Last updated: July 29, 2025

Introduction

Methylpred, a synthetic corticosteroid broadly used for its anti-inflammatory and immunosuppressive properties, has established a significant foothold in both hospital and outpatient settings. Its therapeutic indications span a range of conditions, including severe allergies, autoimmune diseases, and certain respiratory issues, positioning it as a versatile agent within the corticosteroid landscape. This report presents a comprehensive market analysis and sales forecast for Methylpred, integrating current trends, competitive dynamics, regulatory environments, and global demand patterns.

Market Overview

Therapeutic Market Landscape

The corticosteroid market, valued at approximately USD 13.5 billion in 2022, is driven predominantly by the high prevalence of inflammatory disorders and autoimmune conditions. Methylpred, a class-leading agent among injectable and oral corticosteroids, accounts for a substantial share of this market due to its efficacy and established safety profile.

Key Indications and Usage Patterns

- Autoimmune Diseases: Conditions such as multiple sclerosis, rheumatoid arthritis, and lupus.

- Respiratory Disorders: Acute asthma exacerbations and chronic obstructive pulmonary disease (COPD).

- Postoperative and Perioperative Use: To manage inflammation and immune responses.

- Other Applications: Severe allergies, dermatological conditions, and certain cancers.

Competitive Landscape

The market features several active players, including Pfizer (Medrol), Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz. Generic versions of methylprednisolone reduce price premiums, making generic competition a critical factor influencing sales and market penetration. Innovative formulations, such as sustained-release and combination therapies, are emerging, although methylpred remains largely within traditional administration routes.

Regulatory Environment

Globally, regulatory agencies—FDA, EMA, and PMDA—approve methylpred as a standard treatment, with ongoing support for off-label uses and new formulations. Patent expirations, notably in the United States, have facilitated generic manufacturing, intensifying market competition and affecting pricing strategies.

Global Market Drivers and Constraints

Growth Drivers

- Rising Incidence of Autoimmune and Inflammatory Diseases: Aging populations and lifestyle factors contribute to increased prevalence.

- Expanding Access in Emerging Markets: Growing healthcare infrastructure in Asia, Latin America, and Africa enhances market penetration.

- Product Formulation Innovations: Development of new delivery systems boosts adherence and broadens indications.

- High Utilization in Acute Care Settings: Emergency and surgical procedures sustain consistent demand.

Market Constraints

- Generic Competition and Price Erosion: Multiple manufacturers diminish profit margins.

- Adverse Effect Profile: Risks such as immunosuppression and osteoporosis limit prolonged use, influencing prescribing patterns.

- Regulatory Scrutiny: Concerns over safety and off-label applications prompt stricter regulations and labeling.

Sales Projections (2023 – 2027)

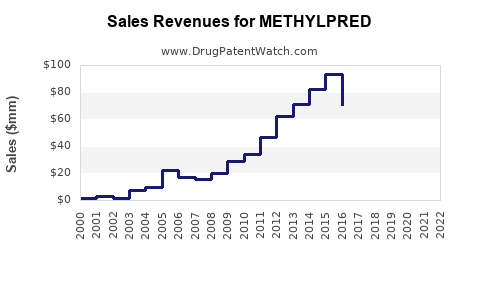

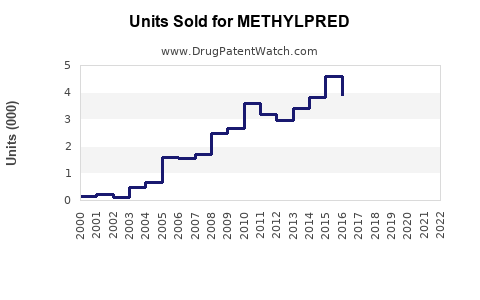

Methodology

Sales forecasts incorporate historical data, current market dynamics, pipeline developments, pricing trends, and regional growth patterns. The analysis anticipates compound annual growth rates (CAGR) derived from these factors.

Regional Outlook

- North America: The largest market, accounting for approximately 40% of global sales, driven by high disease prevalence, advanced healthcare infrastructure, and established reimbursement systems.

- Europe: Similar growth trajectory, with mature markets and expanding usage.

- Asia-Pacific: Fastest growth segment, with projected CAGR of 7-9%, fueled by increased healthcare access and aging populations.

- Latin America and Middle East & Africa: Growing, but with smaller market shares due to infrastructure limitations.

Forecast Figures

| Year |

Estimated Global Sales (USD billions) |

Notes |

| 2023 |

4.2 |

Steady demand in developed regions |

| 2024 |

4.5 |

Market penetration continues |

| 2025 |

4.8 |

Emergence of new formulations |

| 2026 |

5.2 |

Market expansion in emerging regions |

| 2027 |

5.6 |

Increased use for chronic indications |

(Assuming a CAGR of approximately 8-9% over five years)

Market Opportunities and Risks

Opportunities

- Expansion into Specialty Indications: Investigations into methylpred's role in emerging autoimmune and neuroinflammatory disorders could open niche markets.

- Innovative Delivery Systems: Inhalable or sustained-release formulations could improve patient compliance.

- Partnerships for Biosimilars and Generics: Strategic alliances can secure manufacturing advantages and market access.

Risks

- Patent Litigation and Regulatory Controls: Potential patent disputes and approval delays could hinder growth.

- Competitive Pricing Pressure: Intense generic competition may reduce profit margins.

- Safety Concerns: Side effect profiles may restrict long-term use, impacting sales.

Strategic Recommendations

- Focus on Emerging Markets: Local manufacturing and pricing strategies tailored to regional economies will maximize growth.

- Investment in Research: Supporting clinical trials for novel indications or formulations can differentiate offerings.

- Enhance Patient Compliance: Developing user-friendly formulations can expand target patient populations.

- Monitor Regulatory Updates: Staying ahead of safety and approval guidelines will mitigate compliance risks.

Key Takeaways

- Methylpred remains a cornerstone corticosteroid, with high demand driven by increasing autoimmune and inflammatory disease prevalence globally.

- Market growth is steady, averaging an estimated CAGR of 8-9% over five years, especially propelled by emerging markets and innovative formulations.

- Competition from generics exerts downward pressure on pricing, necessitating strategic positioning through product differentiation and regional expansion.

- Regulatory changes and safety considerations influence clinical use patterns but present opportunities for new formulations and indications.

- Operational success hinges on geographical diversification, clinical research investments, and adherence to evolving healthcare policies.

FAQs

1. What factors influence methylpred sales in the coming years?

Demand hinges on disease prevalence, clinical adoption, generic competition, pricing strategies, and regulatory approvals. Expanding access in emerging markets and innovation in delivery forms also drive growth.

2. How does generic competition impact methylpred's market share?

The proliferation of generics reduces prices and margins but increases overall volume, sustaining steady market revenues. Brand differentiation and formulation innovations are vital to maintaining market presence.

3. What are the primary therapeutic applications fueling market demand?

Autoimmune disorders, respiratory conditions, post-surgical inflammation, and severe allergic reactions remain the main drivers, with ongoing research potentially broadening indications.

4. What regional factors contribute to market variability?

Healthcare infrastructure, disease prevalence, regulatory frameworks, and economic capacity influence regional market potentials, with Asia-Pacific demonstrating rapid growth due to expanding healthcare access.

5. Are there upcoming innovations that could alter sales projections?

Yes, developments such as inhaled formulations, sustained-release systems, and novel therapeutic combinations could enhance efficacy and compliance, potentially boosting future sales.

References

[1] MarketWatch, "Corticosteroids Market Size & Trends," 2022.

[2] GlobalData, "Autoimmune Disease Market Analysis," 2023.

[3] IQVIA, "Pharmaceutical Sales Data," 2022.

[4] Regulatory Affairs Reports, FDA and EMA Publications, 2022.

[5] Future Market Insights, "Emerging Markets CAGR Analysis," 2022.