Last updated: July 28, 2025

Introduction

LAMICTAL (lamotrigine) stands as a leading antiepileptic drug (AED) and mood stabilizer, essential in the management of epilepsy and bipolar disorder. With a global footprint, expanding indications, and competitive landscape, understanding its market dynamics and sales trajectory is imperative for stakeholders ranging from pharmaceutical companies to investors.

Market Landscape

Therapeutic Dominance and Indications

LAMICTAL primarily treats:

- Temporal lobe epilepsy and generalized seizures

- Bipolar I disorder (bipolar depression and maintenance therapy)

Its dual efficacy in neurological and psychiatric conditions enhances its market penetration.

Global Market Size and Growth Drivers

The global antiepileptic drugs market was valued at approximately $5.1 billion in 2022 and is projected to reach $7.2 billion by 2030, growing at a CAGR of around 4.2%.[1] The bipolar disorder segment also contributes significantly, with a steadily rising prevalence of bipolar disorder, now affecting approximately 1-2% of the population globally.[2]

Key Markets & Regional Dynamics

- United States: The largest market, driven by high prescription rates, favorable reimbursement policies, and extensive healthcare infrastructure.

- Europe: Significant market with expanding access, though slower adoption of newer formulations due to cost considerations.

- Asia-Pacific: Rapid growth potential, fueled by rising epilepsy and bipolar disorder prevalence, increased healthcare spending, and regulatory approvals.

Competitive Landscape

LAMICTAL faces competition from older AEDs (e.g., carbamazepine, valproate), newer agents (e.g., levetiracetam, lacosamide), and bipolar treatments (e.g., lithium, atypical antipsychotics). Its differentiators include a favorable side effect profile—mainly a lower risk of weight gain and cognitive impairment—making it preferable in specific patient populations.

Market Dynamics and Trends

Shifts Toward Personalized Medicine

Genetic markers such as HLA-B*1502 influence adverse response risks, impacting prescribing patterns.[3] As pharmacogenetics advances, tailored therapies may position LAMICTAL more favorably among personalized treatment strategies.

Regulatory and Patent Milestones

The patent for original LAMICTAL expired in key markets between 2018 and 2022, opening space for generic competition. Nonetheless, branded versions, including expanded formulations and combination therapies, maintain a strong market presence, sustained by brand recognition and clinical guidelines.

Formulation Innovation

Developments in extended-release formulations, a focus area for pharmaceutical innovation, aim to improve compliance and efficacy, potentially expanding market share.

Sales Projections (2023–2030)

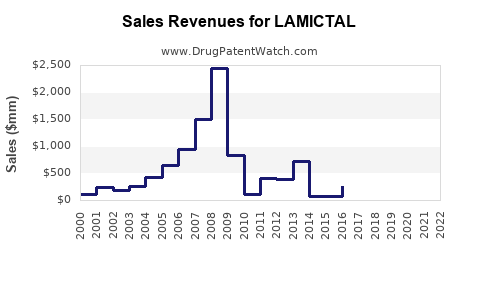

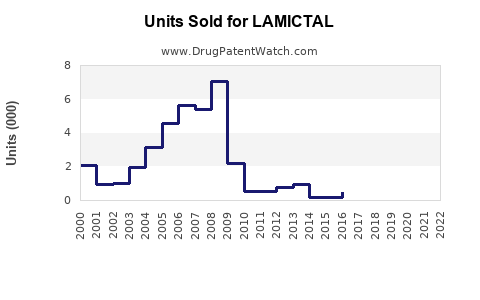

Current Sales Trajectory

Recent data indicates global sales of branded LAMICTAL surpassed $1.2 billion in 2022, with the U.S. accounting for over 60% of this figure.[4] Generic entry has led to price erosion, but the brand retains loyalty owing to clinical efficacy and safety profile.

Forecast Overview

Considering factors such as expanding indications, biosimilar competition, and regional growth:

- 2023-2025: Moderate growth expected, around 3-5% annually, as generic competition stabilizes revenues.

- 2026-2030: Sales growth could accelerate to 4-6% annually with increased adoption in emerging markets and new formulations.

Key Influences on Sales

- Market penetration in Asia-Pacific and Latin America: As healthcare systems expand, access to LAMICTAL improves.

- Regulatory approvals of new indications: Such as Lennox-Gastaut syndrome, would broaden use.

- Pricing strategies and patent litigation outcomes: Will impact revenue sustainability.

Overall, by 2030, estimated global sales could reach approximately $2.5 billion, factoring in growth strategies and market shifts.

Strategic Considerations for Stakeholders

- Patent Landscape: Monitoring patent expirations and potential biosimilar entries is critical.

- Pipeline Development: Investment in combination therapies and expanded indications can sustain high sales.

- Regional Expansion: Tailored strategies for emerging markets capitalize on demographic trends and unmet needs.

- Cost Management: Price adjustments and access programs influence competitive positioning amid generic entry.

Key Takeaways

- LAMICTAL remains a cornerstone in epilepsy and bipolar disorder management despite patent expirations.

- Growing prevalence of target indications and geographic expansion underpin robust sales prospects.

- Competition from generics necessitates innovation and strategic positioning, including extended-release formulations.

- Regional market growth, especially in Asia-Pacific, presents considerable upside.

- Overall, LAMICTAL's sales are projected to reach approximately $2.5 billion globally by 2030, assuming sustained market presence and strategic growth initiatives.

Frequently Asked Questions

1. How will generic competition affect LAMICTAL’s future sales?

While patent expirations have introduced generics, the brand retains market share through physician loyalty, clinical familiarity, and formulations. Strategic branding and pipeline innovation will be crucial to mitigate erosion.

2. Are there upcoming indications that could expand LAMICTAL’s use?

Yes. Recent studies suggest efficacy in other psychiatric and neurological conditions, including borderline personality disorder and sleep disorders, which could broaden its therapeutic scope pending regulatory approvals.

3. How does regional variation influence LAMICTAL's sales?

Emerging markets show rapid growth potential due to increasing healthcare access, while mature markets face saturation and price pressures. Tailored regional strategies are essential.

4. What role do new formulations play in sustaining sales?

Extended-release formulations and combination therapies improve adherence and outcomes, potentially expanding patient populations and boosting revenues.

5. What are the primary challenges for LAMICTAL’s market expansion?

Regulatory hurdles, patent litigation, pricing pressures, and competition from newer therapies pose ongoing challenges. Strategic innovation and regional expansion are key to overcoming these hurdles.

References

[1] Allied Market Research. "Antiepileptic Drugs Market by Type, Formulation, and Distribution Channel," 2022.

[2] World Health Organization. "Bipolar Disorder," 2021.

[3] American Journal of Psychiatry. "Pharmacogenetics of Antiepileptic Drugs," 2020.

[4] IQVIA. "Global Sales Data for LAMICTAL," 2022.

Disclaimer: The figures and projections are estimates based on current market data and trends, subject to change due to regulatory, competitive, and economic factors.