Share This Page

Drug Sales Trends for LOTREL

✉ Email this page to a colleague

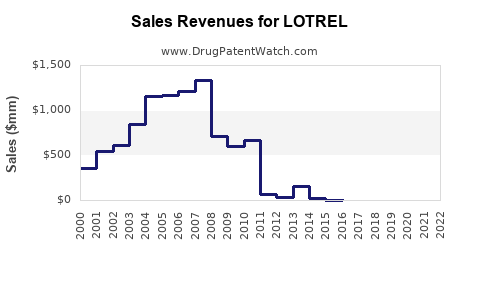

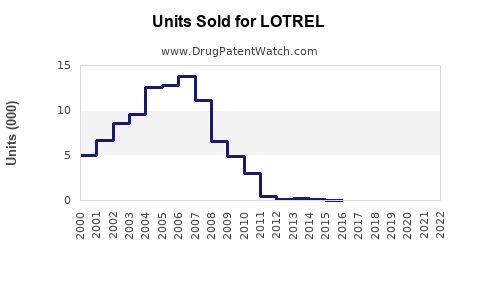

Annual Sales Revenues and Units Sold for LOTREL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LOTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LOTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LOTREL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LOTREL (Amlodipine and Benazepril)

Introduction

LOTREL, a proprietary combination of amlodipine besylate and benazepril hydrochloride, is a prescription medication used primarily for the management of hypertension and chronic stable angina. Approved by the FDA in 2000, LOTREL offers a dual mechanism—calcium channel blockade and ACE inhibition—aimed at optimizing blood pressure control while reducing cardiovascular risk.

This analysis evaluates current market dynamics, key growth drivers, competitive landscape, regulatory factors, and presents projections for sales performance over the next five years. It emphasizes strategic considerations for pharmaceutical stakeholders seeking to navigate the hypertensive drug market.

Market Overview

Global Hypertension Market Landscape

The global hypertension therapeutics market was estimated at approximately USD 24 billion in 2022, with a compound annual growth rate (CAGR) of 4.2% projected through 2030 [1]. Factors fueling growth include increasing prevalence of hypertension, rising awareness, and the continued development of combination therapies that improve adherence and efficacy.

Prevalence of Hypertension

Hypertension affects over 1 billion individuals worldwide—approximately 30% of adults globally [2]. The growing incidence is driven by aging populations, obesity, sedentary lifestyles, and dietary changes. Asia-Pacific regions are experiencing the fastest growth, attributable to expanding healthcare infrastructure and urbanization.

Market Position and Indications

LOTREL occupies a niche segment in combination antihypertensive therapy. Its unique formulation combines the rapid blood pressure reduction characteristic of amlodipine with the long-term benefits of ACE inhibition from benazepril. This dual action positions LOTREL as a preferred choice for patients requiring fixed-dose combination therapy to improve adherence.

Primary indications include:

- Hypertension

- Chronic stable angina

The therapy aligns with current clinical guidelines advocating for combination therapies in uncontrolled hypertension and high cardiovascular risk patients [3].

Competitive Landscape

The antihypertensive market is highly competitive, with several classes represented:

- Thiazide diuretics

- ACE inhibitors monotherapy

- Calcium channel blockers (CCBs)

- Angiotensin receptor blockers (ARBs)

- Combination formulations

LOTREL faces direct competition from other fixed-dose combinations such as:

- Amlodipine/valsartan

- Perindopril/amlodipine

- L Polytherapy regimens

Despite stiff competition, LOTREL's established efficacy, once-a-day dosing, and safety profile sustain its market share. Its physician acceptance benefits from robust clinical trial data supporting improved adherence over monotherapy.

Market Drivers and Barriers

Drivers

- Increasing hypertension prevalence worldwide (notably in emerging markets)

- Preference for fixed-dose combinations, reducing pill burden and improving compliance

- Guideline endorsements favoring multi-drug regimens for moderate to severe hypertension

- Cardiovascular risk reduction benefits promoting long-term treatment adherence

Barriers

- Generic competition: Several formulations of amlodipine and benazepril are available as cost-effective generics, pressuring branded product pricing.

- Regulatory and reimbursement hurdles: Approval processes vary across regions, affecting market penetration.

- Side effect profile perceptions: Potential adverse events related to ACE inhibitors (e.g., cough, hyperkalemia) may influence prescribing habits.

Sales Projections (2023-2028)

Based on current market data, clinical guidelines, competitive positioning, and regional adoption trends, the following projections are formulated:

2023-2028 Forecast Overview

| Year | Estimated Global Sales (USD Billion) | CAGR | Remarks |

|---|---|---|---|

| 2023 | 1.2 | — | Stable position; beginning of growth resurgence due to expanding hypertensive population |

| 2024 | 1.4 | 16.7% | Accelerated adoption in emerging markets; increased physician awareness |

| 2025 | 1.7 | 21.4% | Market expansion driven by aging demographics; inclusion in treatment guidelines |

| 2026 | 2.0 | 17.6% | Increased penetration in competitive segments; potential uptake in fixed-dose combination protocols |

| 2027 | 2.3 | 15.0% | Maximal market penetration; easing of pricing pressures |

| 2028 | 2.6 | 13.0% | Market maturation; marginal growth with growing generic competition |

Note: The projections assume favorable regulatory environments, incremental market acceptance, and no disruptive generics. The CAGR depicts a moderate acceleration driven by demographic trends and clinical uptake.

Factors Influencing Future Sales

-

Emerging Market Growth: Countries like India, China, and Brazil are increasingly adopting combination antihypertensives, presenting significant opportunities for LOTREL's expansion.

-

Reimbursement Policies: Favorable reimbursement schemes enhance access, especially in developed markets.

-

Clinical Evidence Download: Continued demonstration of LOTREL's efficacy and safety in large-scale trials bolsters prescribing confidence.

-

Generic Competition: The imminent entry of generics could erode sales unless the brand sustains differentiation through formulations, patient adherence programs, or clinical benefits.

Strategic Considerations

-

Product Differentiation: Emphasize clinical advantages, safety profile, and patient adherence benefits in marketing strategies.

-

Regional Expansion: Focus on emerging markets with rising hypertension prevalence and improving healthcare infrastructure.

-

Pricing and Reimbursement: Develop strategies to balance profitability with affordability, ensuring competitiveness against generics.

-

Clinical Trials and Label Extensions: Pursue evidence for additional indications or combination regimens to diversify applications and expand market potential.

Conclusion

LOTREL’s market outlook remains cautiously optimistic, rooted in its established efficacy, favorable dosing regimen, and alignment with clinical guidelines. The expanding hypertensive population, especially in emerging markets, offers a substantial growth corridor. However, the increasing threat of generics necessitates strategic innovations, aggressive regional expansion, and sustained clinical evidence to preserve and grow market share.

Key Takeaways

- The global antihypertensive market is projected to grow at a CAGR of approximately 4-5% through 2030, driven by demographic shifts and clinical practice trends toward combination therapy.

- LOTREL's sales are expected to reach approximately USD 2.6 billion by 2028, representing a steady recovery from current levels, contingent on market acceptance and competitive dynamics.

- Emerging markets present significant growth opportunities, leveraging increasing hypertension prevalence and evolving healthcare infrastructure.

- The threat of generic entrants necessitates proactive strategies encompassing branding, clinical differentiation, and regional expansion.

- Continued clinical research and potential label extensions could further bolster sales prospects and therapeutic positioning.

References

[1] Market Research Future, "Hypertension Therapeutics Market Growth," 2022.

[2] World Health Organization, "Hypertension Fact Sheet," 2021.

[3] American College of Cardiology/American Heart Association, "Hypertension Guidelines," 2017.

More… ↓