Last updated: July 29, 2025

Introduction

Metformin Extended Release (ER) stands as a pivotal medication in managing type 2 diabetes mellitus (T2DM), renowned for its efficacy, safety profile, and affordability. As the global diabetes burden escalates—projected to affect over 700 million people by 2045—metformin’s role remains central, especially within the oral antidiabetic market. This report provides a detailed market analysis and sales forecast for Metformin ER, encompassing industry trends, competitive landscape, regulatory factors, and growth drivers.

Market Overview

Global Diabetes Landscape

The global diabetic population is experiencing unprecedented growth. According to the International Diabetes Federation, approximately 537 million adults live with diabetes as of 2021[1], with T2DM accounting for 90-95% of cases. The rising prevalence is driven by urbanization, sedentary lifestyles, and obesity.

Role of Metformin ER in Therapy

Metformin ER is designed for once-daily dosing, improving patient adherence over immediate-release formulations. It reduces gastrointestinal side effects and enhances tolerability. As a first-line therapy, metformin, including ER formulations, forms the backbone of T2DM management.

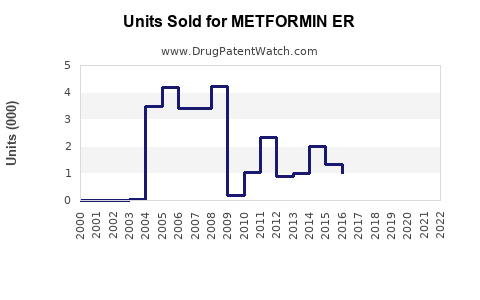

Market Penetration & Adoption

With the increasing emphasis on patient compliance, ER formulations have witnessed higher adoption rates, especially among newly diagnosed patients. Additionally, label expansions and off-label use for metabolic syndrome increase market scope.

Market Dynamics

Key Drivers

- Growing Diabetes Prevalence: The expanding diabetic population directly elevates demand for metformin ER.

- Patient Compliance: ER formulations improve adherence due to convenience and tolerability.

- Cost-Effectiveness: Low cost and broad availability position metformin as a first-line agent globally, especially in developing nations.

- Guideline Endorsement: Leading organizations such as ADA/EASD recommend metformin as initial therapy, bolstering its usage.

Challenges and Constraints

- Generic Competition: Multiple manufacturers offer generic metformin ER, compressing margins.

- Regulatory Hurdles: Patent expirations expedite generic entry but may also lead to market saturation.

- Alternative Therapies: SGLT2 inhibitors, GLP-1 receptor agonists, and other new agents pose competition for advanced or refractory cases.

Regulatory Environment

Regulatory agencies globally, including FDA and EMA, have approved various formulations of metformin ER. Patents for specific ER formulations have mostly expired, enabling generics market entry. Future regulatory hurdles may emerge around formulations that address specific safety or efficacy claims.

Competitive Landscape

Major players include:

- Mitsubishi Tanabe Pharma (Fortamet)

- Mylan/Biocon (Generic formulations)

- Teva Pharmaceuticals

- AbbVie (known for formulation innovations)

- Hikma Pharmaceuticals

The market is highly fragmented with dominant generics landscape and minimal brand loyalty, making price competitiveness crucial.

Market Trends

- Shift towards Fixed-Dose Combinations: Combining metformin ER with other antidiabetics enhances adherence.

- Emerging Markets Growth: Substantial growth driven by increasing healthcare access and diabetes prevalence.

- Digital Health Adoption: Telemonitoring and adherence apps promote ER formulations’ benefits.

- Innovations in Formulation: Efforts to improve pharmacokinetics and reduce side effects continue.

Sales Projections for Metformin ER

Assumption Framework

- Global CAGR: Estimated between 4.5%–6% over 2023–2030, driven by increasing diabetic populations.

- Market share: Metformin ER maintains approximately 60-70% share among metformin formulations.

- Pricing trends: Slight decline anticipated due to generic competition, with average price erosion around 2-3% annually.

- Geographic factors: Developed markets (US, Europe) exhibit slower growth but higher pricing; emerging markets (Asia, Africa) display rapid volume expansion.

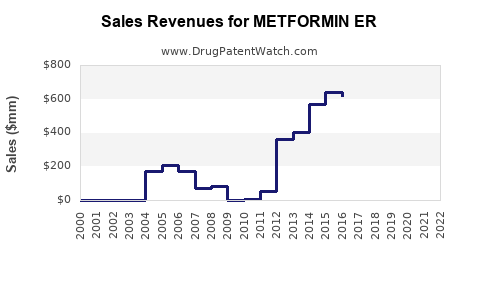

Projected Market Size

In 2022, the global metformin ER market is valued at approximately USD 2.5 billion[2].

By 2030, with the growth assumptions:

- Global Market Value: Projected to reach USD 4.5–5 billion.

- Annual Sales Volume: Anticipated to grow at ~5% CAGR, ending around 2029–2030 at ~USD 5 billion+.

Forecast Breakdown

| Year |

Estimated Market Size (USD Billion) |

Growth Rate |

Notes |

| 2023 |

2.7 |

8% |

Post-pandemic recovery influences sales |

| 2025 |

3.4 |

10% |

Increased adoption in developing nations |

| 2027 |

4.0 |

9% |

Regulatory clarity and formulary updates |

| 2030 |

5.0 |

6-7% |

Market saturation and generics impact |

Key Factors Shaping Sales

- Market expansion in Asia and Africa

- Increased use in prediabetes and metabolic syndrome

- Regulatory incentives promoting generic substitution

- Innovative ER formulations with improved profiles

Strategic Considerations for Stakeholders

- Brand Differentiation: Focus on formulation improvements—better absorption, fewer side effects.

- Pricing Strategy: Competitive pricing in emerging markets coupled with value-added services.

- Regulatory Navigation: Anticipate patent expirations and expedite generic submissions.

- Partnership Development: Collaborate with local manufacturers and distributors.

- Digital Engagement: Leverage telemedicine and adherence tools to expand reach and improve compliance.

Conclusion

Metformin ER occupies a robust position in the global antidiabetic market, supported by epidemiological trends and guideline endorsements. Future sales growth is driven by growing diabetes prevalence, increasing adoption in emerging markets, and ongoing innovations. Despite intense generic competition, strategic product positioning and geographic expansion can sustain revenue streams.

Key Takeaways

- The global market for metformin ER is projected to grow at a CAGR of approximately 5–6% through 2030, reaching USD 5 billion.

- Dominant growth factors include rising diabetes rates, improved patient compliance, and expanding access in emerging markets.

- Intense generic competition necessitates strategic differentiation via formulation innovation and regional licensing.

- Market growth is likely to be tempered by patent expirations, pricing pressures, and the advent of newer therapeutic classes.

- Stakeholders should prioritize regulatory agility, strategic partnerships, and digital health integration to capitalize on market opportunities.

FAQs

Q1: How does the patent expiry impact the sales of metformin ER?

A: Patent expirations typically lead to increased generic manufacturing and lower prices, which can reduce revenue for brand-name versions but expand overall market volume.

Q2: Which regions are expected to see the fastest growth for metformin ER?

A: Emerging markets in Asia, Africa, and Latin America will experience the fastest sales volume growth due to increasing diabetes prevalence and expanding healthcare access.

Q3: To what extent does competition from newer antidiabetic drugs affect metformin ER sales?

A: While newer agents like SGLT2 inhibitors and GLP-1 receptor agonists offer benefits for advanced disease, metformin remains the first-line therapy for most T2DM cases, thus maintaining its core role.

Q4: Are there any recent formulation innovations expected to influence market dynamics?

A: Yes, innovations aimed at reducing gastrointestinal side effects, improving absorption, and combining metformin with other agents can differentiate products and sustain sales.

Q5: How can companies optimize sales projections amid regulatory uncertainties?

A: Continuous monitoring of patent statuses, proactive regulatory submissions, and strategic licensing are essential to mitigate risks and capitalize on market opportunities.

Sources

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 10th Edition.

[2] Market Research Future. (2022). Global Metformin Market Analysis.