Last updated: July 30, 2025

Introduction

Metoprolol Tartrate, a selective beta-1 adrenergic receptor blocker, is widely prescribed for managing cardiovascular conditions such as hypertension, angina pectoris, and post-myocardial infarction care. Its established efficacy, favorable safety profile, and generic availability have cemented its role in cardiovascular therapy. This report provides a comprehensive market analysis and sales projection for Metoprolol Tartrate, assessing current trends, competitive landscape, regulatory environment, and future market opportunities.

Market Overview

Global Cardiovascular Disease Market

The global cardiovascular disease (CVD) therapeutics market, valued at approximately USD 40 billion in 2022, is characterized by steady growth driven by increasing prevalence, aging populations, and rising awareness. Within this space, beta-blockers like Metoprolol Tartrate constitute a significant segment owing to their widespread usage in hypertension and ischemic heart disease management.

Market Penetration of Metoprolol Tartrate

Metoprolol Tartrate holds an estimated 15-20% share of the global oral beta-blocker market, which itself accounts for roughly USD 8-10 billion annually. Its popularity stems from its proven efficacy, extensive clinical data, and cost-effectiveness, especially in generic forms.

Key Market Drivers

- Rising Prevalence of Hypertension and CVD: The World Health Organization (WHO) estimates over 1.28 billion adults worldwide living with hypertension, a primary indication for Metoprolol Tartrate.

- Aging Population: Demographic shifts, especially in North America, Europe, and parts of Asia, increase the demand for cardiovascular medications.

- Generic Market Expansion: Patent expirations for branded formulations have enhanced access to affordable generics, boosting sales.

- Guideline Endorsements: Clinical guidelines from AHA, ESC, and other authorities consistently recommend beta-blockers as first-line or second-line therapies.

Competitive Landscape

Key Players

Major pharmaceutical companies involved in the production and marketing of Metoprolol Tartrate include:

- Teva Pharmaceuticals (Generic leadership)

- Mylan (now part of Viatris)

- Pfizer (Branded and generic)

- Novartis (via Sandoz Biosimilars)

- Alkem Laboratories (India)

The intense competition in the generics segment results in aggressive pricing and wide availability, constraining profit margins but expanding market penetration.

Regulatory Environment

The drug is off-patent globally, facilitating widespread generics manufacturing. Regulatory agencies like the FDA (U.S.) and EMA (Europe) maintain streamlined approval pathways for generics, further amplifying market access. However, regional variations in prescription preferences and formulary listings influence sales dynamics.

Regional Market Analysis

North America

North America remains the largest market, driven by high cardiovascular disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. The U.S. accounts for approximately 40-45% of global sales.

Europe

Europe exhibits stable growth, with mature markets and high generic penetration. Countries like Germany and the UK show strong continuous demand.

Asia-Pacific

APAC presents significant growth potential due to population size, rising urbanization, and increasing healthcare expenditure. India and China are key markets, with burgeoning manufacturing capacities.

Latin America and Middle East

Emerging markets with consistent growth owing to expanding healthcare delivery systems and government initiatives promoting access to affordable medicines.

Sales Projections

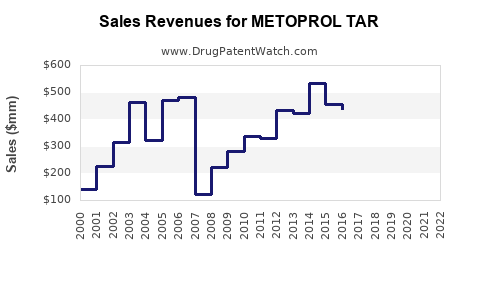

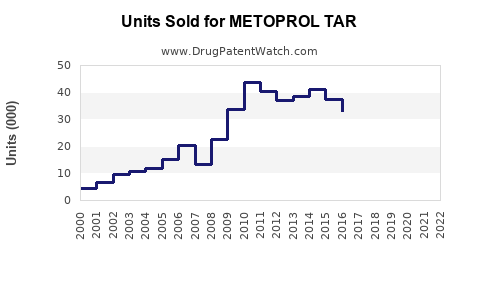

Historical Sales Data

From 2018 to 2022, global sales of Metoprolol Tartrate have shown a compounded annual growth rate (CAGR) of approximately 4-6%, reflecting steady demand.

Projected Sales (2023–2028)

Based on market trends, demographic factors, and industry data, the following projections are made:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

$1.8 |

5% |

| 2024 |

$1.9 |

5.5% |

| 2025 |

$2.0 |

5% |

| 2026 |

$2.1 |

4.5% |

| 2027 |

$2.2 |

4.5% |

| 2028 |

$2.3 |

4.5% |

These projections consider increased adoption in underserved regions, ongoing patent expirations, and competitive pricing.

Influencing Factors

- Generic Market Growth: Continued expansion of low-cost generics will sustain volume growth.

- New Therapeutic Indications: Emerging evidence may expand indications or combination therapies involving Metoprolol.

- Regulatory Changes: Potential patent litigations or regulatory shifts could temporarily disrupt supply or affect pricing.

Market Challenges

- Competition from Other Beta-Blockers: Drugs like Atenolol, Bisoprolol, and Carvedilol offer alternative options, influencing regional preferences.

- Adverse Event Concerns: Safety concerns or contraindications may reduce usage in certain populations.

- Reimbursement Limitations: In some markets, reimbursement policies favor newer or branded therapies.

Opportunities

- Expansion in Developing Markets: Increasing healthcare access opens avenues for growth.

- Combination Therapies: Developing fixed-dose combinations may improve adherence and expand use.

- Regulatory Approvals for New Indications: Broader indications could boost sales.

Conclusion

Metoprolol Tartrate remains a cornerstone in cardiovascular therapeutics with a stable and expanding market. The generic segment's dominance ensures ongoing accessible pricing, fostering volume growth. Market growth will primarily be driven by demographic trends, the expansion of healthcare infrastructure in emerging economies, and the sustained prevalence of CVDs. Companies involved in manufacturing and marketing Metoprolol Tartrate should focus on regional customization, regulatory navigation, and innovation in formulations to sustain competitive advantage.

Key Takeaways

- The global market for Metoprolol Tartrate is projected to grow at approximately 4.5–5% annually through 2028.

- North America leads the market, with Asia-Pacific offering the highest growth potential due to demographic trends.

- Generic proliferation ensures affordability and broadening access, maintaining steady demand.

- The competitive landscape is highly concentrated among generic manufacturers, necessitating strategic pricing and supply chain robustness.

- Opportunities lie in expanding indications, developing combination therapies, and penetrating emerging markets with tailored strategies.

FAQs

1. Will the patent expiration of branded Metoprolol products significantly impact sales?

Yes. Patent expirations facilitate the entry of generics, increasing competition but also expanding accessible market volume, which sustains overall sales growth despite price pressures.

2. How do regional healthcare policies influence Metoprolol Tartrate sales?

Reimbursement policies, formulary inclusions, and healthcare infrastructure vary by region, affecting prescribing patterns and accessibility, thereby directly impacting sales volumes.

3. Are there emerging therapeutic alternatives threatening Metoprolol’s market share?

While newer beta-1 selective agents and combination therapies exist, Metoprolol's established efficacy and cost-effectiveness maintain its relevance, especially in the generic form.

4. What role do regulatory agencies play in shaping the market?

Regulatory agencies streamline approvals for generics, facilitate market entry, and ensure quality standards. Policy changes, such as incentivizing biosimilars or generics, further expand market opportunities.

5. How can stakeholders capitalize on emerging markets for future growth?

Investing in localized marketing, navigating regulatory landscapes effectively, and understanding regional treatment guidelines can help stakeholders expand market share in developing regions.

Sources:

[1] World Health Organization. "Global Burden of Cardiovascular Diseases." 2022.

[2] IQVIA. "Global Cardiovascular Market Data," 2022.

[3] PharmaMarketWatch. "Beta-Blocker Market Trends," 2022.

[4] US Food and Drug Administration (FDA). "Generic Drug Approval Process," 2022.

[5] European Medicines Agency (EMA). "Market Authorization of Generic Medicines," 2022.