Last updated: July 28, 2025

Introduction

Metformin, a cornerstone in the management of type 2 diabetes mellitus (T2DM), has maintained a dominant position within the pharmaceutical landscape for decades. Recognized for its efficacy, safety profile, and affordability, metformin remains the first-line treatment globally—that is, unless contraindicated—making it a critical asset for pharmaceutical companies. This report offers an in-depth market analysis and sales forecast for metformin, emphasizing current dynamics, growth drivers, competitive landscape, and future trends influencing its market trajectory.

Market Overview

Historical Context and Current Status

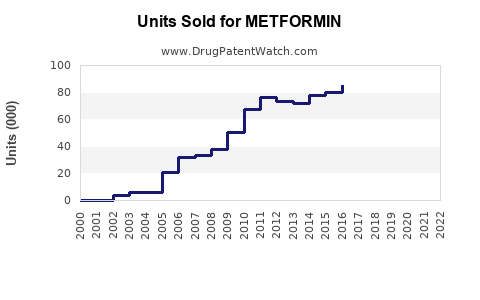

Metformin, developed in the 1950s and widely introduced in the 1990s, is an oral biguanide. As per recent data, it remains the most prescribed antidiabetic medication globally, with over 150 million prescriptions annually [1]. Its global market share accounts for approximately 70-75% of all prescribed oral hypoglycemics for T2DM, underpinned by its proven efficacy, safety, and cost-effectiveness.

Global Market Size

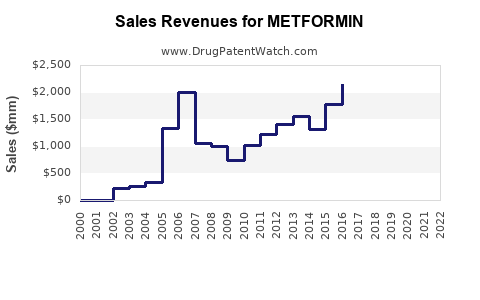

The global metformin market was valued at approximately USD 3.8 billion in 2022 [2], with projections estimating it to reach USD 5.2 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of close to 4.0% over the forecast period (2023-2030).

Key Market Regions

- North America: Largest market, driven by high T2DM prevalence, high healthcare expenditure, and favorable reimbursement policies. The U.S. accounts for nearly 50% of global sales.

- Europe: Significant market size with stable growth; driven by aging populations and early adoption of guidelines endorsing metformin.

- Asia-Pacific: Fastest-growing market segment, propelled by escalating diabetes prevalence, urbanization, and improving healthcare infrastructure. China and India are key contributors.

- Rest of the World: Emerging markets show increasing adoption due to generic availability and rising awareness.

Market Dynamics

Drivers

- High Prevalence of Type 2 Diabetes: The International Diabetes Federation estimates 537 million adults living with diabetes globally in 2021, forecasted to reach 700 million by 2045 [3]. This rising prevalence directly correlates with increasing demand for metformin.

- Guideline Endorsements: Main international guidelines (ADA, EASD) recommend metformin as first-line therapy, ensuring sustained demand.

- Cost-Effectiveness and Accessibility: Generic formulations have kept prices low, facilitating widespread use in low- and middle-income countries.

- Expanded Uses: Emerging research explores off-label benefits, including polycystic ovary syndrome (PCOS), obesity, and longevity, potentially broadening its application.

Challenges

- Safety Concerns: Rare but serious adverse effects like lactic acidosis, especially in renal impairment, influence physician prescribing behavior.

- Market Saturation in Mature Markets: High penetration limits growth potential in developed regions.

- Competition from Newer Agents: The advent of SGLT2 inhibitors and GLP-1 receptor agonists offers alternatives with additional cardiovascular benefits, challenging metformin’s dominance in certain patient populations.

- Regulatory Constraints: Patent expirations and generic proliferation may limit innovation-driven revenue streams.

Competitive Landscape

The market features numerous generic manufacturers, with prominent proprietary players including Eli Lilly, Boehringer Ingelheim, and Mitsubishi Tanabe Pharma (metformin formulations with extended-release variants). Major generic producers include Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical Industries.

Regulatory pathways focused on dosed formulations, combination therapies, and extended-release products are vital considerations for market players seeking to expand their portfolios.

Future Trends and Opportunities

- Combination Formulations: Increasing demand for fixed-dose combinations with other antidiabetics, improving adherence and outcomes.

- Development of Extended-Release Formulations: Enhanced formulations aim for improved gastrointestinal tolerability and patient compliance.

- Digital Health Integration: Integration with digital health tools for better disease management could enhance metformin's utilization.

- Innovation in Indications: Continued clinical trials exploring metabolic and age-related indications could open new revenue streams.

Sales Projections (2023-2030)

Factors Affecting Projections

- Prevalence Trends: Rising T2DM rates will underpin demand.

- Market Penetration: Saturation in mature markets may limit growth, but emerging markets provide substantial growth opportunities.

- Pricing Dynamics: Cost pressures and generic competition will persist, influencing pricing strategies.

- Regulatory and Reimbursement Policies: Variations across countries impact prescribing and sales volumes.

Forecast Summary

| Year |

Estimated Market Size (USD Billions) |

Growth Rate (CAGR) |

| 2023 |

4.2 |

- |

| 2024 |

4.4 |

4.8% |

| 2025 |

4.6 |

4.5% |

| 2026 |

4.8 |

4.3% |

| 2027 |

5.0 |

4.2% |

| 2028 |

5.2 |

4.0% |

| 2029 |

5.3 |

2.8% |

| 2030 |

5.4 |

2.8% |

Market growth decelerates after 2028 due to market saturation in key regions. However, significant growth in Asia-Pacific and off-label applications could sustain upward momentum.

Key Drivers for Sustained Growth

- Rapid urbanization and lifestyle changes in emerging economies.

- Population aging, increasing the number of patients eligible for metformin therapy.

- Expanding indications supported by ongoing clinical research.

Conclusion

The global metformin market remains resilient, driven by the escalating prevalence of T2DM and endorsement as a first-line agent worldwide. While mature markets face saturation, significant opportunities exist in emerging regions and through formulation innovations. Competitors should focus on strategic investments in combination therapies, novel formulations, and expanding indications to maintain growth momentum.

Key Takeaways

- Dominant Position: Metformin remains the primary medication for T2DM, supporting steady sales growth.

- Growth Potential: Emerging markets and new formulations sustain future expansion, especially preempting market saturation.

- Competition: Generic proliferation limits revenue in mature markets; innovation and formulation development are crucial.

- Strategic Focus: Expanding indications, combination medications, and digital health integration can unlock additional revenue streams.

- Regulatory Considerations: Variations in regional policies require tailored market strategies to optimize sales.

FAQs

-

What factors influence the global sales of metformin?

The main drivers are rising T2DM prevalence, clinical guideline endorsements, generic availability, and demand in emerging markets. Challenges include market saturation in developed regions, competition from newer drugs, and safety concerns.

-

How does patent expiration affect metformin sales?

Patent expiry enables generic manufacturers to produce cheaper formulations, increasing access but reducing brand-name sales margins. This drives overall market volume but pressures pricing structures.

-

Are there new indications for metformin beyond diabetes?

Yes. Research explores its off-label use in polycystic ovary syndrome (PCOS), obesity, anti-aging, and cardiovascular risk management, potentially broadening the market.

-

What are the prospects for extended-release formulations?

Extended-release formulations improve gastrointestinal tolerability and adherence, representing a growth segment influenced by patient preferences and clinician demand.

-

How do regional differences impact metformin’s market?

Developed markets exhibit high saturation but stable demand, while emerging markets experience rapid growth due to increasing disease prevalence and improving healthcare infrastructure.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th Edition.

[2] MarketWatch. (2023). Global Metformin Market Size, Share & Industry Analysis.

[3] International Diabetes Federation. (2021). Diabetes Facts & Figures.