-

Regulatory Approvals & Off-Patent Status

Availability of generic formulations lowers costs and broadens accessibility, further driving volume sales.

Market Challenges

-

Antimicrobial Resistance (AMR): Growing resistance reduces clinical efficacy and prompts clinical guideline reassessments.

-

Safety & Side Effect Profile: Gastrointestinal disturbances, metallic taste, and potential neurotoxicity limit long-term or widespread use.

-

Regulatory & Patent Landscape: While off-patent, some formulations may face regulation challenges or market saturation.

-

Alternatives & Novel Agents: Introduction of new antimicrobial classes and targeted therapies may influence traditional usage patterns.

Competitive Landscape

The market comprises a mix of branded offerings and predominantly generic versions. Major pharmaceutical players such as Teva, Mylan (now part of Viatris), and Sandoz dominate the supply chain. The commoditized nature of metronidazole, driven by patent expiration, results in high price sensitivity and fierce price competition.

Emerging biosimilar entries and regional manufacturers intensify the competitive environment, putting downward pressure on prices and margins.Companies investing in formulation improvements, such as extended-release forms, or combination therapies can differentiate their offerings.

Sales Projections (2023-2030)

Accounting for regional growth, regulatory trends, and competitive forces, the following projections are estimated:

| Year |

Estimated Global Sales (USD Million) |

Growth Rate (%) |

| 2023 |

620 |

— |

| 2024 |

645 |

4.0 |

| 2025 |

670 |

3.8 |

| 2026 |

695 |

3.7 |

| 2027 |

725 |

4.3 |

| 2028 |

755 |

4.1 |

| 2029 |

785 |

4.0 |

| 2030 |

820 |

4.2 |

Note: These figures incorporate market expansion trends, factoring in the high growth in emerging regions and anticipated stabilization in mature markets.

Future Opportunities & Strategic Considerations

-

Emerging Applications: Investigate new therapeutic roles in H. pylori eradication, anaerobic infections in surgery, or microbiome modulation.

-

Formulation Innovation: Development of patient-friendly formats (e.g., topical gels, sustained-release tablets) enhances adherence and expands indications.

-

Regional Expansion: Tailored marketing strategies targeting growing markets in Asia and Africa can capitalize on unmet needs.

-

Resistance Management: Investing in surveillance and stewardship programs may prolong the clinical utility of metronidazole.

Conclusion

Metronidazole remains a cornerstone antibiotic with a stable global demand driven by its broad-spectrum activity and low cost. Although faced with challenges from resistance and emerging therapies, its continued role in managing prevalent infections supports steady sales growth going forward. Maximal market penetration in emerging regions, formulation enhancements, and strategic partnerships will be critical to boosting future revenues.

Key Takeaways

- The global metronidazole market is projected to grow at approximately 3.9% CAGR through 2030, reaching over USD 820 million.

- North America and Europe will maintain dominance, but Asia-Pacific is expected to be the fastest-growing region.

- Patent expiration and the availability of generics facilitate widespread access, sustaining high-volume sales.

- Challenges include antimicrobial resistance, safety concerns, and competition from new compounds.

- Opportunities lie in formulation innovation, regional expansion, and exploring new therapeutic indications.

FAQs

1. What are the primary clinical indications for metronidazole?

Metronidazole is predominantly used to treat bacterial vaginosis, anaerobic bacterial infections, protozoal diseases such as amoebiasis and giardiasis, and Helicobacter pylori-associated ulcers.

2. How does antimicrobial resistance affect metronidazole sales?

Emerging resistance may reduce clinical efficacy, leading to decreased use in some indications and necessitating alternative therapies, potentially impacting future sales volumes.

3. Are there ongoing developments to improve metronidazole formulations?

Yes. Efforts focus on extending-release formulations, topical gels, and combination therapies to enhance patient compliance and expand indications.

4. Which regions are expected to experience the highest growth in metronidazole demand?

The Asia-Pacific region is projected to see the fastest growth, driven by rising infection burdens and expanding healthcare infrastructure.

5. How might regulatory changes influence the metronidazole market?

Stringent regulations around antimicrobial use and approval processes could affect manufacturing, marketing, and distribution, either constraining or enabling market expansion depending on implementation.

Sources:

[1] Grand View Research, “Global Metronidazole Market Size & Share Analysis,” 2023.

[2] GlobalData, “Pharmaceutical Market Overview,” 2023.

[3] World Health Organization, “Antimicrobial Resistance Surveillance Report,” 2022.