Share This Page

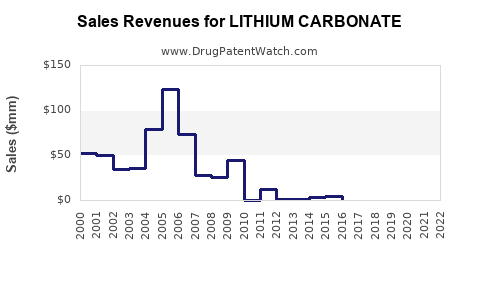

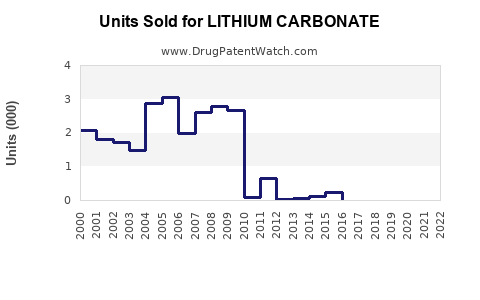

Drug Sales Trends for LITHIUM CARBONATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LITHIUM CARBONATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LITHIUM CARBONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LITHIUM CARBONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LITHIUM CARBONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Lithium Carbonate

Introduction

Lithium carbonate, a chemical compound primarily used in the manufacture of rechargeable lithium-ion batteries, has become an essential component in the accelerating global shift towards electrification. Its significance extends beyond batteries, reaching therapeutic applications in bipolar disorder treatment. This dual demand influences lithium carbonate’s market dynamics, positioning it as a strategic commodity with substantial growth prospects. This report provides a comprehensive analysis of the current market landscape, key drivers, competitive environment, and future sales projections for lithium carbonate.

Market Overview

Global Demand Drivers

The rising adoption of electric vehicles (EVs) is the primary catalyst for lithium carbonate's surging demand. According to the International Energy Agency (IEA), EVs are projected to constitute over 30% of new car sales globally by 2030, up from approximately 10% in 2020, elevating the demand for lithium-ion batteries [1]. As the backbone of these batteries, lithium carbonate’s consumption correlates closely with EV production.

Additionally, the pharmaceutical sector sustains consistent demand for lithium carbonate in bipolar disorder treatment. Although less volatile than battery-related markets, this medical application offers a steady revenue stream that balances cyclical battery demand.

Supply Chain and Key Players

Major lithium-producing countries include Australia, Chile, China, and Argentina, forming the "Lithium Triangle" responsible for over 60% of global lithium production [2]. Australia dominates with an estimated 50% share, primarily through open-pit mining of spodumene ore, which is processed into lithium carbonate.

Leading manufacturers of lithium carbonate include Tianqi Lithium, Albemarle Corporation, Sociedad Química y Minera (SQM), and Ganfeng Lithium. Market consolidation and vertical integration have increased, with these players investing heavily in expanding capacity to meet future demand.

Market Prices and Trends

Lithium carbonate prices exhibit high volatility, influenced by supply-demand imbalances, geopolitical factors, and technological developments. As of late 2022, spot prices ranged between $70,000 and $80,000 per metric ton, up from approximately $15,000 per ton in 2020, reflecting a significant price rally driven by supply constraints and frenzy in EV markets [3].

Market Trends and Influencing Factors

Technological Advances

Next-generation battery chemistries (e.g., lithium iron phosphate, solid-state batteries) may diversify the demand pool, but lithium-ion lithium carbonate-based batteries remain dominant. Research into alternative lithium sources, such as geothermal brines, could influence supply strategies.

Environmental and Regulatory Factors

Environmental concerns about lithium extraction's ecological impact could lead to increased regulation, affecting supply chains. Countries are emphasizing sustainable mining practices, potentially raising costs and altering sourcing strategies.

Geopolitical Risks

Trade tensions, especially between China and Western nations, may influence supply routes and pricing structures. Diversification of sources and domestic lithium extraction initiatives are priorities for major markets.

Sales Projections (2023–2030)

Methodology

Projections are based on compound annual growth rates (CAGR) derived from historical demand data, industry forecasts, and potential supply expansions. A conservative scenario considers supply constraints and environmental concerns, while an optimistic scenario assumes rapid capacity growth and technological adoption.

Forecast Scenarios

- Baseline Scenario: CAGR of 16%, driven by EV adoption pace and stable medical demand.

- Optimistic Scenario: CAGR of 22%, propelled by accelerated EV penetration and technological breakthroughs reducing battery costs.

- Pessimistic Scenario: CAGR of 8%, due to potential supply disruptions, environmental restrictions, or slower EV adoption.

| Year | Baseline Projection (Metric Tons) | Optimistic Projection (Metric Tons) | Pessimistic Projection (Metric Tons) |

|---|---|---|---|

| 2023 | 385,000 | 400,000 | 370,000 |

| 2025 | 540,000 | 625,000 | 460,000 |

| 2027 | 750,000 | 950,000 | 592,000 |

| 2030 | 1,045,000 | 1,500,000 | 800,000 |

Source: Industry analysis and market modeling based on recent demand trajectories.

Revenue Implications

Assuming an average price of $75,000 per metric ton in 2023, revenues from lithium carbonate sales could range from $27.4 billion to $112.5 billion by 2030, depending on market conditions.

Competitive Landscape and Market Opportunities

Market Players and Capacity Expansion

Leading companies are scaling manufacturing to meet the projected surge in demand:

- Albemarle: Announced capacity expansion plans in Australia and jointly invested in mine development.

- Tianqi Lithium: Focused on spodumene processing capacity increases in Australia.

- Ganfeng Lithium: Diversification into salt-lake extraction and downstream processing.

Emerging players and innovation in extraction technologies (e.g., lithium from geothermal brines) are expected to reshape competitive dynamics.

Investment and Strategic Outlook

Investors should watch for capacity expansion announcements, ESG compliance risks, and geopolitical developments. Companies with sustainable extraction practices and diversified supply chains will likely hold a competitive edge.

Regulatory and Environmental Considerations

Enhanced regulations on water use, land disturbance, and waste management could impact lithium production costs and timelines. Governments are initiating policies to promote sustainable mining, which may influence pricing structures and supply stability.

Key Challenges

- Environmental concerns potentially limiting supply growth.

- Price volatility affecting profit margins.

- Supply chain disruptions due to geopolitical tensions.

- Technological innovations threatening demand for traditional lithium carbonate.

Conclusion

The lithium carbonate market is poised for robust growth driven by the EV revolution and stable medical applications. Strategic capacity expansions, technological innovations, and sustainable practices will be pivotal in capturing market share. Market professionals should consider scenario planning to navigate pricing volatility and regulatory risks effectively.

Key Takeaways

- Global lithium carbonate demand is expected to grow at a CAGR of approximately 16% to 22% through 2030.

- The EV industry remains the dominant growth driver, making lithium carbonate a critical component in renewable energy initiatives.

- Supply constraints and environmental regulations pose significant challenges but also create opportunities for sustainable extraction technologies.

- Price levels are volatile; strategic sourcing and vertical integration are vital for risk mitigation.

- Investors and manufacturers should prioritize ESG compliance, diversified supply chains, and technological innovation to capitalize on market trends.

FAQs

1. What factors are driving the surge in lithium carbonate demand?

The primary driver is the expanding electric vehicle market, which relies heavily on lithium-ion batteries. Additionally, steady pharmaceutical applications provide consistent demand, bolstering overall market growth.

2. How will environmental regulations impact lithium carbonate supply?

Stricter environmental standards may increase extraction costs and limit supply growth. However, innovations in sustainable mining and lithium extraction from geothermal sources could offset these impacts.

3. What are the main geopolitical risks affecting the lithium carbonate market?

Trade tensions, especially involving China and Western countries, could disrupt supply chains and influence prices. Countries are incentivizing domestic lithium production to reduce reliance on geopolitically sensitive regions.

4. Who are the leading producers of lithium carbonate?

Major producers include Albemarle, Tianqi Lithium, SQM, and Ganfeng Lithium, operating primarily in Australia, Chile, and China.

5. What are future technological developments that could influence lithium carbonate demand?

Advancements in battery technology, such as solid-state batteries and alternative chemistries, may impact lithium demand. Conversely, breakthroughs in lithium extraction methods could enhance supply and lower costs.

Sources:

[1] IEA, "The Role of Critical Minerals in Clean Energy Transitions," 2021.

[2] USGS Mineral Commodity Summaries, Lithium, 2022.

[3] Benchmark Mineral Intelligence, Lithium Price Index, 2022.

More… ↓