Last updated: July 29, 2025

Introduction

LEVEMIR (insulin detemir) is a long-acting basal insulin analog developed for the management of diabetes mellitus. Since its approval, it has established itself within the subcutaneous insulin segment, catering primarily to patients requiring basal insulin therapy. This report provides a comprehensive market analysis and sales projection for LEVEMIR, considering current market dynamics, competitive landscape, regulatory factors, demographic trends, and technological innovations.

Market Overview

Global Diabetes Prevalence and Insulin Market Size

The global diabetes population reached approximately 537 million adults in 2021, with projections reaching 643 million by 2030, according to the International Diabetes Federation (IDF) [1]. The rising prevalence of both type 1 and type 2 diabetes strongly underpins the insulin market's growth, critically influencing demand for basal insulin formulations such as LEVEMIR.

The global insulin market was valued at around USD 25 billion in 2022 and is expected to grow annually at a compound annual growth rate (CAGR) of approximately 8.5% over the next five years, driven by increasing chronic disease burden, rising awareness, and innovation in delivery systems [2].

Product Positioning and Competitive Landscape

LEVEMIR competes with other long-acting insulins, including insulin glargine (Lantus, Basaglar), insulin degludec (Tresiba), and biosimilar offerings. Pfizer, Novo Nordisk, Sanofi, and Eli Lilly dominate the insulin sector, with these incumbents aggressively expanding their portfolios and enhancing patient adherence through pen devices and digital health integrations.

LEVEMIR’s advantages include a predictable pharmacokinetic profile, reduced hypoglycemia risk, and flexible dosing options, which have sustained its market relevance. However, biosimilar competition and insulins with longer duration or more convenient dosing regimens pose ongoing challenges.

Market Drivers and Barriers

Drivers

- Increasing Diabetes Prevalence: A global surge in diabetes cases maintains robust demand for insulin therapies.

- Patient-Centric Innovations: Development of prefilled pens and smart delivery devices improves adherence, favoring products like LEVEMIR.

- Regulatory Approvals: Favorable regulatory pathways facilitate market expansion, especially in emerging markets.

- Shift Toward Basal Insulin Analogs: Growing preference for long-acting insulins over intermediate options enhances LEVEMIR’s sales potential.

Barriers

- Cost and Reimbursement Issues: High insulin costs and limited reimbursement impede access, especially in low-income regions.

- Biosimilar Competition: The entry of biosimilar versions undercuts pricing and market share of branded products like LEVEMIR.

- Patient Preference: Preference for insulins with once-daily dosing and minimal injections influences market penetration.

- Regulatory Challenges: Variations in approval processes across regions can delay product uptake.

Regional Market Dynamics

North America

The U.S. accounts for the largest share of the insulin market due to high diabetes prevalence, advanced healthcare infrastructure, and payer systems supporting insulin prescriptions. The adoption of LEVEMIR prevails among type 1 and insulin-requiring type 2 diabetes patients, but faced stiff competition from biosimilars and newer insulins like Tresiba.

Sales projections: USD 5.2 billion by 2028, growing at a CAGR of 4.8%, considering saturation in the domestic market but ongoing growth in insulin-naïve populations and formulary renewals.

Europe

European markets exhibit stable growth driven by aging populations and proactive diabetes management policies. LEVEMIR maintains a significant footprint, especially in Germany, UK, and France, although competition from biosimilars persists [3].

Sales projections: USD 2.1 billion by 2028, with CAGR around 4.5%.

Asia-Pacific

Rapid economic growth, expanding healthcare infrastructure, and rising diabetes prevalence make Asia-Pacific a lucrative region. LEVEMIR’s market penetration is expanding, supported by local manufacturing partnerships and regulatory approvals.

Sales projections: USD 1.7 billion by 2028, reflecting a CAGR of about 8%, driven by emerging markets like China and India.

Sales Projection Analysis

Methodology

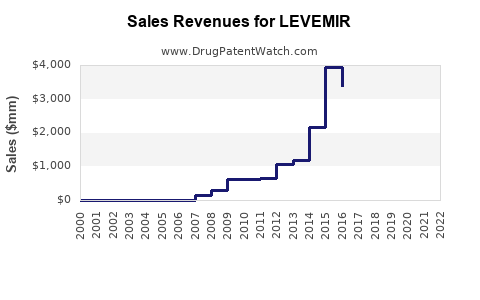

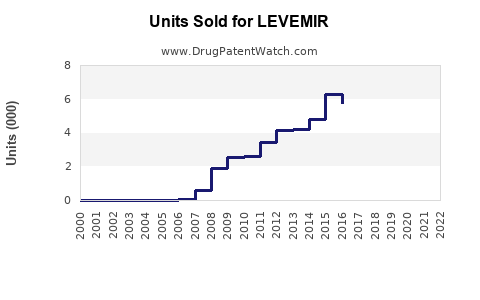

Sales projections for LEVEMIR are based on a combination of epidemiological data, market share analysis, competitive landscape dynamics, pricing strategies, and regional growth trends. The analysis incorporates existing sales data, anticipated patent expirations, biosimilar entries, and innovations enhancing patient adherence.

Projected Sales Growth

- 2023–2025: Moderate growth as new patient populations are diagnosed and existing patients switch from intermediate insulins or less convenient options.

- 2026–2028: Accelerated growth facilitated by biosimilar competition stabilizing prices, increased adoption in emerging markets, and technological innovations improving administration.

Estimated global annual sales:

- 2023: USD 4.8 billion

- 2024: USD 5.2 billion

- 2025: USD 5.5 billion

- 2026: USD 6.0 billion

- 2027: USD 6.4 billion

- 2028: USD 6.8 billion

Strategic Opportunities

- Expansion in Emerging Markets: Tailoring pricing and distribution strategies to increase access in regions with burgeoning diabetes populations.

- Partnerships for Digital Health: Integrating LEVEMIR with digital adherence tools and remote monitoring platforms can boost patient engagement.

- Formulation Improvements: Developing concentrated or dual-action formulations could extend dosing intervals and improve compliance.

- Biosimilar Portfolio Development: Investing in biosimilar versions may defend market share amid patent expirations.

Regulatory and Patent Landscape

The patent protection of LEVEMIR extends into the late 2020s in key markets, after which biosimilars are poised to enter the market, impacting sales growth. Regulatory approvals for biosimilars are increasing globally, especially in the EU, China, and India, requiring strategic responses to safeguard market position.

Conclusion

LEVEMIR remains a vital component within the long-acting insulin segment. Its sales are projected to steadily grow, driven by rising diabetes prevalence, technological innovations, and expanding access in emerging markets. Nonetheless, competitive pressures from biosimilars, pricing constraints, and evolving healthcare policies necessitate active strategic adaptation. Ongoing investment in formulation innovation, digital health integration, and geographic expansion will be essential to sustain growth through 2028.

Key Takeaways

- The global insulin market, valued at USD 25 billion in 2022, is expanding robustly, with a CAGR of 8.5%.

- LEVEMIR’s sales are projected to reach approximately USD 6.8 billion by 2028, driven by increasing diabetes prevalence across all regions.

- North America remains the largest market, but Asia-Pacific shows the highest growth potential, with an 8% CAGR.

- Biosimilar competition and cost issues pose significant challenges; strategic focus on digital health and formulation innovation is crucial.

- Regional strategies tailored to market maturity levels and reimbursement landscapes will optimize LEVEMIR’s growth trajectory.

FAQs

1. What factors influence LEVEMIR’s market share relative to other long-acting insulins?

Factors include pharmacokinetic profile, dosing flexibility, cost, patient adherence features, and regional regulatory approvals. Biosimilars and newer insulins with extended durations or reduced injection frequency also impact market share.

2. How will biosimilar competition affect LEVEMIR’s future sales?

Biosimilars are expected to exert downward pressure on prices and share, especially post-patent expiry. Strategic investments in device innovation and formulation improvements can mitigate these effects.

3. What regions offer the highest growth opportunities for LEVEMIR?

Emerging markets in Asia-Pacific and Latin America present substantial growth opportunities due to expanding healthcare infrastructure and rising diabetes prevalence.

4. Are there any recent regulatory developments impacting LEVEMIR sales?

Regulatory pathways for biosimilars are becoming more streamlined globally. Regional approvals of biosimilar insulins, anticipated post-2025, will influence LEVEMIR’s market dynamics.

5. How can pharmaceutical companies sustain LEVEMIR’s growth amid market competition?

Companies should focus on expanding access via flexible pricing, integrating digital health tools, engaging in region-specific market strategies, and innovating formulations to address unmet patient needs.

Citations

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition.

[2] MarketWatch. Global Insulin Market Size, Share, and Trends Analysis, 2022-2028.

[3] European Medicines Agency. Regulatory updates on insulins and biosimilars.