Share This Page

Drug Sales Trends for MEDROL

✉ Email this page to a colleague

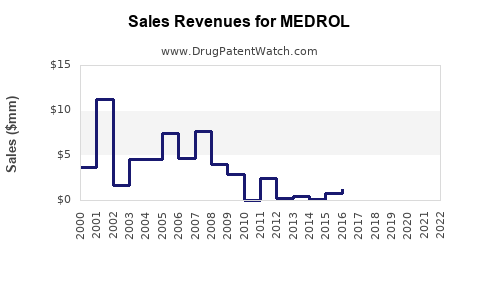

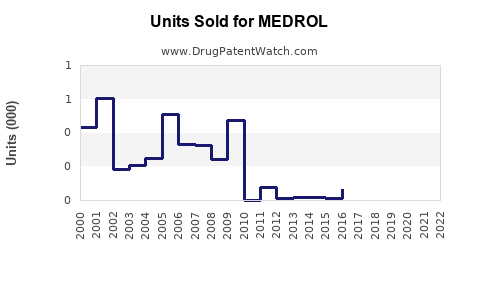

Annual Sales Revenues and Units Sold for MEDROL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Medrol (Methylprednisolone)

Introduction

Medrol, with the generic name methylprednisolone, is a corticosteroid widely used for its anti-inflammatory and immunosuppressive properties. It addresses a broad spectrum of indications, including allergic reactions, autoimmune disease, dermatoses, and certain inflammatory conditions. As a leading corticosteroid in both developed and emerging markets, understanding Medrol’s market dynamics and future sales prospects is crucial for pharmaceutical stakeholders, investors, and healthcare planners.

Market Overview

Global Market Size

The corticosteroid market, projected at USD 7.4 billion in 2021, is expected to grow at an annual compound growth rate (CAGR) of approximately 3-4% over the next five years [1]. Medrol, as a flagship oral corticosteroid, commands a significant share within this segment due to its established efficacy, wide approval base, and longstanding market presence.

Leading Indications and Use Cases

Medrol's primary indications include:

- Allergic conditions (e.g., asthma, allergic rhinitis)

- Rheumatologic diseases (e.g., rheumatoid arthritis, lupus)

- Dermatologic conditions (e.g., psoriasis, eczema)

- Endocrine disorders (e.g., adrenal insufficiency)

- Certain neoplastic diseases (as part of chemotherapy regimens)

Its versatility supports consistent demand, especially in managing acute exacerbations of chronic diseases. The COVID-19 pandemic prominently increased corticosteroid prescriptions, including methylprednisolone, for severe cases, serving as a catalyst for short-term sales growth [2].

Competitive Landscape

Medrol faces competition from various corticosteroids such as prednisone, dexamethasone, and hydrocortisone, with generics dominating the majority of prescription volume due to their cost-effectiveness. Key competitors include:

- Prednisone (broader global presence)

- Dexamethasone (notably after recognition in COVID-19 therapy)

- Hydrocortisone (for topical and systemic use)

The patent landscape favors generics, limiting brand-specific premiums but ensuring high-volume sales.

Regional Market Dynamics

North America

North America, primarily the U.S., remains the largest market for Medrol. The region benefits from high healthcare expenditure, robust insurance coverage, and a high prevalence of autoimmune and inflammatory disorders. The adoption of corticosteroids in emergency settings further sustains sales [3].

Europe

European markets mirror North American trends with strong prescription habits, although regulatory differences and increased generic competition temper revenue growth.

Asia-Pacific

Asia-Pacific exhibits the fastest growth, driven by expanding healthcare infrastructure, rising prevalence of autoimmune diseases, and increased access to affordable generics. China and India are notable markets due to their large populations and generic manufacturing capacity.

Latin America and Middle East

Growing healthcare investments, increasing disease awareness, and expanding insurance coverage fuel market expansion in these regions.

Regulatory and Reimbursement Landscape

Medrol’s approval spans multiple regulatory agencies, including the FDA and EMA. Its status as a generic medication facilitates rapid access and reimbursement in most markets. Price pressures, particularly in price-sensitive regions, necessitate competitive pricing strategies by manufacturers.

Sales Projections

Historical Sales Trends

Historical data indicates steady growth in Medrol’s global sales, buoyed by its widespread use and generic availability. For example, U.S. sales hovered around USD 1.2 billion annually pre-pandemic, with fluctuations based on prescribing trends and patent expirations.

Future Sales Forecast

Assuming moderate growth influenced by increased prevalence of autoimmune conditions, expanding healthcare access in emerging markets, and the strategic positioning of methylprednisolone formulations, the following projections are plausible:

- 2023-2027 CAGR: 3-4%

- Global Sales in 2027: USD 8.5–9.0 billion

Key growth drivers include:

- Rising demand in middle-income countries

- Expanded indications, such as COVID-19-related respiratory therapy

- Increased utilization in hospital and outpatient settings

Potential headwinds encompass pricing pressures, patent expiration impacts, and competition from newer therapeutic modalities like biologics in autoimmune diseases.

Market Opportunities and Challenges

Opportunities

- Formulation Innovation: Developing fixed-dose combinations and new delivery systems could enhance patient compliance and expand usage.

- Chronic Disease Management: Increased diagnosis of autoimmune and inflammatory conditions offers long-term prescription potential.

- Market Penetration in Emerging Economies: Local production and competitive pricing strategies could boost sales.

Challenges

- Generic Competition: Intense price competition diminishes brand premiums.

- Regulatory Scrutiny: Stringent approval processes and post-market surveillance requirements.

- Side Effect Profile: Corticosteroids' adverse effects necessitate cautious prescribing, which may influence sales margins.

Strategic Recommendations

- Enhance Market Access: Engage with payers for favorable reimbursement terms, especially in cost-sensitive regions.

- Invest in Differentiation: While challenging in generics, exploring novel formulations or combination therapies could distinguish Medrol.

- Monitor Regulatory Trends: Stay ahead of evolving safety and efficacy standards to ensure continued approval and marketability.

Key Takeaways

- Robust Demand: Medrol maintains steady global demand due to its broad therapeutic profile.

- Market Growth: The corticosteroid segment is projected to grow modestly, driven by increased autoimmune disease prevalence and expanding healthcare access in emerging markets.

- Competitive Landscape: The dominance of generics imposes pricing pressures yet offers volume-based revenue opportunities.

- Emerging Trends: The COVID-19 pandemic has temporarily boosted corticosteroid use, with potential long-term implications.

- Strategic Focus: Manufacturers should prioritize market expansion, formulation innovation, and payer engagement to sustain and grow Medrol sales.

FAQs

1. What are the primary markets driving Medrol sales globally?

The United States and Europe are the leading markets due to high healthcare expenditure and disease prevalence, while Asia-Pacific offers high-growth potential owing to demographic and economic expansion.

2. How does the patent status influence Medrol’s market dynamics?

As a government-approved generic, Medrol faces intense price competition, limiting brand premiums but enabling widespread access and high-volume sales.

3. What impact did COVID-19 have on Medrol’s sales?

The pandemic temporarily increased corticosteroid prescriptions, including methylprednisolone, especially for severe COVID-19 cases, boosting short-term sales.

4. What are the key challenges for Medrol's future growth?

Intense generic competition, pricing pressures, regulatory scrutiny, and the side effect profile of corticosteroids could constrain future growth.

5. How can manufacturers leverage emerging markets for Medrol?

By local manufacturing, cost-effective pricing, and expanding indications, manufacturers can capitalize on rising demand and healthcare expansion in regions like Asia and Latin America.

References

- MarketsandMarkets. Corticosteroids Market by Type, Indication, Distribution Channel, and Region. 2021.

- WHO. Corticosteroid Use in COVID-19 Patients. 2022.

- IQVIA. The Impact of COVID-19 on the Prescribing Trends of Corticosteroids. 2021.

More… ↓