Share This Page

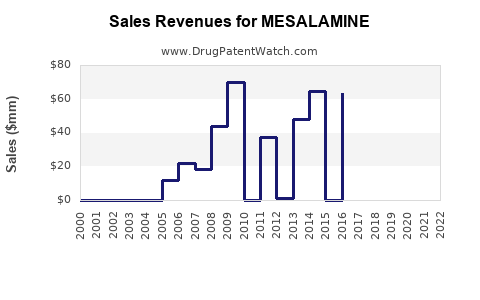

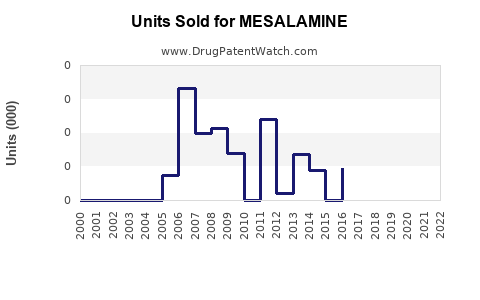

Drug Sales Trends for MESALAMINE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MESALAMINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| MESALAMINE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Mesalamine

Introduction

Mesalamine, also known as 5-aminosalicylic acid (5-ASA), remains a cornerstone in the therapeutic management of inflammatory bowel diseases (IBD), notably ulcerative colitis (UC) and Crohn's disease (CD). Its profile as a first-line anti-inflammatory agent, cost-effectiveness, and well-established safety profile have sustained its demand globally. This market analysis delineates current market dynamics, growth drivers, competitive landscape, and forecasts sales trajectories for mesalamine over the next five years.

Market Overview

The global mesalamine market was valued at approximately USD 1.2 billion in 2022. It primarily serves North America, Europe, and Asia-Pacific regions, with North America accounting for nearly 45% of the market share owing to higher prevalence of IBD, advanced healthcare infrastructure, and strong clinical adoption. The expanding prevalence of IBD, coupled with increasing diagnosis rates, has stimulated demand for mesalamine formulations, including oral and enema forms.

Market Drivers

-

Rising Prevalence of IBD

The global incidence of IBD has escalated significantly. The CDC reports an estimated 1.6 million Americans with IBD, with prevalence rising annually (CDC, 2022). Similar trends are observed in Europe and Asia-Pacific, driven by lifestyle changes and urbanization. The World Gastroenterology Organisation attributes the global rise to environmental factors and improved detection methods.

-

Established Efficacy and Safety Profile

Mesalamine's long-standing clinical utility, with minimal systemic absorption and adverse effects, sustains physician confidence. Its role in maintenance therapy reduces flare-ups and hospitalization, contributing to consistent demand.

-

Expansion of Formulations

Innovations in drug delivery, including delayed-release tablets, suppositories, and enemas, allow personalized treatment regimens, expanding market penetration across patient demographics.

-

Growing Awareness and Screening

Increased awareness campaigns and screening programs facilitate early diagnosis, subsequently increasing prescription rates of mesalamine.

-

Pipeline and Combination Therapies

While newer biologics and immunomodulators are emerging, mesalamine remains first-line due to affordability and safety, especially in mild to moderate cases (Mayo Clinic, 2022).

Competitive Landscape

Major pharmaceutical players dominate the mesalamine market:

- AbbVie (Apriso, Lialda)

- Ferring Pharmaceuticals (Asacol HD)

- Takeda Pharmaceuticals (Delzicol)

- Sun Pharmaceutical Industries (Mesalamine brands)

- Mylan (now part of Viatris)

These companies focus on optimizing formulations, improving bioavailability, and expanding regional access. Patent expirations or generic entries post-2020 have intensified price competition, further shaping the market.

Market Challenges

-

Generic Price Erosion

Increased generic availability has led to significant price reductions, constraining profit margins for branded formulations.

-

Competition from Biologics

Growing use of biologics in moderate to severe IBD cases could indirectly influence mesalamine sales, particularly if new data supports broader usage.

-

Regulatory Approvals

Stringent regulations and differing regional approval pathways may delay new formulations and limit market expansion in some territories.

Sales Projections (2023-2028)

Using a compound annual growth rate (CAGR) estimate of approximately 4.5%, driven by rising prevalence and improved access, the market is projected to grow from USD 1.2 billion in 2022 to approximately USD 1.75 billion by 2028.

| Year | Estimated Market Size | CAGR | Remarks |

|---|---|---|---|

| 2023 | USD 1.25 billion | 4.2% | Post-pandemic healthcare normalization |

| 2024 | USD 1.31 billion | 4.5% | Increased diagnosis, wider formulary use |

| 2025 | USD 1.38 billion | 4.5% | Product innovations bolster sales |

| 2026 | USD 1.45 billion | 4.4% | Patent expiries lead to generic competition |

| 2027 | USD 1.62 billion | 4.7% | Market expansion in Asia-Pacific |

| 2028 | USD 1.75 billion | 4.5% | Continued growth driven by prevalence |

Regional Outlook

- North America: Continues to lead with high prevalence rates, early adoption, and advanced healthcare systems.

- Europe: Steady growth due to increasing IBD prevalence and improved healthcare access.

- Asia-Pacific: Faces fastest growth potential (CAGR ~6%), driven by rising IBD cases, increasing healthcare spending, and expanding pharmaceutical infrastructure.

- Rest of World: Growing markets, though constrained by regulatory and economic factors.

Strategic Opportunities

-

Generic and Biosimilar Development

Accelerating entries into markets post-patent expiry can capture price-sensitive segments. Biosimilars, although less relevant for mesalamine due to its small-molecule nature, could reshape competition if formulations evolve.

-

Formulation Innovations

Developing targeted delivery systems or combination therapies to improve efficacy and adherence presents growth avenues.

-

Emerging Markets Penetration

Focused expansion into Brazil, India, China, and Southeast Asia will capitalize on rising disease prevalence and increasing healthcare infrastructure.

Conclusion

Mesalamine’s market remains robust, buoyed by rising IBD prevalence and ongoing clinical reliance. While generics pose pricing pressures, demand for newer formulations and regional growth, particularly in Asia-Pacific, are expected to drive steady sales growth. Industry stakeholders must adapt to escalating competition, patent expirations, and evolving clinical paradigms by innovating and expanding geographic presence.

Key Takeaways

- Steady Growth Anticipated: The mesalamine market is poised to grow at approximately 4.5% CAGR through 2028, reaching USD 1.75 billion.

- Regional Expansion Opportunities: Asia-Pacific presents significant upside, driven by increasing disease incidence and healthcare investments.

- Patent Expiries and Generics: These will intensify pricing competition, demanding strategic differentiation.

- Innovation Focus: Development of novel formulations and delivery mechanisms could enhance adherence and expand therapeutic applications.

- Epidemiological Trends: Rising IBD prevalence underscores the need for accessible, cost-effective therapies; mesalamine remains central.

FAQs

1. How has the patent landscape affected mesalamine sales?

Patent expirations, mainly around 2019-2020, led to a surge in generic entries, resulting in price reductions and increased accessibility, which initially pressured branded sales but also expanded overall market volume.

2. What are the primary formulations of mesalamine?

Mesalamine is available as oral delayed-release tablets, suppositories, enemas, and foam preparations, allowing tailored treatment for different disease locations.

3. How does the increasing use of biologics impact mesalamine sales?

While biologics target moderate to severe IBD, mesalamine remains first-line for mild cases, ensuring continued demand. However, shifts towards biologic use in earlier disease stages could marginally impact sales.

4. What regional factors influence mesalamine market growth?

Healthcare infrastructure, regulatory environments, disease prevalence, and economic factors drive regional market dynamics, with Asia-Pacific showing rapid growth potential.

5. Are there new developments in mesalamine formulations?

Research focuses on enhancing bioavailability, targeted delivery, and combination therapies, which can improve patient adherence and clinical outcomes, fostering future sales growth.

Sources:

- Centers for Disease Control and Prevention (CDC), 2022. “Inflammatory Bowel Disease Prevalence.”

- Mayo Clinic, 2022. “Mesalamine (5-aminosalicylic acid) overview.”

- MarketWatch, 2023. “Global Mesalamine Market Size and Forecast.”

- World Gastroenterology Organisation, 2022. “Epidemiology of IBD.”

- Pharmaceutical technology reports, 2022-2023. “Evolution of Mesalamine Formulations.”

More… ↓