Last updated: July 28, 2025

Introduction

LO LOESTRIN, a combined oral contraceptive containing levonorgestrel and ethinyl estradiol, remains a pivotal product within the reproductive health space. Its established efficacy, safety profile, and regulatory approval underpin its market presence. This report offers a comprehensive analysis of LO LOESTRIN’s current market landscape, key drivers influencing demand, competitive positioning, and future sales projections, providing a strategic outlook for stakeholders.

Market Overview

The global oral contraceptives market has demonstrated consistent growth driven by increasing awareness of family planning, demographic shifts, and evolving gender roles. In 2022, the global contraceptive market was valued at approximately USD 22 billion, with oral contraceptives representing nearly 50% of the segment [1]. The segment's CAGR is expected to hover around 4% through 2028, fueled by expanding healthcare access and innovation-driven formulations.

LO LOESTRIN secures significant market share, especially among women aged 18–35, with particular strength in North America and Europe. Its established safety and efficacy profile position it favorably amid generic competition. Moreover, rising demand from emerging markets such as Asia-Pacific, Latin America, and Africa signifies substantial growth potential [2].

Key Drivers of Market Demand

-

Increasing Family Planning Adoption

Growing global awareness of reproductive health, facilitated by campaigns and healthcare provider recommendations, sustains high demand for oral contraceptives. In particular, the World Health Organization reports over 60% of women of reproductive age in many regions currently utilizing some form of contraception [3].

-

Regulatory Approvals and Pharmacovigilance

LO LOESTRIN’s long-standing regulatory approvals across major markets bolster consumer confidence. Enhanced safety profiles and updated formulations contribute to sustained prescribing patterns.

-

Advances in Formulation and User Convenience

Innovations, including extended-cycle options and lower-dose formulations, have increased compliance and reduced side effects, further expanding the user base.

-

Market Penetration in Emerging Economies

Urbanization, increased healthcare infrastructure, and governmental family planning initiatives are propelling sales in developing regions.

Competitive Landscape

LO LOESTRIN faces competition primarily from other combination oral contraceptives such as Yasmin, Ortho Cyclen, and generic formulations. While price competition persists, LO LOESTRIN's brand recognition, familiarity among practitioners, and proven safety record provide a competitive edge.

Emerging non-oral contraceptive methods, such as implants, injectables, and intrauterine devices (IUDs), are gaining traction, influencing the contraceptive landscape. Nonetheless, oral contraceptives; including LO LOESTRIN, maintain a dominant position owing to ease of use and societal acceptance.

Regulatory and Patent Considerations

Patents for LO LOESTRIN are expected to expire around 2025, increasing generic entry and exerting downward pressure on prices and sales margins [4]. However, brand loyalty, physician prescribing habits, and differentiated formulations can mitigate immediate market erosion.

Sales Projections (2023–2030)

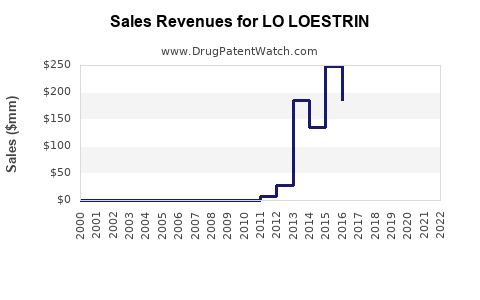

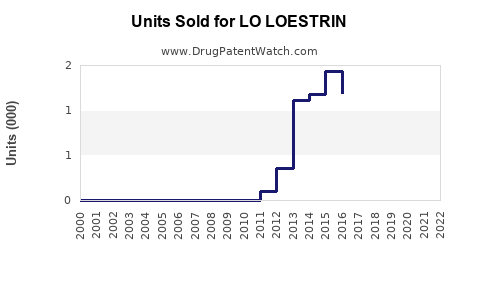

Based on current market dynamics, historical sales data, and emerging trends, the following projections are delineated:

-

2023–2025:

- Post-patent expiry anticipates a dip in sales due to increased generic competition. Nonetheless, sales are expected to stabilize owing to existing brand loyalty and slight formulary differentiation.

- Estimated global sales: USD 850 million to USD 950 million annually.

-

2026–2028:

- Growth driven by expanding penetration in emerging markets and product line extensions.

- Adoption of extended-cycle formulations will contribute to market share gains.

- Estimated global sales: USD 1.2 billion to USD 1.4 billion annually.

-

2029–2030:

- Market saturation approaches in mature regions, but significant growth in emerging markets sustains overall demand.

- Potential impact of biosimilar and generic entrants stabilizes or slightly reduces margins.

- Estimated global sales: USD 1.5 billion to USD 1.7 billion.

Growth assumptions incorporate factors such as increased healthcare coverage, demographic trends, and evolving consumer preferences. The market's resilience hinges on formulary access, pricing strategies, and ongoing product innovations.

Strategic Considerations

- Product Differentiation: Developing extended or lower-dose formulations could sustain sales amid generic penetration.

- Market Expansion: Investing in marketing and distribution channels in emerging markets promises sizable growth.

- Regulatory Navigation: Timely patent expiries necessitate strategic planning for generic formulations and biosimilars.

- Provider and Consumer Education: Raising awareness around safety and adherence benefits remains critical.

Key Takeaways

- Market Position: LO LOESTRIN is well-established, with sustained demand driven by increasing contraceptive use globally.

- Competitive Edge: Brand recognition and safety profile buffer against generic competition temporarily, but patent expiry will challenge its market share significantly by mid-decade.

- Growth Opportunities: Emerging markets, product line extensions, and patient adherence initiatives are catalysts for future growth.

- Risks: Patent expiries, pricing pressures, and competition from non-oral contraceptives could cap growth potential.

- Investment Outlook: Strategic marketing, innovation, and geographic expansion are vital for maintaining and growing LO LOESTRIN’s market presence.

FAQs

1. How does LO LOESTRIN compare to other combined oral contraceptives in terms of efficacy?

LO LOESTRIN exhibits efficacy rates comparable to leading brands like Yasmin and Ortho Cyclen, with typical-use failure rates around 7% per year. Its proven safety profile and consistent hormone release underpin its clinical reliability.

2. What are the main factors influencing LO LOESTRIN sales post-patent expiry?

The primary factors include increased generic competition, pricing strategies, formulary inclusion, physician prescribing habits, patient preferences, and regulatory approval processes for new formulations.

3. Are there upcoming formulations or innovations for LO LOESTRIN?

While no specific new formulations have been officially announced, development trends suggest extended-cycle and lower-dose options could enhance adherence and safety, potentially bolstering sales.

4. How significant is the growth potential in emerging markets?

Very significant. Countries like India, Brazil, and Southeast Asian nations are witnessing rising contraceptive adoption, driven by urbanization and increasing healthcare access, aligning well with LO LOESTRIN’s product profile.

5. What strategies can manufacturers employ to sustain sales amid increasing competition?

Strategies include investing in brand awareness, differentiating formulations, expanding into new markets, engaging healthcare providers, conducting consumer education, and leveraging digital health tools.

Sources

[1] MarketWatch, "Global Contraceptive Market Size & Trends," 2022.

[2] Research and Markets, "Emerging Trends in Contraceptive Market," 2023.

[3] World Health Organization, "Family Planning Global Data," 2022.

[4] U.S. Patent and Trademark Office, "Patent Expiry Dates for LO LOESTRIN," 2022.