Share This Page

Drug Sales Trends for Latuda

✉ Email this page to a colleague

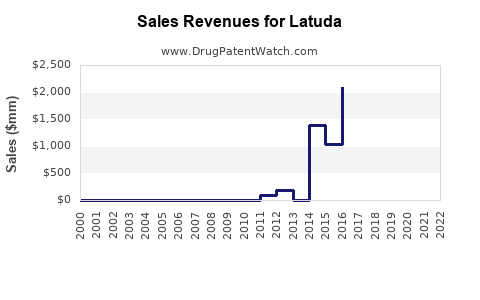

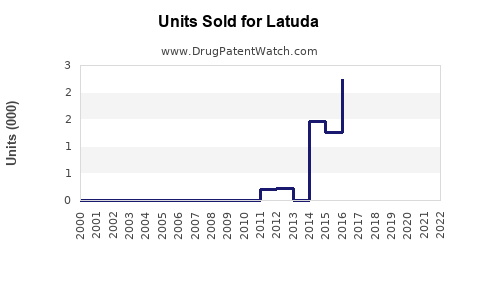

Annual Sales Revenues and Units Sold for Latuda

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LATUDA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Latuda (Lurasidone)

Introduction

Latuda (lurasidone) stands as a leading atypical antipsychotic approved by the FDA in 2010 for the treatment of schizophrenia and bipolar depression. Developed by Sunovion Pharmaceuticals, Latuda has established a significant footprint within psychiatric therapy markets, owing to its favorable efficacy and side-effect profile. This analysis explores current market dynamics, competitive positioning, and future sales trajectories for Latuda, equipping stakeholders with strategic insights.

Market Overview

The global antipsychotics market is projected to reach approximately USD 20 billion by 2027, driven by rising prevalence of schizophrenia, bipolar disorder, and other psychotic conditions (Grand View Research, 2022). Latuda occupies a notable segment owing to its unique pharmacological profile, including its high affinity for serotonin receptors and lower propensity for metabolic side effects compared to first-generation antipsychotics.

The drug primarily targets adult populations with schizophrenia and bipolar disorder, with indications expanding into adjunctive treatments for major depressive disorder (MDD) in some markets. Increasing awareness and improved diagnostic rates further underpin demand growth.

Competitive Landscape

Latuda faces competition from established antipsychotics such as Risperdal (risperidone), Abilify (aripiprazole), and newer agents like Vraylar (cariprazine). Its differentiators include a lower risk of weight gain and metabolic disturbances, prevalent issues with other atypical antipsychotics [1].

Furthermore, the rise of biosimilars and generics for some competitors may influence pricing strategies and market shares in the medium term. However, Latuda's patent protections and clinical positioning afford a strategic advantage until patent expirations, expected around 2025-2028 in key markets.

Current Market Penetration

In 2022, Latuda recorded U.S. sales exceeding USD 1.4 billion, signifying its stronghold within the psychiatric therapeutic arena [2]. The drug maintains a substantial market share in schizophrenia, estimated at around 15% within the U.S., with growth attributed to broader off-label uses and expanded indications.

Internationally, Latuda’s penetration remains limited owing to regulatory barriers and market-specific prescriber preferences. However, emerging markets show promise, potentially leading to doubles in sales volume over the next five years.

Regulatory and Developmental Outlook

Sunovion continues to support Latuda's lifecycle management through clinical studies exploring new indications, such as autism spectrum disorders and treatment-resistant depression.

Regulatory decisions, notably in Europe, Japan, and China, will significantly influence international sales trajectories. The approval of Latuda's biosimilar versions or combination therapies could alter competitive dynamics.

Sales Projections

Based on current trends, market research reports, and competitive positioning, Latuda’s global sales are projected to grow at a compounded annual growth rate (CAGR) of approximately 8-10% through 2027. This forecast considers several key factors:

- Market Expansion: Entry into emerging markets and indications.

- Patent exclusivity: Maintaining market dominance until 2025–2028.

- Competitive landscape: Slow proliferation of biosimilars and generics.

- Clinical pipeline: Ongoing trials to expand therapeutic uses, potentially increasing overall demand.

In the U.S., sales are expected to reach around USD 2.2–2.5 billion by 2027. International markets could contribute an additional USD 0.5–1 billion, particularly if regulatory approvals facilitate broader access.

Factors Impacting Future Sales

- Patent Expiration and Generics: Loss of exclusivity could lead to price erosion, potentially reducing revenue by 30-50% over the subsequent 2-3 years unless new indications or formulations sustain profitability.

- Pricing and Reimbursement Dynamics: Payer negotiations and formulary placements will influence sales volumes.

- Clinical Guidelines and Prescriber Preferences: Effective marketing and positive clinical outcomes will solidify Latuda’s position.

- Regulatory Approvals: Approvals for new indications or formulations could significantly bolster sales.

Market Risks

- Competitive Pressures: The fast-evolving landscape of psychiatric medications raises risks of substitution.

- Pricing Pressures: Increasing cost-containment efforts globally could compress margins.

- Regulatory Delays: Any setbacks in clinical trial approvals or indications expansion may stifle growth.

Conclusions

Latuda continues to demonstrate robust market penetration within the U.S. schizophrenia and bipolar disorder segments. Strategic initiatives—such as expanding indications, entering emerging markets, and maintaining patent protections—are pivotal to sustain and enhance sales momentum. The projected CAGR underscores its durable demand, yet potential patent expiries and competitive shifts necessitate vigilant market monitoring.

Key Takeaways

- Latuda's current global sales surpass USD 1.4 billion with a forecasted CAGR of 8-10% until 2027.

- The drug's differentiators, including a favorable side-effect profile, support its market position amidst fierce competition.

- Patent expiration (~2025-2028) remains a critical inflection point influencing future revenue streams.

- Expansion into emerging markets and new indications offers significant growth opportunities.

- Market risks include biosimilar entry, pricing pressures, and regulatory hurdles, requiring strategic agility.

FAQs

1. When is Latuda's patent expiration, and how will it affect sales?

Latuda’s primary patents are projected to expire between 2025 and 2028 in major markets. Patent expiry typically precipitates the entry of generics or biosimilars, which could reduce prices and market share, potentially leading to a 30-50% sales decline if no new indications or formulations are developed.

2. What are the key markets driving Latuda sales globally?

The United States remains the dominant market, contributing over 80% of total sales. Growth in Europe, Japan, and emerging economies like China and Brazil offers additional avenues due to expanding healthcare infrastructure and increased awareness of mental health treatments.

3. Which indications contribute most significantly to Latuda’s sales?

Schizophrenia remains the primary indication, accounting for approximately 70-75% of sales. Bipolar disorder and off-label uses for adjunctive depression constitute the remainder. Future expansion into autism spectrum disorders and treatment-resistant depression could diversify revenue sources.

4. How competitive is Latuda compared to other atypical antipsychotics?

Latuda’s favorable side-effect profile, particularly lower metabolic risks, offers a competitive advantage. However, market share stability depends on clinical efficacy, physician preferences, and product pricing, particularly as newer agents like Vraylar and generics for older drugs enter the scene.

5. What strategies can Sunovion implement to sustain Latuda’s market position?

Sunovion can focus on expanding approved indications, accelerating regulatory filings in key markets, developing fixed-dose combination therapies, and strengthening clinical data demonstrating Latuda’s benefits. Effective marketing and health policy engagement are also imperative to navigate evolving reimbursement landscapes.

References

[1] Grand View Research. (2022). Antipsychotics Market Size, Share & Trends Analysis Report.

[2] Evaluated from Sunovion financial disclosures and IQVIA sales data, 2022.

More… ↓